Report by James Ooi/ uSMART Market Strategist

Summary: This article explores the impact of economic recessions on the stock market. Analysts suggest that the recent robust performance of the Nasdaq 100 index has raised concerns regarding the sustainability of the technology sector. Furthermore, the current stock market continues to lack widespread upward momentum. Despite short-term bearish factors, there are still high-quality companies (such as Apple, Amazon, Visa, Tesla, Costco, and Microsoft) that warrant investors' attention. It is advisable for investors to gradually establish long-term positions and consider investing in ETF products to capture some market returns.

.jpg)

About James:

Over 13 years of experience in buy-side and sell-side of capital markets

Former Fund Manager of renowned asset management firm

Focus on fundamental analysis and macro-outlook for US & Singapore markets

SGX Academy trainer

This Week’s Market Outlook

This week's important economic data in the United States include April's New Home Sales, Manufacturing PMI, and Service PMI, which will be released on Tuesday. The FOMC Meeting Minutes, Unemployment Claims, and Preliminary GDP q/q will be released on Thursday. Additionally, the PCE and UoM Consumer Sentiment will be released on Friday. Furthermore, the market is also closely monitoring Treasury Secretary Yellen's speech on Wednesday and the latest updates regarding the debt ceiling.

As of last Friday, over 95% of the companies in the S&P 500 index had released their earnings reports, and 78% of them reported higher-than-expected EPS.

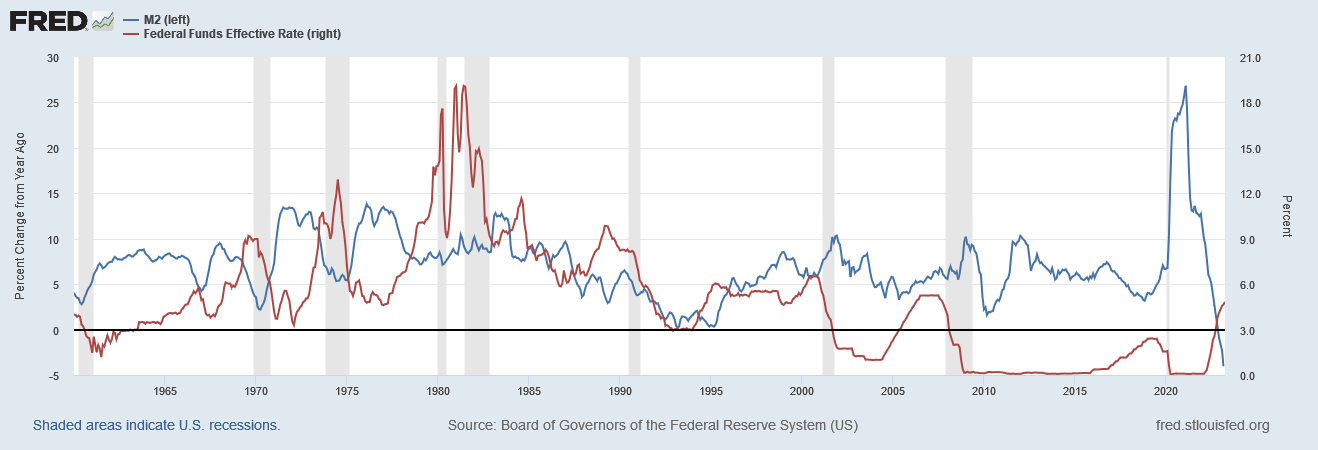

Generally, the growth rates of the M2 money supply have historically been largely positive (Figure 1), indicating an increasing amount of money in circulation. However, in March 2023, M2 growth year-on-year was negative at -4.05%. This marks the fourth consecutive month of negative year-on-year growth since December 2022. Negative growth in the M2 money supply signifies a contracting economy and suggests the presence of liquidity problems. Therefore, the Federal Reserve may not prefer the M2 money supply growth to remain negative for an extended period, as it could lead to a liquidity crunch. Consequently, the Fed might be inclined to initiate interest rate cuts in the latter half of 2023 as a measure to prevent a liquidity problem.

Figure 1: M2 Money Supply YoY Growth vs Fed Fund Rate

Source: Fred, 12 May 2023

Source: Fred, 12 May 2023

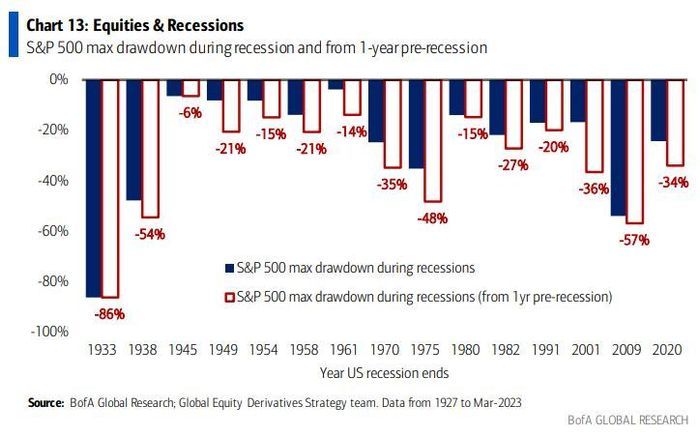

According to Bank of America's research data spanning from 1927 to March 2023, it has been observed that in eight out of the last ten recessions, the S&P 500 index had suffered declines of over 20% from one year beforehand. Additionally, there have been a total of 15 recessions since 1927, and in each case, the drawdowns experienced one year before the recession were greater than those witnessed during the actual recessions. Thus, the drawdown observed in October of last year could potentially be the most severe if there is an imminent recession.

Figure 2: S&P max drawdown during recession and from 1-year pre-recession

Source: Market Watch, BofA

Source: Market Watch, BofA

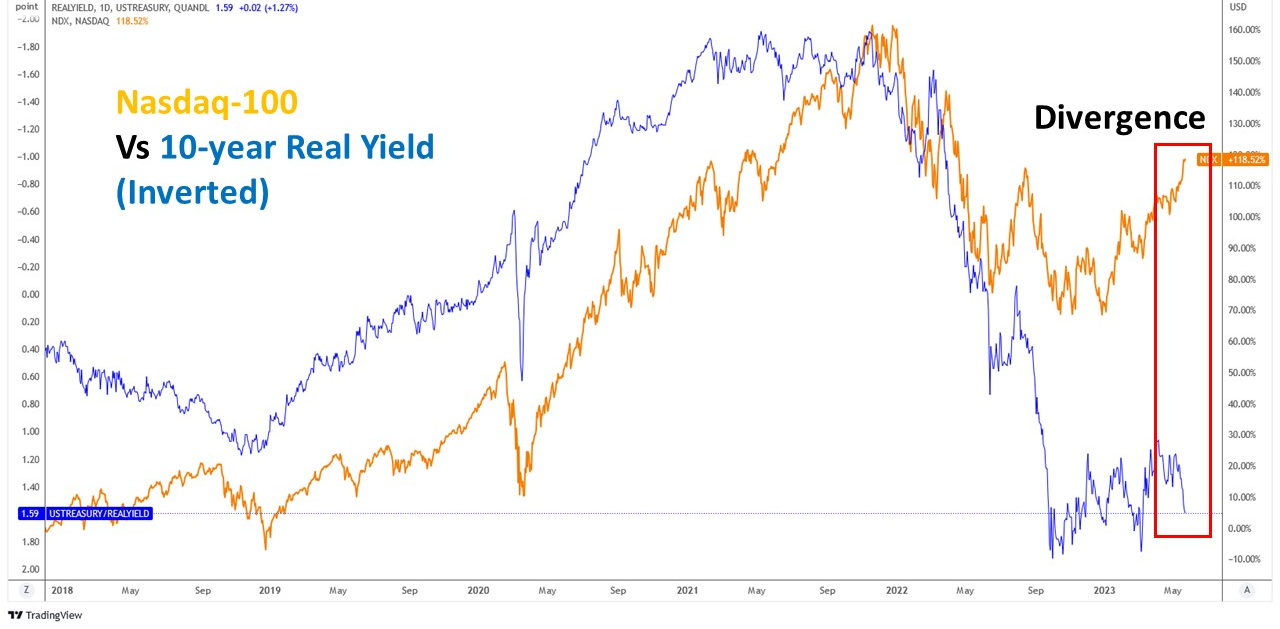

Typically, the NASDAQ-100 tends to move in line with the inverted US 10-year Real Yield(Figure 3). However, the recent outperformance of the NASDAQ-100 has caused a divergence between the two, raising concerns about the sustainability of the tech rally. This is because bond markets usually lead equity markets, and the pessimism among bond investors indicates that the tech rally may not stay higher for longer.

Figure 3: Nasdaq-100 vs 10-year Real Yield

Source: uSMART, Tradingview, 23 May 2023

Source: uSMART, Tradingview, 23 May 2023

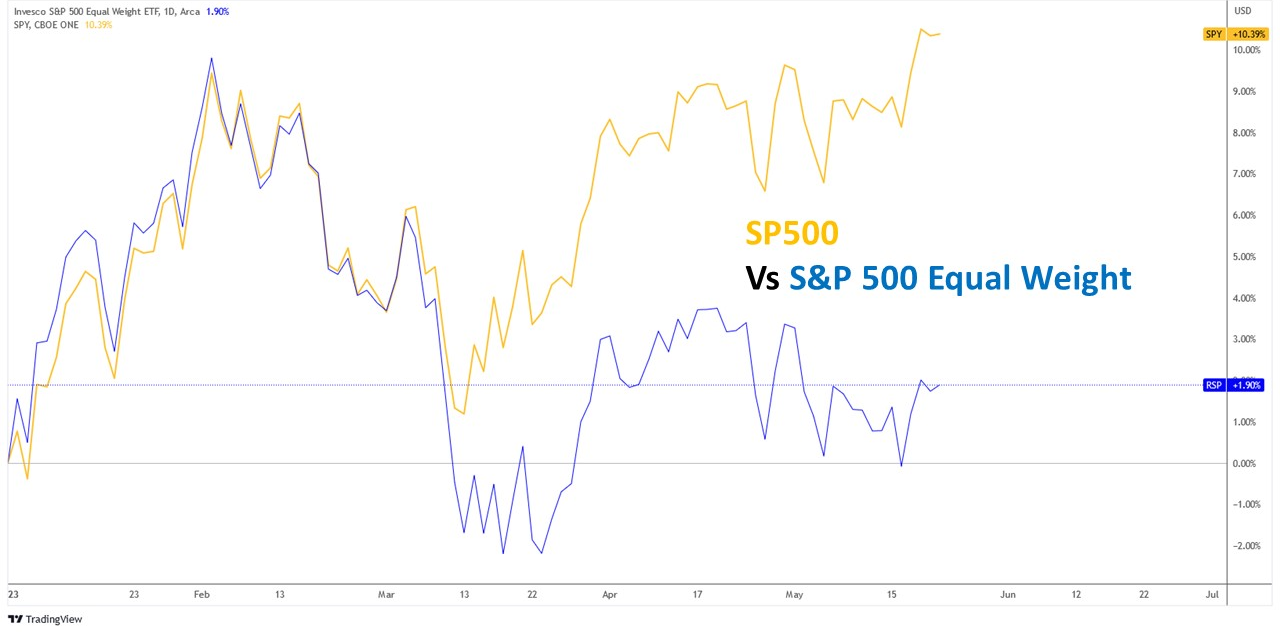

Thus far this year, the S&P 500 has provided a return of +10.4%, while the S&P 500 Equal Weight has returned 1.9% (Figure 4). The outperformance of the S&P 500 indicates that the equity market still lacks breadth.

Figure 4: S&P 500 vs S&P 500 Equal Weighted

Source: uSMART, Tradingview, 23 May 2023

Source: uSMART, Tradingview, 23 May 2023

Conclusion:

- There have been noticeably fewer discussions about recession in recent quarterly earnings calls, indicating that corporations have become less concerned about the economic outlook.

- Additionally, more analysts are beginning to upgrade their year-end target. However, the S&P 500 only experiences a modest 0.56% increase in May.

- Both bullish and bearish perspectives present compelling arguments regarding the equity market. Bulls emphasize the gradual improvement in economic data and stronger-than-anticipated corporate earnings, whereas bears contend that the equity market lacks breadth and that expectations for rate cuts are unrealistic.

- I remain short term bearish as both the S&P 500 and Nasdaq-100 have recorded year-to-date gains primarily driven by PE expansion.

- Currently, there are several high-quality companies, such as Apple, Amazon, Visa, Tesla, Costco, and Microsoft, that continue to demonstrate strong long-term EPS growth potential. Investors may consider gradually establishing long-term positions in these companies. Additionally, investors can also explore ETFs like SPY, QQQ, and SUSA to capture some market returns.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimer:

This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global