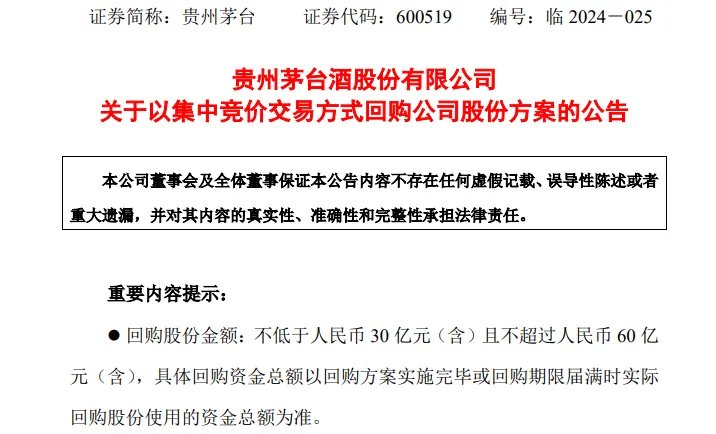

On the evening of September 20, Kweichow Moutai (SH600519, stock price 1263.92 CNY, market cap 1.59 trillion CNY) announced a plan to repurchase shares worth 3 billion to 6 billion CNY, with a buyback price not exceeding 1795.78 CNY per share. Moutai stated that this buyback aims to protect the interests of the listed company and its investors while enhancing investment confidence. The plan will be funded by the company’s own capital and will result in the cancellation of shares to reduce registered capital.

This marks the first share buyback in Moutai's 23 years since going public.

What is a Share Buyback?

- A share buyback refers to a company repurchasing its own issued shares from the market.

- The two common types of buybacks are direct buybacks and tender offers.

- Reasons for share buybacks include increasing stock prices when undervalued, addressing crises from hostile takeovers or mergers, providing better returns to shareholders, and optimizing capital structure.

- When executed at the right price and time, buybacks can boost stock prices, but this is not guaranteed. Investors should conduct thorough analysis before purchasing the company's stock.

Why Consider a Buyback?

- If a company believes its stock price is significantly undervalued, it may consider a buyback to raise the price. According to Warren Buffett's 2020 letter to shareholders, Berkshire will only buy back shares when Buffett and Charlie Munger believe the stock price is below its value.

- Companies may also consider buybacks to address crises from hostile takeovers and mergers, as seen in ExxonMobil’s buybacks in 1989 and 1994.

- Buybacks can provide better returns to shareholders, as reducing the number of publicly held shares increases earnings per share. If the company maintains the same total annual dividend, each shareholder will receive more.

- Buybacks can optimize capital structure. Strong, steadily growing companies may leverage to repurchase shares, thereby improving related financial metrics.

According to Kweichow Moutai's announcement, the total amount for this buyback will not be less than 3 billion CNY and not more than 6 billion CNY, with a maximum repurchase price of 1795.78 CNY per share. The expected number of shares to be repurchased is approximately 1.6706 million to 3.3412 million shares, representing about 0.13% to 0.27% of the total issued shares as of the announcement date.

As of June 30, 2024, Kweichow Moutai had total assets of 279.207 billion CNY, net assets attributable to shareholders of 218.576 billion CNY, and cash and cash equivalents of 145.267 billion CNY.

source:uSMART SG

From a market perspective, Kweichow Moutai's stock price has been declining recently, dipping to 1245.83 CNY per share on September 19, marking a new low for the period. As of today’s close, the year-to-date decline has reached 25.25%. Analysts suggest that the rare buyback may stabilize investor expectations regarding the stock price and help boost market confidence.

The buyback plan is viewed as a crucial measure for Moutai to maintain its stock price and enhance investor confidence. Firstly, the cancellation of shares will reduce the company's capital, improving financial metrics such as earnings per share, return on equity, and dividends per share, thus benefiting investors.

Secondly, from a market value management perspective, the buyback reflects Moutai's confidence in the industry's future prospects and acknowledgment of the company's growth potential. This action may help stabilize market expectations and boost confidence, positively impacting Moutai’s stock price recovery.

Assuming the full 6 billion CNY allocated for the buyback is utilized, it would represent only 2.15% of the company's total assets, 2.75% of net assets attributable to shareholders, and 4.13% of cash and cash equivalents. Therefore, this buyback will not significantly impact Kweichow Moutai's financial condition.

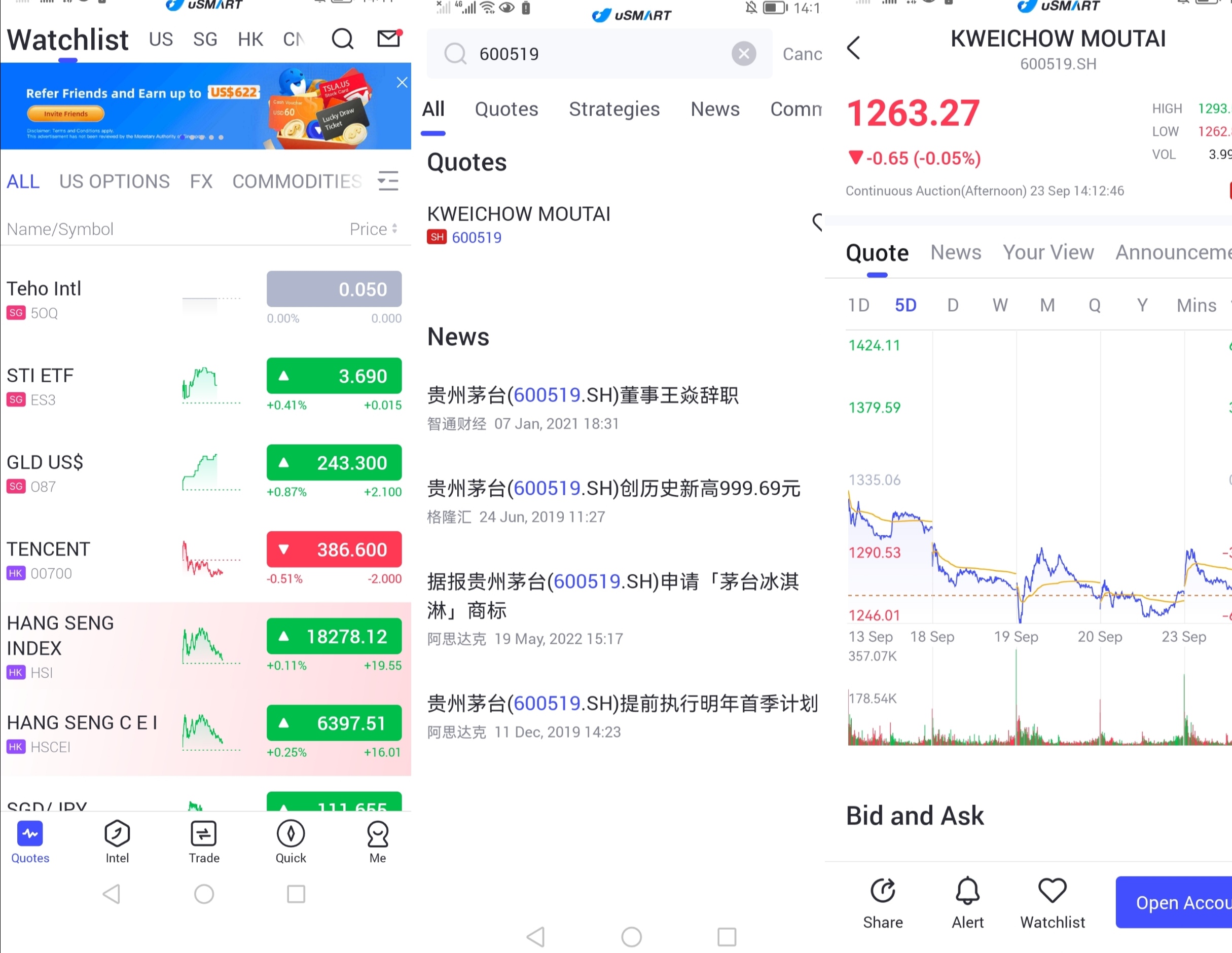

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "600519", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group