According to Goldman Sachs' model, given the current macro environment, the VIX level should be 24.5, significantly higher than the current level. Additionally, over the past 30 years, the VIX has averaged a 6% increase from September to October each year. The U.S. stock market is also facing macro catalysts such as the upcoming elections, Federal Reserve meetings, and the October earnings season.

What are VIX call options?

VIX call options are derivatives based on the CBOE Volatility Index (VIX), reflecting market expectations of future volatility. Investors typically buy these options when market uncertainty increases, to hedge risks or seek profits. Their ultimate purpose is to provide protection or returns during market fluctuations, making them suitable for traders looking to gain insights into market sentiment.

Advantages of VIX call options

The advantages of VIX call options include risk hedging, potential high returns, and liquidity. They can protect portfolios during market turbulence, while investors can capitalize on profit opportunities arising from increased volatility. Furthermore, VIX options are actively traded, making them easy to buy and sell.

On Wednesday, the “fear index” measuring U.S. stock market volatility, the VIX, rose 3.5% to 18.23 points, marking a three-day increase. However, it remains significantly lower than the four-year high of 38.57 reached on August 5, during “Black Monday.” Nevertheless, this downward trend in volatility is not expected to last, and the team believes that risks will rise before the elections, recommending the purchase of VIX call options.

Source: uSMART SG

Goldman Sachs' options research team outlined three key reasons to hold VIX in a recent report.

The first key reason is Goldman Sachs’ volatility economic model, which predicts potential upward movement in VIX levels based on economic frameworks, seasonal volatility increases, and upcoming macro/micro catalysts affecting stock volatility. According to the current macroeconomic environment, the model estimates that the VIX level should be 24.5, and if each explanatory variable encounters a one standard deviation economic shock, the VIX level could reach 33. In contrast, the VIX was about 18.2 on Wednesday.

The second key reason is that historical studies by Goldman Sachs indicate that volatility tends to increase seasonally. Over the past 30 years, the VIX has averaged a 6% rise from September to October. Research into regional volatility seasonality has shown a consistent upward trend in major indices from August to October. Considering seasonal factors and upcoming macro/micro catalysts, Goldman Sachs believes that the current VIX level has upward risks.

The third key reason involves the upcoming macro/micro catalysts. The Goldman report lists several expected major catalysts, such as the U.S. elections, the Federal Reserve's FOMC meetings in November and December, and the October earnings season for U.S. publicly traded companies, all of which are anticipated to drive expectations of rising volatility.

Based on their economic framework for modeling stock volatility, increased seasonal volatility, and upcoming macro/micro catalysts, Goldman Sachs' options team believes that VIX levels may rise from now on. Their volatility economic model estimates the VIX level at 24.5, while the current level is 18.2. Additionally, their historical volatility research indicates that the VIX averages 22 in October, 4 points higher than the current level. Goldman Sachs believes that lower implied volatility, the upcoming October earnings season, and the elections provide investors with enticing opportunities to hedge against potential increases in volatility.

Four variables are particularly important in explaining volatility: (1) the unemployment rate (yearly change), (2) growth in non-durable consumer spending (quarterly change), (3) the ISM new orders index, and (4) the absolute difference between core CPI (yearly change) and core PPI (yearly change).

How to trade investments on uSMART:

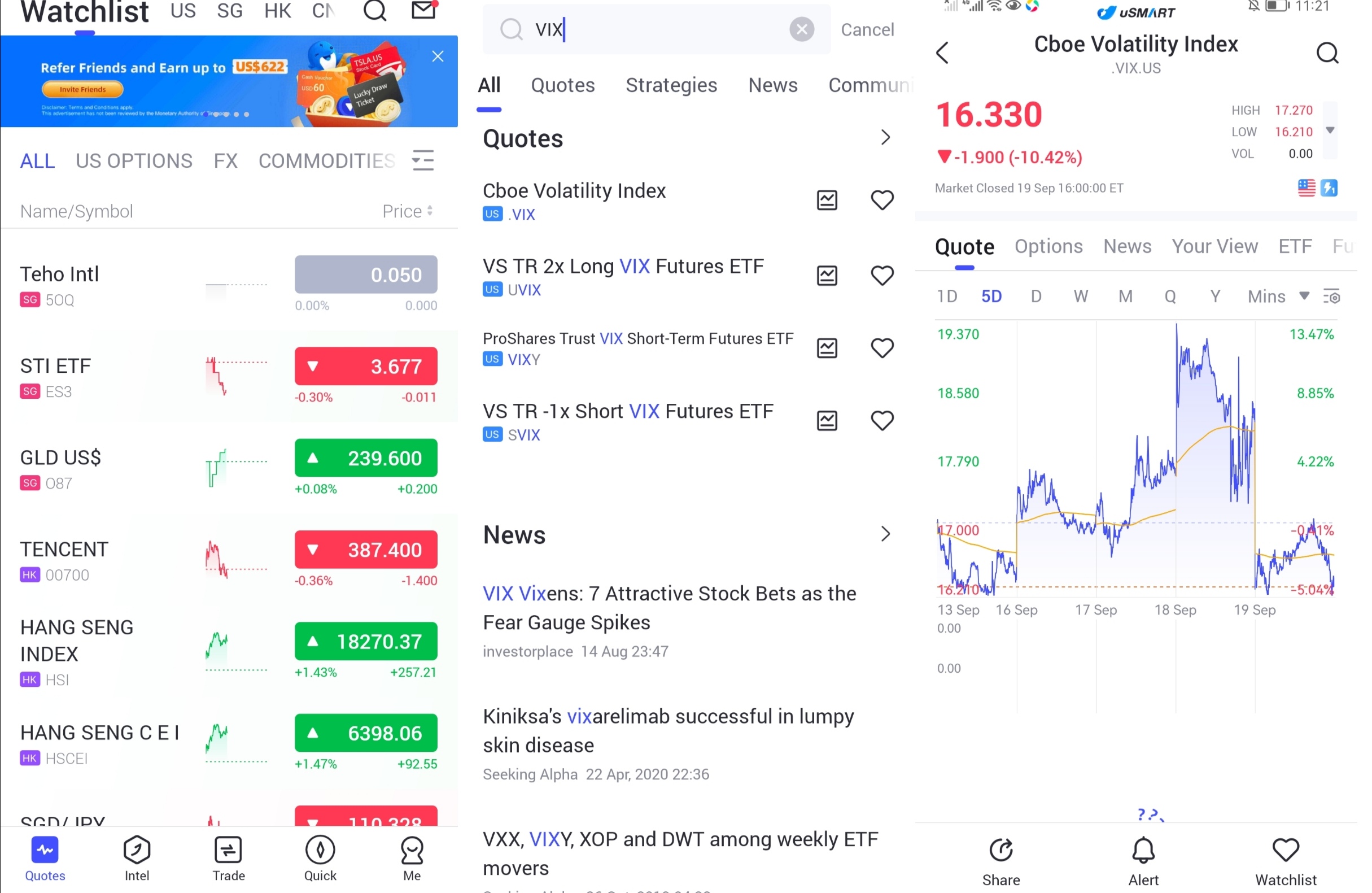

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "VIX", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group