On October 4, in the New York foreign exchange market, the U.S. dollar rose broadly against major currencies, with the USD/JPY exchange rate reaching the 149 yen range, marking the highest level in about a month and a half. The primary reason for this rise was the market's belief that the pace of interest rate cuts by the Federal Reserve (FRB) would slow down, influenced by the U.S. employment data from September.

According to the Nikkei, from the end of June to the end of August, the yen appreciated by about 16 yen against the dollar. This appreciation is the largest since the end of the Asian financial crisis in 1998, which saw a change of 25 yen. The main cause is the "tug-of-war" in supply and demand for yen trading, as Japanese companies began to repatriate overseas funds, and Japanese life insurance companies consciously hedged against currency fluctuations to cope with the yen's appreciation. Multiple factors have combined to increase yen buying.

The yen is the third most traded currency globally and one of the three major safe-haven currencies. Fluctuations in the yen's exchange rate attract significant attention from global financial markets, as substantial swings can have a major impact on Japan's economy and the world economy. Since 2022, as the Federal Reserve commenced a new round of interest rate hikes, the yen has entered a rapid depreciation phase.

A Review of Yen Depreciation

Since March 2022, the yen has experienced persistent and rapid depreciation due to aggressive rate hikes by the Federal Reserve, reaching its most severe level in nearly 20 years. The yen's exchange rate depreciated from 115 at the beginning of March 2022 to 133 by the end of July, marking a decline of 15.7%, far exceeding that of other Asian currencies during the same period, which drew attention in the international market. On September 22, after the yen fell below 145.9, the Bank of Japan intervened in the foreign exchange market for the first time in 24 years. However, the intervention had limited effect, as the yen briefly rebounded before continuing to depreciate significantly. On October 21, the yen fell below the 150 mark against the dollar but surged back, ultimately closing at 147, with a fluctuation of 3.84%. In November 2022, as the Fed slowed its rate hikes, the yen began to recover, though the volatility remained significant, with a 7.16% rise in November. On December 20, the Bank of Japan adjusted the target upper limit for 10-year government bond yields from 0.25% to 0.5%, resulting in a substantial appreciation of the yen, bringing it back to around 130, with a single-day increase of 3.8%. The yen continued to rise in December, with a monthly increase of 5.03%.

Factors Influencing Yen Exchange Rate Changes

- Expectations of Tightening Monetary Policy Fail: The pace of the Federal Reserve's rate hikes and its monetary policy direction directly influence the dollar's performance and, subsequently, the yen's exchange rate. In 2021, the Fed's policy shift drove a significant strengthening of the dollar, resulting in yen depreciation.

- Widening U.S.-Japan Interest Rate Differential: When the interest rate differential between the U.S. and Japan widens, overseas funds tend to flow out of Japan, which is detrimental to the yen.

- Weak Economic Growth in Japan: While the U.S. economy is recovering strongly, Japan's economic performance lags, providing further support for the dollar and exacerbating the depreciation pressure on the yen.

However, Yen Depreciation Provides Certain Advantages for Forex CFDs

- Profit from Shorting the Yen: If traders anticipate the yen's depreciation and short the yen using forex CFDs, they may profit. For example, traders can buy USD/JPY (going long on USD/JPY), and as the yen depreciates, the dollar appreciates relative to the yen, allowing them to profit from the exchange rate difference.

- Leverage Amplifies Returns: Forex CFDs typically offer leverage, meaning traders can control larger positions with less capital. In a yen depreciation trend, leverage can amplify traders' profits. If traders make accurate judgments, even small fluctuations in the exchange rate can lead to significant profits.

- Arbitrage Opportunities: When the yen depreciates, Japan's interest rates typically remain low. Traders can profit through "carry trades," which involve borrowing low-interest currency (yen) and investing in high-interest currency, benefiting from the interest rate differential. This can also be achieved with forex CFDs, especially by hedge funds and institutional investors that may employ this strategy.

- Increased Demand for Safe Havens: Yen depreciation can lead to a rise in market risk appetite, especially when the global economy is in a state of flux. Forex CFDs allow traders to hedge against risks by shorting the yen or diversifying into multiple currency pairs in a yen depreciation environment.

How to trade investments on uSMART:

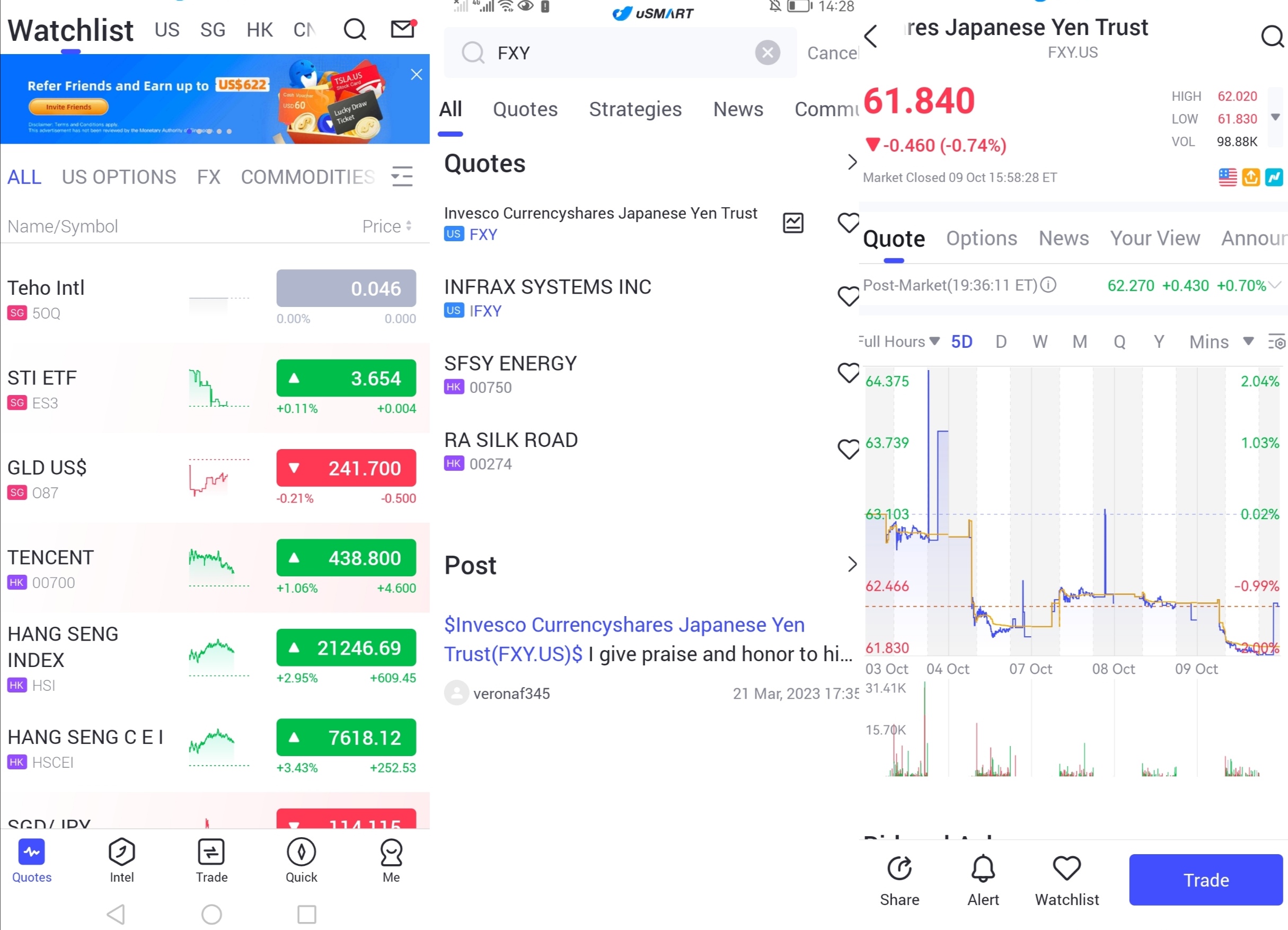

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "FXY", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group