.jpg)

US Macro Strategy Weekly Report – 24 July 2023

James Ooi/ uSMART Market Strategist

Over 13 years of experience in buy-side and sell-side of capital markets

Former Fund Manager of renowned asset management firm

Focus on fundamental analysis and macro-outlook for US & Singapore markets

SGX Academy trainer

This Week’s Market Outlook:

- This week's important economic data in the United States includes: Monday's PMI data, Tuesday's consumer confidence index, Thursday's FOMC Statement, U.S. 2Q GDP, initial jobless claims, and durable goods orders, and Friday's June PCE.

- Several important financial reports will be published this week:

July 25 (Tuesday): Verizon, GM, 3M, GE, Spotify, Microsoft, Alphabet, Snap, Visa, Teladoc, Texas Instruments

July 26 (Wednesday): Boeing, AT&T, Coca-Cola, Hilton, Meta Platforms, Chipotle, ServiceNow, Lam Research, eBay

July 27 (Thursday): McDonald's, Mastercard, Honeywell, Enphase, Ford, Intel, Roku

July 28 (Friday): Exxon Mobil, Procter & Gamble, Chevron

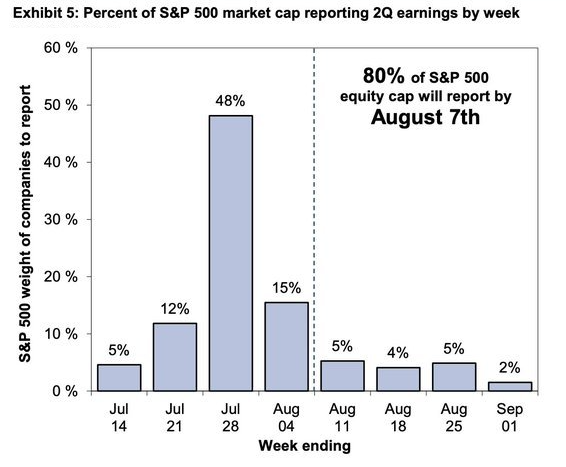

- This week, companies representing 48% of the total market value of the S&P 500 index will release their financial reports (as shown in Figure 1), potentially causing significant market volatility.

Figure 1: Companies representing 48% of S&P 500 index announcing results this week

Source: Goldman Sachs

- We anticipate volatility to start increasing based on seasonality (Figure 2).

Figure 2: VIX Seasonal Chart (Past 25 Years)

Source: uSMART, Bloomberg, 22 Jul 2023

Special Issue:

Nasdaq 100 Rebalancing: What Does It Mean for Investors?

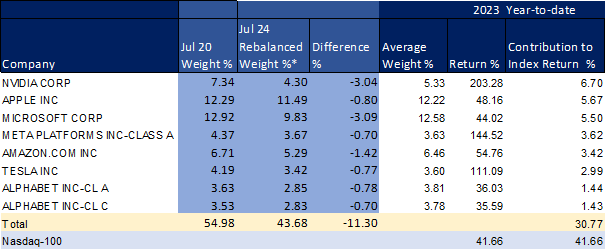

The Nasdaq-100 index will undergo a special rebalance, which will take effect before the market opens on Monday, July 24th. The special rebalance was prompted by the outstanding performance of the "magnificent 7" companies, namely Nvidia, Apple, Microsoft, Meta Platforms, Amazon, Tesla, and Alphabet. The significant increase in their share prices led to a rise in their market capitalization and, consequently, their contribution to the Nasdaq-100 weight.

Currently, the "magnificent 7" accounts for 55% of the Nasdaq-100, triggering the special rebalance as rebalance aims to reduce the index's concentration in its largest constituents, in line with the Nasdaq-100 weighting criteria, which are designed to adhere to fund diversification rules. It is important to note that the Nasdaq-100 special rebalance will not result in the addition or removal of any company.

The purpose of the special rebalance exercise is to promote diversification. This can have the effect of shifting investors' focus to smaller weight US stocks within the Nasdaq-100.

How Will This Rebalance Affect The 7 Tech Stocks In The Short Term?

*The rebalance weight are based on Pro forma filing.

Source: uSMART, Bloomberg, Bofa, 24 Jul 2023

The Nasdaq-100 rebalancing will have the most significant impact on the "magnificent 7" as they will experience the most substantial reduction in weightage. Their combined weight within the Nasdaq-100 index will be decreased from 55% to 44% after the rebalancing. It is important to note that these 7 tech stocks have notably outperformed other component stocks generally this year and have contributed to almost 73.86% of the Nasdaq-100 index's total increase since the beginning of the year.

The short-term impact of the Nasdaq-100 rebalancing is expected to come from two fronts: passive management and active management.

Passive Management Funds (ETFs):

ETFs that aim to track the Nasdaq-100 index will be affected by the rebalancing. Fund managers of these ETFs will need to buy and sell shares to match the newly rebalanced index. However, the "magnificent 7" companies have already completed their rebalancing at the end of the market closing session on 21 July. This could partly explain why most of the "magnificent 7" suffered some losses near the Friday closing session. Moving forward, when the Nasdaq opens on 24 July, there should be no further impact on these companies from passive funds.

Active management Funds (e.g. Unit trust):

As active funds, unlike passive funds, are benchmark agnostic, the active fund managers are not bound to follow the rebalanced weight of the Nasdaq-100 index. unlike passive funds,

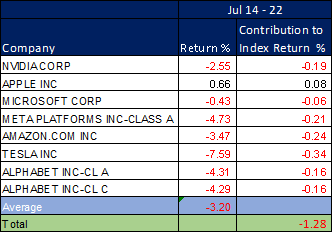

They have the flexibility to make their own investment decisions irrespective of the index. It is notable that since Nasdaq released the pro forma filing weight on 14 July, the "magnificent 7" has suffered an average loss of -3.2%. This suggests that active fund managers have been reducing the weight of these 7 tech stocks in their portfolios.

The Performance Of The "Magnificent 7" In The Past Week:

Source: uSMART, Bloomberg, 24 Jul 2023

Furthermore, within the next two weeks, five of the "magnificent 7" companies, namely Apple, Microsoft, Meta Platforms, Amazon, and Alphabet, are scheduled to release their earnings reports. If the earnings results are disappointing, it could lead to further selling pressure on these stocks as some active portfolio managers may wait until the earnings release before deciding on portfolio rebalancing

2Q2023 Earnings Announcement Date:

Source: uSMART, Bloomberg, 24 Jul 2023

However, in the long run, the impact may be limited as these 7 tech stocks are likely to benefit from the ongoing secular growth of AI implementation.

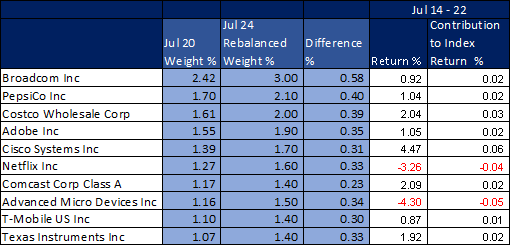

Top Constituent changes other than the “magnificent 7”:

Source: uSMART, Bloomberg, 24 Jul 2023

The rebalance will result in a reduction of the influence of the "magnificent 7" as their weight is redistributed to other stocks within the Nasdaq-100. By decreasing the weight of these dominant companies, the rebalancing exercise may encourage investors to shift their attention to other component stocks and explore potential opportunities within a broader range of companies. However, since the changes are generally less than 0.5% for component stocks other than the "magnificent 7", the impact should be considered negligible.

Investors should not overreact to the rebalancing exercise since the fundamentals of the companies are more important.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimer:

This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Singapore

Singapore Hongkong

Hongkong United States

United States Group

Group Global

Global