Historically, during U.S. rate cut cycles, the bond market has performed the best, generally exhibiting a bull market. The equity market tends to perform poorly during significant economic recessions or unforeseen crises. Gold stands out among commodities due to its negative correlation with real U.S. Treasury yields.

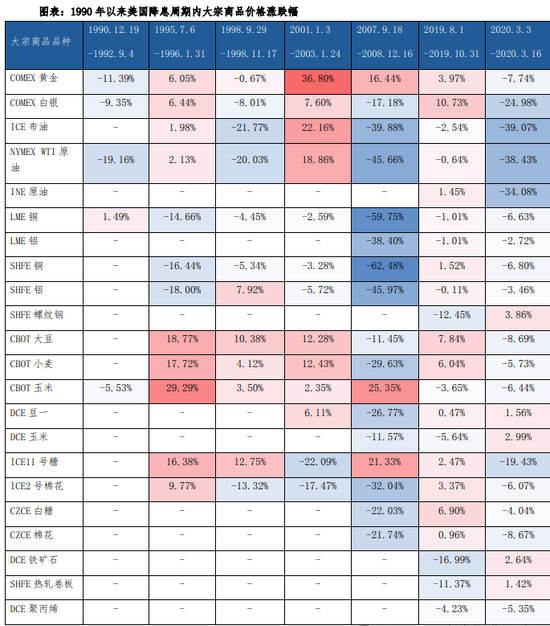

Impact of Fed Rate Cuts on Commodity Markets

The relationship between Federal Reserve rate cuts and commodity prices is not a direct linear one; it heavily depends on market demand conditions and economic fundamentals. While rate cuts can stimulate capital markets in the short term by releasing liquidity, such positive effects are often anticipated and priced in before policy implementation. Therefore, the asset price fluctuations post-rate cut largely reflect the market's reaction to the actual effectiveness and intensity of the policies. In the medium to long term, commodity price trends are primarily driven by economic fundamentals, particularly the sustainability of rate cuts and the degree of economic slowdown. If the economic recession worsens and demand shrinks, commodity prices may remain under pressure; conversely, economic recovery could drive prices up.

Data Source: WIND, GF Futures Development Research Center

In this round of Fed rate cuts, the immediate impact on commodity prices has been characterized by volatility, while the long-term trend may gradually shift towards price increases. The liquidity released by rate cuts provides short-term market benefits, but due to the lagging effects of economic fundamentals and demand recovery, short-term price fluctuations remain significant, especially for commodities like crude oil, copper, and aluminum, which are still in a volatile pattern. In the medium to long term, as financial easing conditions gradually permeate, improvements on the demand side are expected to drive commodity prices up, particularly impacting export markets first. Overall, the transmission effect of rate cuts on commodities depends on the continued improvement of demand.

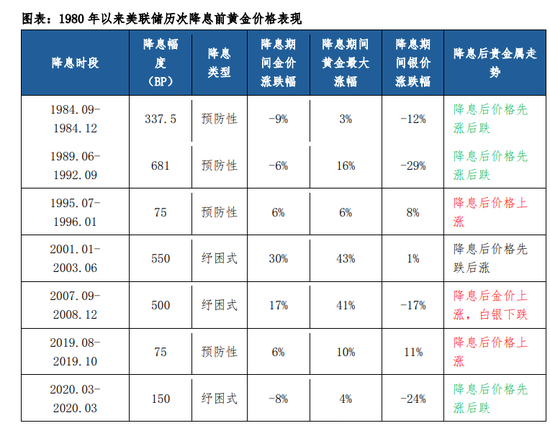

Impact of Fed Rate Cuts on Precious Metals

From a broader perspective on the purpose of rate cuts, the general conditions triggering the Fed to lower rates include slowing economic growth, rising recession risks, or short-term unexpected events that disrupt financial markets. The Fed's decision to cut rates, based on considerations of "stabilizing the economy" or "stabilizing financial conditions," can be categorized into two types: "preventive" and "relief" rate cuts. Preventive rate cuts typically occur when inflation is stable and unemployment is at a temporary low, but there are potential recession risks. Relief rate cuts may happen even before the economy enters a recession, especially when financial risks are already exposed and recession risks loom large.

Reviewing seven representative rate cut cycles by the Fed, four were preventive and three were relief cuts. In preventive cut cycles, the probability of gold rising is around 50%, depending on whether the U.S. economy can achieve a "soft landing" post-cut. If the fundamentals stabilize gradually, expectations for continued rate cuts may weaken or shift toward tightening, limiting gold's upside potential, as seen in the 1995 and 2019 cycles. Conversely, if a recession occurs post-cut, gold may decline due to liquidity or demand tightening, as seen in the 1984 and 1989 cycles. In relief rate cut scenarios, the probability of gold rising is higher, with greater average increases, often triggered by economic or financial crises, as gold's safe-haven properties are fully activated. This was evident during the bursting of the internet bubble in 2001 and the subprime mortgage crisis in 2007.

Data Source: WIND, GF Futures Development Research Center

Silver prices show significant differences under the two types of rate cuts. In non-recessionary periods, silver typically trends upward in a "reflationary" environment, while during recessionary periods, liquidity crises or economic downturns affecting industrial demand may lead to significant price corrections.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group