ASML, the lithography giant hailed as the "pinnacle of human technology," reported a rare earnings miss, sparking a global sell-off in chip stocks. ASML's weak performance came as a major disappointment to investors, pouring cold water on the recent strong rebound in semiconductor stocks from the "summer sell-off wave." According to incomplete statistics, by the close of Asian markets on Wednesday, the global chip sector—including major players like NVIDIA, AMD, SK Hynix, and Samsung—had collectively lost over $420 billion in market value since the opening of U.S. markets on Tuesday.

The manner in which ASML’s earnings were released was nothing short of dramatic. The company originally planned to report its third-quarter results on Wednesday. However, due to a "technical glitch," the earnings report was unexpectedly posted on the company's website early Tuesday morning during U.S. market trading hours—a mishap of “major proportions.” For a tech giant controlling the most critical part of global chip production, such an error is historically rare.

Following the release, ASML’s ADRs (American Depositary Receipts) on U.S. markets plummeted more than 17% at one point, before closing down 16.26% at $730.43. On the Amsterdam Stock Exchange, its share price dropped by 16%, marking the largest single-day decline since 1998, with trading halted several times throughout the day. The stock plunge also caused ASML to lose its title as the "highest market cap tech company in Europe," handing it over to German software giant SAP, which has greatly benefited from the AI boom.

In addition to the earnings miss, reports emerged that the U.S. government is considering restricting sales of advanced AI chips to certain Middle Eastern countries. This would include high-demand data center AI chips from NVIDIA and AMD, further pressuring ASML's stock. Such restrictions could reduce demand for AI chips from companies like NVIDIA, potentially leading to TSMC (Taiwan Semiconductor Manufacturing Company) cutting back on production for these chips, thus impacting ASML's earnings forecasts.

In stark contrast, TSMC's latest earnings report reinforced the investment belief that the AI boom is still in full swing, with demand for AI chips remaining extraordinarily strong. TSMC’s CEO, C.C. Wei, expressed great optimism about the future demand for AI chips during the company’s earnings call, emphasizing that demand for CoWoS advanced packaging is far exceeding supply.

"The company is fully committed to addressing customer demand for CoWoS advanced packaging capacity. Even with this year's capacity doubling, and another doubling next year, it is still far from enough," Wei said. The CoWoS advanced packaging capacity is crucial for the production of broader AI chips, such as NVIDIA's Blackwell AI GPU. "Virtually all AI innovators are working with TSMC, and the demand for AI-related products is real, and I believe this is just the beginning."

TSMC management expects its full-year revenue to grow nearly 30%, exceeding the general analyst forecast of 20%-25%, and surpassing its own previous guidance. Additionally, TSMC expects its revenue from data center AI server chips (which include NVIDIA’s AI GPUs, Broadcom’s AI ASICs, and other AI chips) to more than double this year.

After ASML’s earnings miss, some analysts even suggested that despite ASML’s poor performance, it might actually benefit stocks like NVIDIA, the "AI picks and shovels" players, as ASML’s results hint that demand for data center AI chips remains robust. Judging by stock performance, ASML, which controls the critical capacity of chip production, has significantly underperformed NVIDIA. The market, through its monetary support, seems to have already decided who the true winners in the chip sector are.

Thus, the earnings results from both ASML and TSMC—two giants in the semiconductor supply chain—reveal that the logic supporting stocks closely tied to AI chips is incredibly solid. The bullish trend for AI chip leaders like NVIDIA may be far from over. With NVIDIA holding an 80%-90% market share in data center AI chips, it may continue breaking historical stock price records, and surpassing the commonly forecasted $150 mark might just be a matter of time.

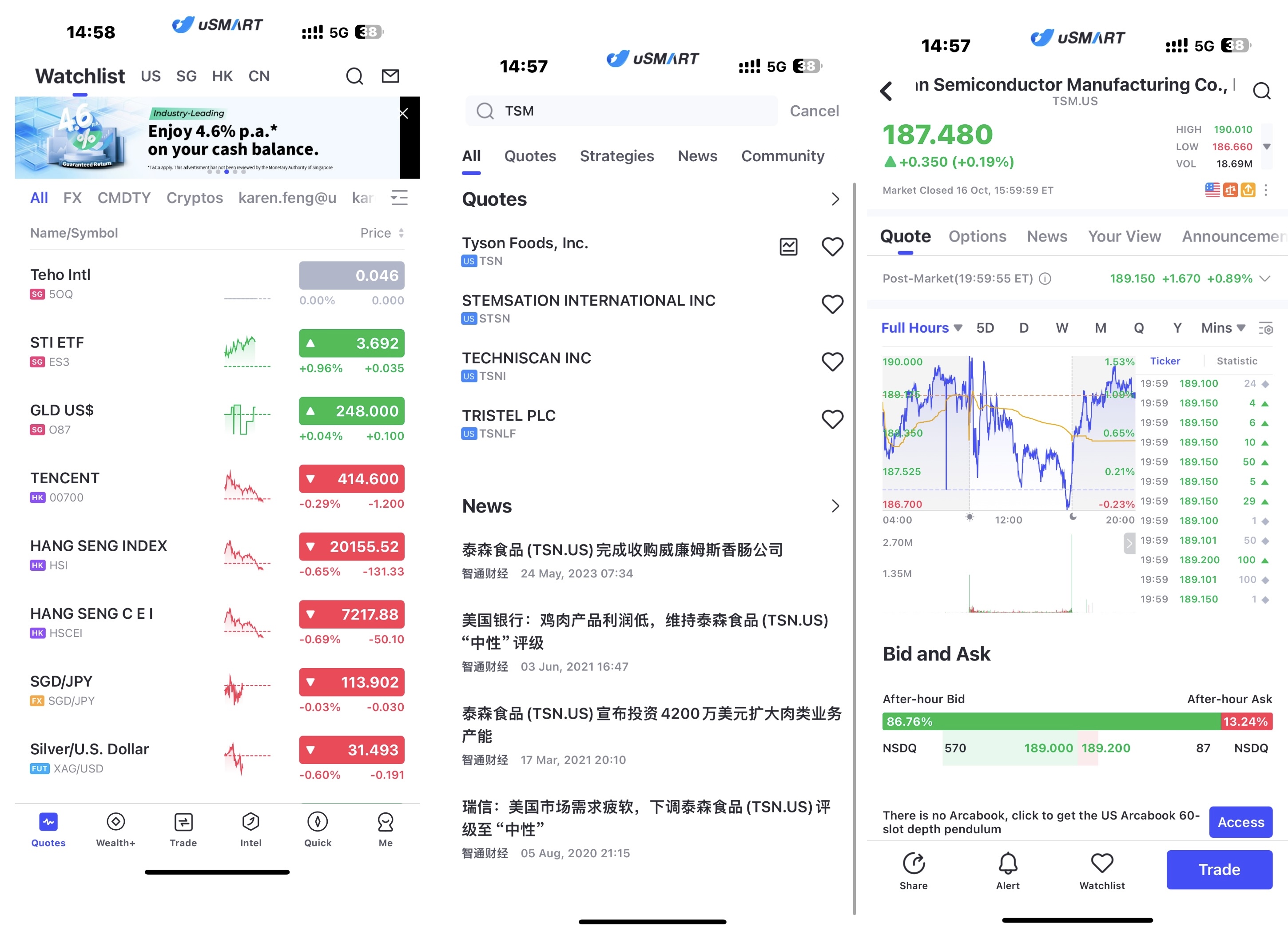

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "TSM", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group