At the November FOMC meeting concluded today, the Federal Reserve cut interest rates by 25 basis points (bp) to 4.5-4.75%, in line with expectations. During the press conference, Chair Jerome Powell addressed recent trends in employment and inflation, the impact of the U.S. election on future rate cut prospects, and even whether he might resign. Overall, the tone of the meeting was neutral, with an open stance on future policy paths. The market reacted positively, with U.S. Treasury yields and the dollar falling, while the Nasdaq and gold prices rebounded.

U.S. stocks reached new record highs, U.S. Treasury bonds saw strong rebounds, and commodity prices rose. By measuring performance across different asset classes, yesterday's market movement could be considered one of the best for a Fed meeting day this year.

As U.S. Treasury yields hit new highs and Trump was elected, a common concern arose: why did Treasury yields rise instead of fall after the Fed's rate cut? How many more rate cuts can be expected from the Fed? And how will the U.S. election impact the outlook for future rate cuts?

What Adjustments Did the Fed Make to Its Policy and Communication?

The Fed's 25bp rate cut brought the benchmark rate down to 4.5-4.75%, meeting market expectations. In its statement, the Fed made slight adjustments to its language regarding employment and inflation. For instance, it changed the description of the job market from “slowed” to “generally eased,” acknowledging that recent data was heavily influenced by temporary factors (such as hurricanes and strikes). It also removed the reference to inflation continuing to decline (“further”) and omitted expressions of increased confidence in inflation returning to 2%, given that inflation surprised to the upside in September. The market is also wary that Trump’s policies could reignite inflation risks. These subtle changes indicate a shift in the Fed’s assessment, although it does not signal a significant departure from its targets (Powell stated, “The labor market is not a primary source of inflation pressure”).

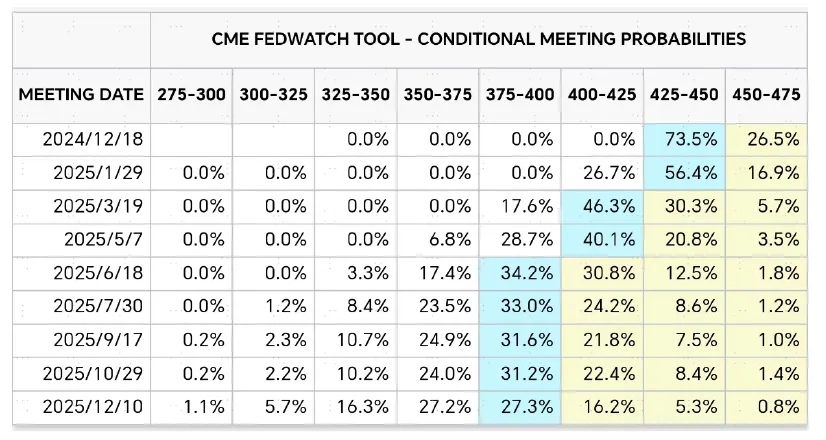

Regarding the path of future rate cuts, Powell emphasized that decisions will be data-dependent (“not on any preset course”). This makes sense, as the impact of the U.S. election on growth and inflation will take time to assess. Powell mentioned that before the December FOMC meeting, there would still be one more non-farm payroll report and two inflation readings to guide policy. Currently, the CME futures market implies a sharply narrowed path for rate cuts, projecting three remaining cuts: one in December, one in March, and one in June, with the federal funds rate reaching 3.75-4% by June 2025.

source:CME

Will the U.S. Election Affect Rate Cuts?

When asked about the upcoming December meeting, Powell noted that it was too early to rule out any “possibilities” for the meeting. He stated that slowing the pace of rate cuts is “something we are just starting to think about.” “We are moving toward a more neutral stance. This has not changed since September. We just need to see where the data takes us.”

In the short term, the election does not directly impact policy, but it can affect growth and inflation over the longer term. Powell downplayed the immediate impact of Trump’s victory on Fed policy, stating that it is premature to predict how the next administration’s policies will reshape the economic outlook. “We do not speculate, guess, or assume which policies will be implemented. In the short term, the election will not affect our policy decisions.” However, over time, post-election policies will inevitably have economic implications. This response was expected, and it suggests that the Fed’s rate cut decisions are not politically driven and will not change due to the election results. Nevertheless, Trump’s policy proposals could affect future growth and inflation, which would, in turn, influence the Fed’s rate cut decisions.

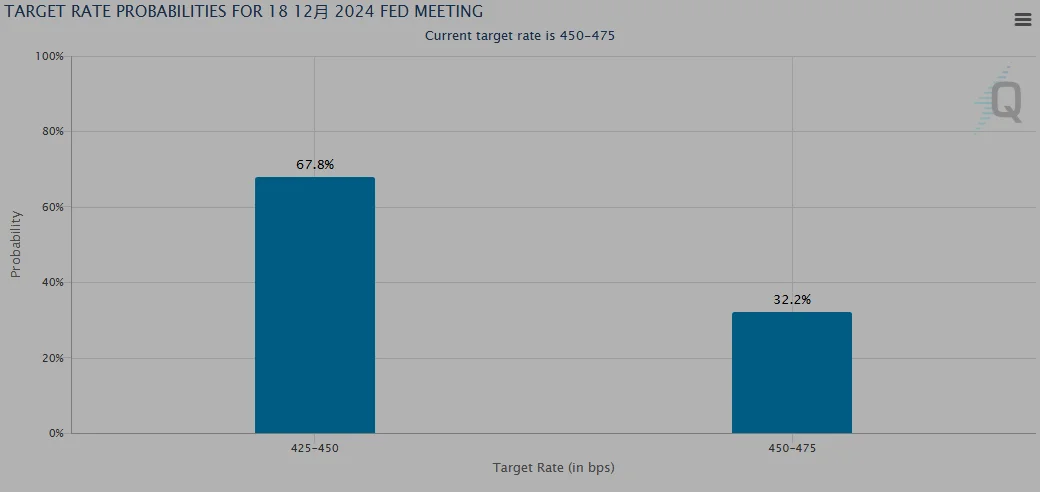

The CME FedWatch tool shows that traders currently estimate a 67.8% probability of a 25bp rate cut in December and a 32.2% chance of no change.

How Many More Rate Cuts Can We Expect?

Market expectations for the path of future rate cuts have been swinging between extremes, influenced by recent economic data and the post-election outlook. At present, CME rate futures project only three more rate cuts, in December, March, and June, with a final rate of 3.75-4%. While we have previously challenged the market’s overly optimistic assumptions of consecutive 50bp cuts and more than 200bp of total cuts by next year, the current forecast may be too pessimistic.

In terms of magnitude, cutting rates to around 3.5% appears reasonable. 1) Returning monetary policy to a neutral view: According to Fed models and the median value of the dot plot estimates of the natural rate, the real natural rate in the U.S. is around 1.4%. With short-term PCE likely at 2.1%-2.3%, 4-5 rate cuts of 25bp each to a range of 3.5%-3.8% is a reasonable target. 2) From the perspective of the Taylor Rule: Assuming the Fed assigns equal weight to inflation and employment targets by 2025, with long-term goals of 2% inflation and a 4.2% unemployment rate, the long-term federal funds rate estimate is 2.9%. Based on our year-end estimates of a 4.2% unemployment rate and 2.3% core PCE inflation (YoY), the Taylor Rule indicates an appropriate federal funds rate of 3.1%, although year-end inflation spikes and risks could lead to smaller rate cuts.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group