ETFs can be classified into several categories. In today's financial world, Exchange-Traded Funds (ETFs) have become an important choice for investors. ETFs can be seen as investment tools that combine various assets (such as stocks, bonds, commodities, etc.) into a single security, which is then listed and traded on an exchange. The operational mechanism of ETFs allows investors to indirectly invest in a variety of assets contained within them by buying or selling ETF shares, thus achieving the goal of diversified investment.

Imagine going to a buffet for a meal. The buffet offers a variety of dishes, including salads, main courses, desserts, and more. Now, suppose you purchase a buffet voucher, which allows you to sample all the dishes in the buffet without having to buy each one separately.

ETFs are similar to this buffet voucher. They consist of many different investment options, such as stocks, bonds, commodities, and so on. When you buy an ETF, it's like purchasing this buffet voucher –you indirectly own a variety of investments contained within it, without having to buy each one individually. This allows you to invest in multiple assets through a single transaction, achieving investment diversification.

Characteristics of ETFs:

Diversified Investment: ETFs typically contain a variety of assets, allowing investors to indirectly diversify their investments across different markets, industries, or asset classes by purchasing ETF shares, thereby reducing investment risk.

- High Liquidity: ETFs are traded on exchanges, enabling investors to buy or sell ETF shares at any time, which gives ETFs high liquidity. Investors can quickly trade when needed.

- Low Costs: Compared to other investment tools, ETFs generally have lower management fees and transaction costs. This is because the operational mechanism of ETFs is relatively simple, and they typically employ a passive management strategy, avoiding frequent buying or selling or asset allocation adjustments.

- High Transparency:The investment portfolio of ETFs is usually disclosed regularly, allowing investors to clearly understand the composition and weight distribution of the assets held. This transparency helps investors make better asset allocations and risk management decisions.

Types of ETFs:

Stock ETFs:

- Benchmark index: Stock index

- Main holdings: Primarily hold stocks as assets, tracking specific indices (such as the S&P 500) or stocks from specific industries or regions.

- Subtypes:

- Broad-based ETFs: When selecting component stocks, there's no restriction on which industries to invest in. The main purpose is to capture overall market performance. Common broad-based ETFs include the Shanghai and Shenzhen 300 ETF, CSI 500 ETF, ChiNext ETF, SSE 50 ETF, and STAR 50 ETF. These ETFs are suitable for investors who have a holistic view of the market or specific sectors, or for long-term investors.

- Sector ETFs: Also known as sector index funds, they primarily track indices of specific industries or themes. Through sector ETFs, investors can conveniently and effectively invest in specific sectors they favor, participate in stage trading opportunities, or adopt sector rotation strategies. Examples include healthcare sector ETFs, securities sector ETFs, financial sector ETFs, and consumer sector ETFs.

- Index ETFs: These ETFs directly track specific market indices, such as the S&P 500 Index or the Nasdaq Index. The performance of index ETFs is highly correlated with the performance of the tracked indices.

- Strategy ETFs: Strategy ETFs are exchange-traded funds based on specific investment strategies or factors. Unlike index ETFs that track market indices, strategy ETFs aim to outperform market averages by selecting and adjusting stock portfolios. These strategies may include value investing, growth investing, low volatility investing, etc.

Bond ETFs:

- Benchmark index: Bond index

- Main holdings: Primarily hold bonds as assets, tracking specific bond indices or specific types of bonds (such as government bonds, corporate bonds).

- Subtypes:

- Government Bond ETFs: These ETFs primarily invest in bonds issued by governments, such as US Treasury bonds and treasury bills. Government bond ETFs are generally considered to be relatively safe bond investments, as government bonds have lower default risks.

- Corporate Bond ETFs: These ETFs primarily invest in bonds issued by corporations, including investment-grade and high-yield bonds. Corporate bond ETFs typically have higher risks and returns compared to government bond ETFs, as corporate bonds carry higher default risks.

- Investment-Grade Bond ETFs: These ETFs primarily invest in bonds with higher credit ratings, typically BBB grade or above. Investment-grade bond ETFs have lower default risks, but usually offer lower yields.

- High-Yield Bond ETFs: These ETFs primarily invest in bonds with lower credit ratings, typically BB grade or lower. High-yield bond ETFs have higher default risks, but correspondingly higher potential returns.

- Short-Term Bond ETFs: These ETFs primarily invest in bonds with short-term maturities, typically ranging from 1 year to 5 years. Short-term bond ETFs have lower volatility and are suitable for investors seeking stable income.

Bond ETFs, as a type of exchange-traded open-end index fund, come in various types, covering categories such as government bond ETFs, corporate bond ETFs, municipal bond ETFs, and more. Additionally, there are ETFs focusing on specific areas such as high-yield bonds or convertible bonds, providing investors with more refined investment choices.

Commodity ETFs:

- Benchmark index: Commodity index

- Main holdings: Primarily hold commodities as assets, tracking specific commodity indices (such as gold, silver, oil) or specific commodity markets.

- Subtypes:

- Gold ETFs

- Silver ETFs

- Oil ETFs

- Agricultural ETFs

- Precious Metals ETFs

- Multi-commodity ETFs

These are some common types of commodity ETFs, each with its specific investment targets, risk characteristics, and return profiles. Investors can choose the commodity ETF that best suits their needs and risk preferences.

REITs ETFs:

- Benchmark index: Real Estate Investment Trusts (REITs) index.

- Main holdings: REITs ETFs primarily hold stocks of real estate investment trust companies or real estate-related assets, such as commercial properties, residential properties, office buildings, etc. These assets typically generate stable rental income and may appreciate in value over time.

- Subtypes:

- Commercial Real Estate ETFs: Primarily invest in stocks of commercial real estate REITs, such as shopping centers, office buildings, etc.

- Residential Real Estate ETFs: Primarily invest in stocks of residential real estate REITs, such as apartment buildings, real estate developers, etc.

- Office Building ETFs: Primarily invest in stocks of office building REITs, such as office towers, commercial parks, etc.

Cryptocurrency ETFs:

- Main holdings: Cryptocurrency assets are held as assets, aiming to allow investors to indirectly invest in the cryptocurrency market by purchasing ETF shares.

- Subtypes:

- Bitcoin ETFs: These ETFs primarily hold Bitcoin as assets and track the performance of Bitcoin prices. Bitcoin ETFs enable investors to indirectly invest in the Bitcoin market and benefit from price fluctuations.

- Ethereum ETFs: Similar to Bitcoin ETFs, Ethereum ETFs primarily hold Ethereum as assets and track the performance of Ethereum prices. Investors can indirectly invest in the Ethereum market by purchasing Ethereum ETF shares.

- Multi-cryptocurrency ETFs: These ETFs hold multiple types of cryptocurrencies as assets, such as Bitcoin, Ethereum, Litecoin, etc. Multi-cryptocurrency ETFs aim to provide diversified investment options, allowing investors to spread their investments across different types of cryptocurrencies.

Compared to traditional commodity ETFs, the cryptocurrency market is more volatile and unstable, with higher investment risks.

Currency ETFs:

- Benchmark index: Currency index.

- Main holdings: Various currencies are held as assets, aiming to allow investors to indirectly invest in the currency market by purchasing ETF shares.

- Subtypes:

- USD ETFs

- EUR ETFs

- JPY ETFs

- Currency basket ETFs

Currency ETFs, as an important investment tool, also exhibit diverse characteristics. From traditional currency market fund ETFs to ETFs focusing on specific currencies or currency pairs, and even ETFs incorporating special investment strategies such as leverage or inverse strategies, different types of currency ETFs offer investors a wide range of choices.

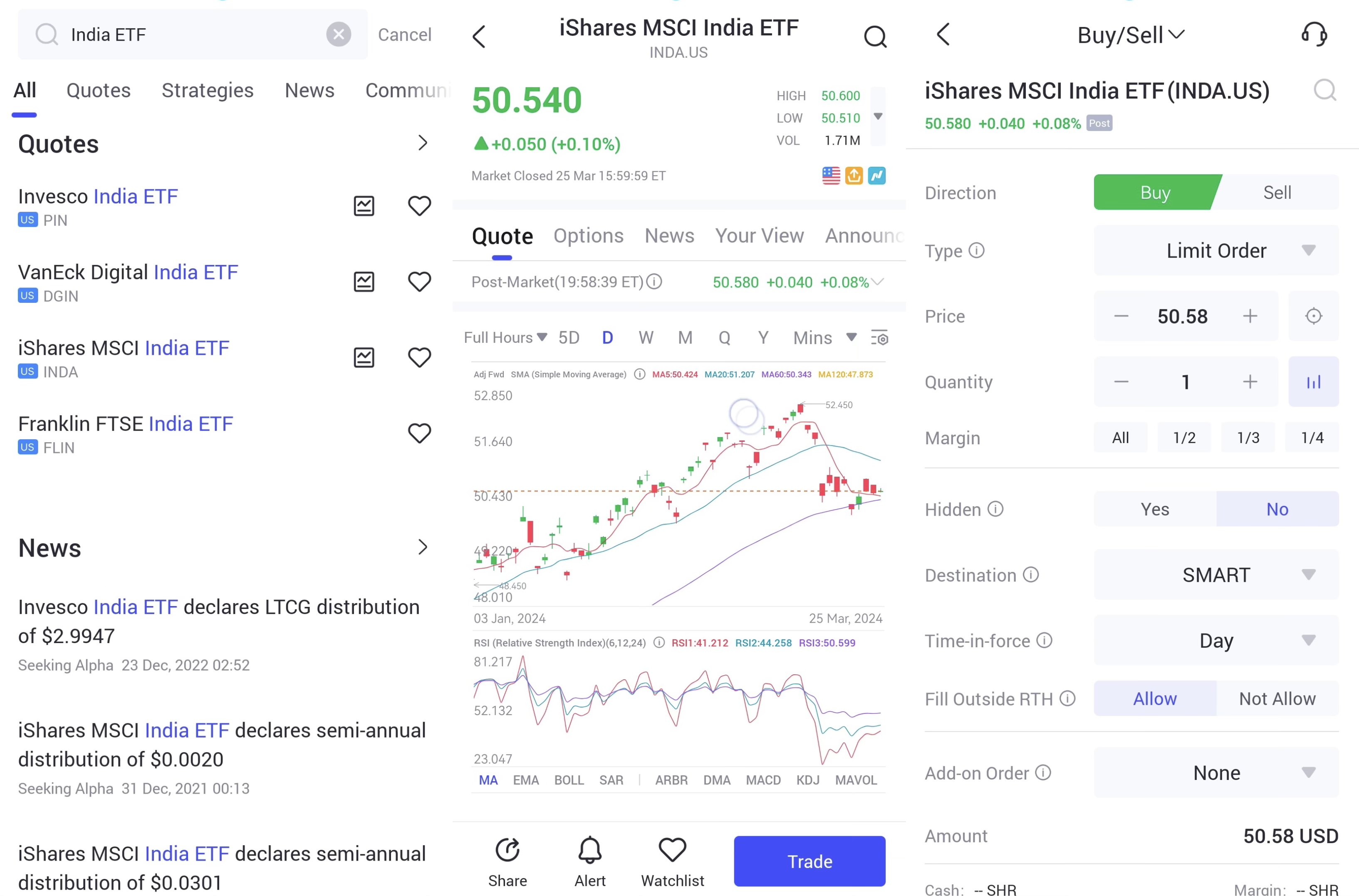

How to place a trade on uSMART mobile application:

After logging into the uSMART SG APP, navigate to the "Markets" section by clicking on the bottom of the page. Then, tap on the search button at the top of the page, search for ETF, and click on "Learn More" for details. Next, click on the "Trade" option in the bottom right corner, select "Buy/Sell," and proceed to choose the stock price, quantity, and trading conditions before submitting the order. If opting for the "Smart Order" feature, simply select the type of smart order. Below are image-guided instructions.

(This diagram is provided for illustrative purposes exclusively)

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global