Report by James Ooi/ uSMART Market Strategist

Summary:This article discusses some current situations in the US stock market. Analyst believes that the Fed's rate hike is on pause, but interest rates will still remain relatively high. He thinks that the market's prediction of three rate cuts before the end of the year is overly optimistic. The recent stock market decline may have been driven purely by seasonality and high-level adjustments, and there has been no bad news in the fundamentals. Although there is a possibility of another round of market decline, some individual stocks have already bottomed out, and investors should not wait for the market's lowest point to buy stocks. During the market adjustment period, investors should consider investing in ETFs such as SPY, QQQ, and SUSA to pursue market returns.

About James:

Over 13 years of experience in buy-side and sell-side of capital markets

Former Fund Manager of renowned asset management firm

Focus on fundamental analysis and macro-outlook for US & Singapore markets

SGX Academy trainer

This Week’s Market Outlook

- This week's important economic data in the United States includes the Consumer Price Index (CPI) on Wednesday, Producer Price Index (PPI) on Thursday, and the University of Michigan Consumer Sentiment Index on Friday. In addition, President Biden will meet with Republican leaders on Tuesday to negotiate raising the US debt ceiling.

- This week, investors are keeping an eye on the corporate earnings reports of several companies. Airbnb, Affirm, and Rivian are scheduled to report their earnings on Tuesday, while Disney and Roblox will report on Wednesday.

- At present, 85% of the total market value of companies in the S&P 500 index have released their financial reports. Of these, 79% of the companies that have reported their earnings per share (EPS) have exceeded expectations.

- Despite the fact that the US stock market remains at elevated levels, safe-haven assets such as gold and US money market funds are still hovering near historic highs, indicating that some investors remain risk-averse and skeptical about the resumption of the bull market.

- So far in May, the 'Sell in May and go away' adage has not shown much momentum, with only a slight decline of 0.73%."

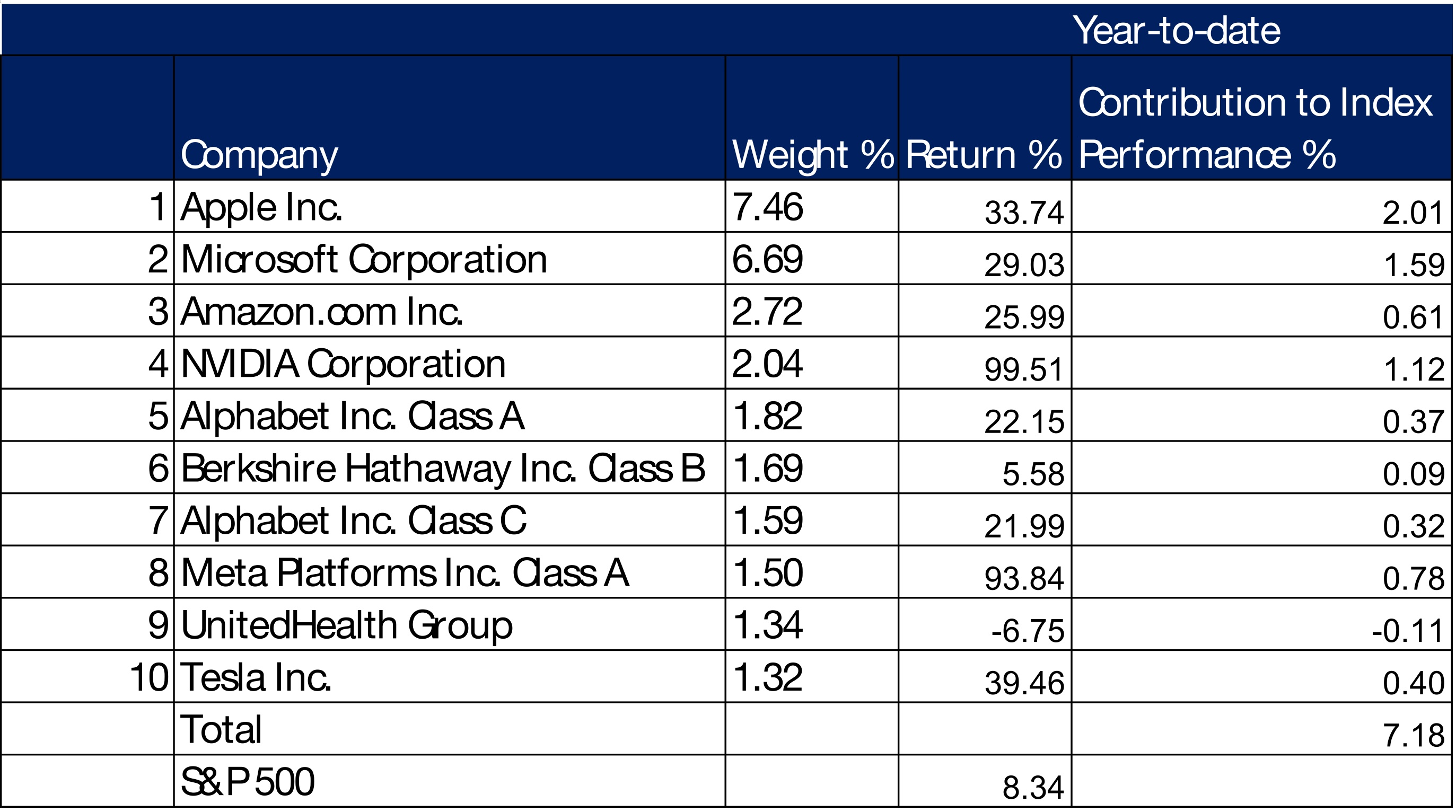

- The recent rally in the US stock market can be largely attributed to the exceptional performance of a few select companies. Specifically, the top 10 weighted stocks in the S&P 500 and Nasdaq 100 indices have contributed a significant portion of their respective gains, accounting for 86% and 81% of the total increase, as illustrated in Figures 1 and 2.

Figure 1: What percentage of the S&P 500 index's total return is contributed by the top 10 companies?

Source:uSMART, Bloomberg, 9 May 2023

Source:uSMART, Bloomberg, 9 May 2023

Figure 2: What percentage of the Nasdaq 100 index's total return is contributed by the top 10 companies? Source:uSMART, Bloomberg, 9 May 2023

Source:uSMART, Bloomberg, 9 May 2023

Technical analysis of US stock indices

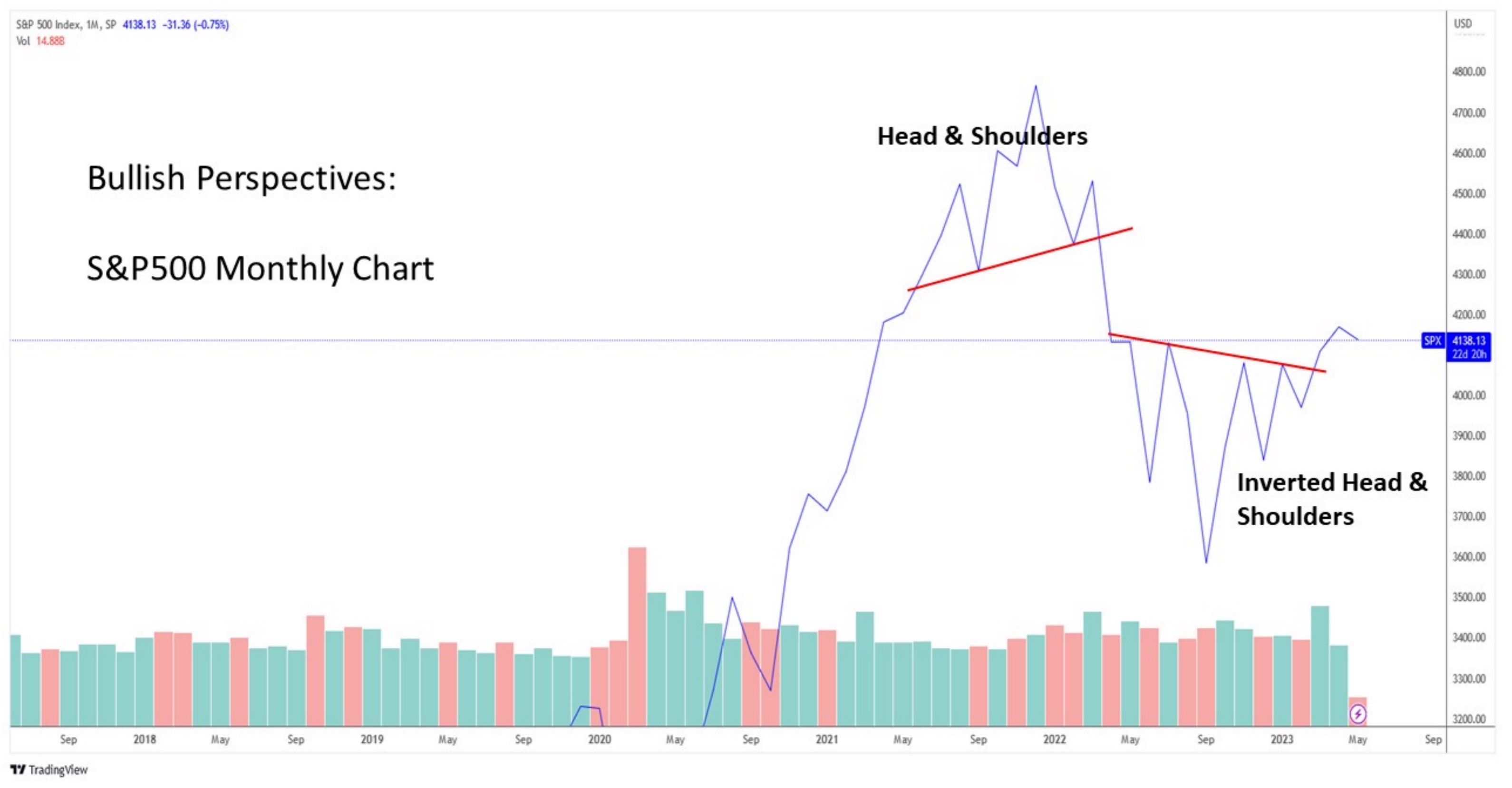

- Bullish Perspective: S&P 500 has broken the neckline of an inverted head and shoulders pattern and is anticipated to continue its upward trend.(Figure 3)

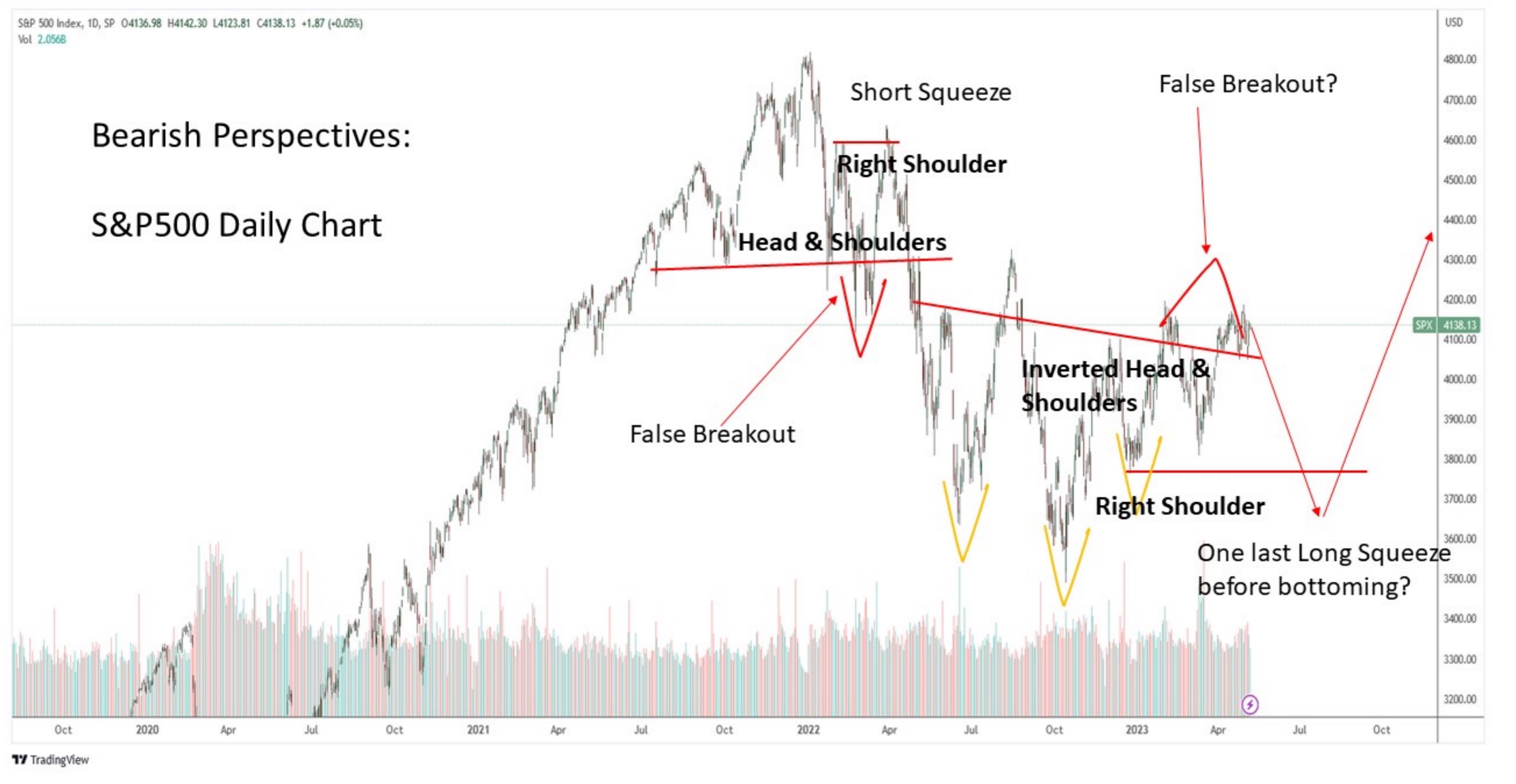

- Bearish Perspective: Although S&P 500 has broken the neckline of an inverted head and shoulders pattern and is anticipated to continue its upward trend, this could be a false breakout like March 2022 and we might experience another round of decline (Figure 4)

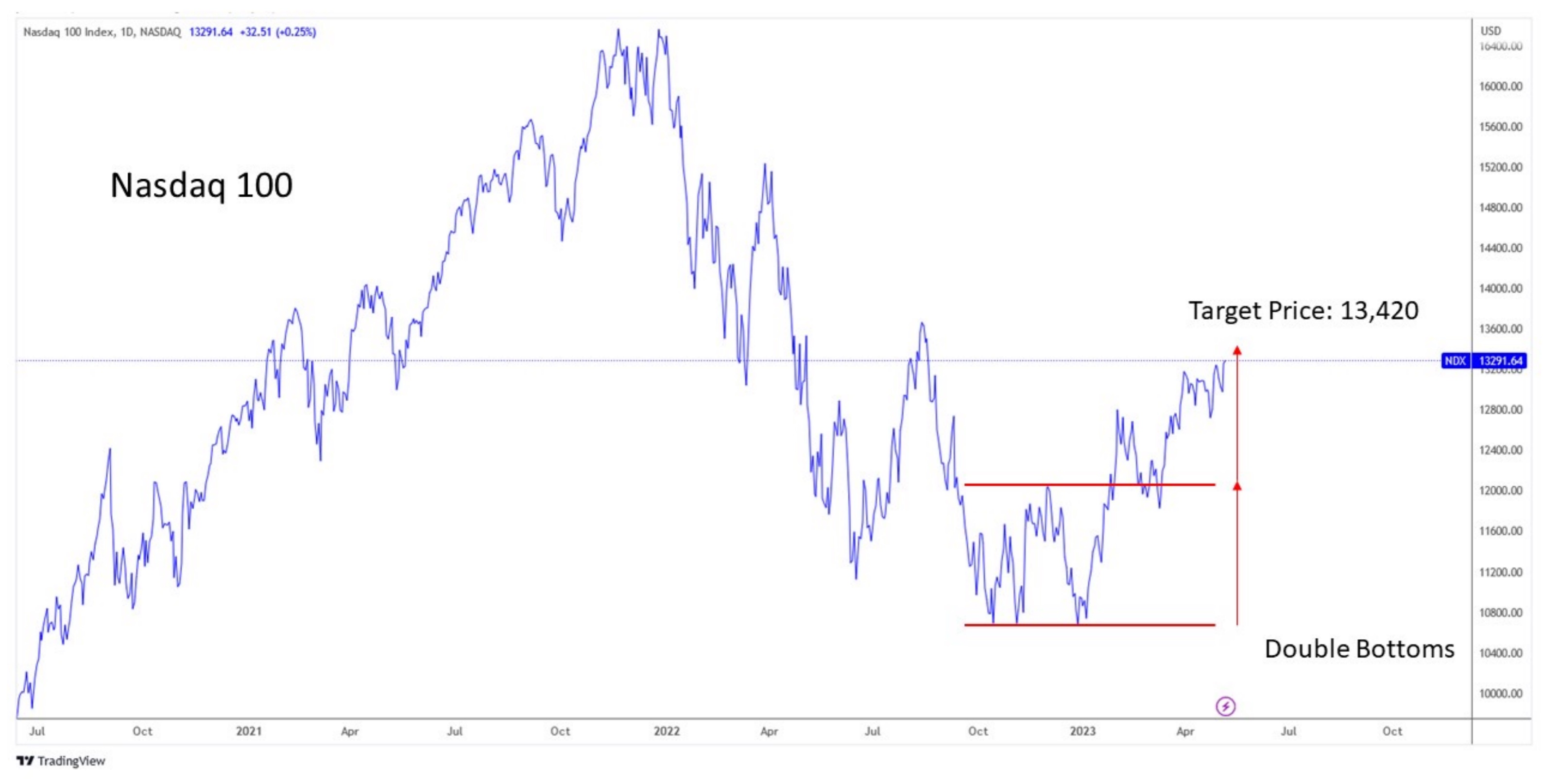

- The Nasdaq index is on the cusp of reaching its target price of 13,420 for a double bottom pattern, with the current price hovering at 13,291. This strengthens the indication that bullish investors may soon take profits. If the market hence experiences a downturn, it is likely that technology stocks will lead the decline. (Figure 5)

Figure 3: Bullish View - S&P 500 Source:uSMART, Tradingview, 9 May 2023

Source:uSMART, Tradingview, 9 May 2023

Figure 4: Bearish View – S&P 500

Source:uSMART, Tradingview, 9 May 2023

Figure 5: Nasdaq 100

Source:uSMART, Tradingview, 9 May 2023

Summary

- Last week, the Federal Reserve's interest rate decision increased by 25 basis points and indicated a pause in rate hikes. However, I believe that interest rates will still remain relatively high before the end of the year. Currently, the market predicts three rate cuts (a total of 75 basis points) before the end of the year, which appears to be overly optimistic.

- If equity market continues its decline, it may be attributed to the "sell in May and go away" seasonality effect, as earnings reports have generally exceeded expectations and the banking crisis does not seem to spread further. In the absence of any negative news, a decline in the market is likely due to seasonality and technical correction, which may be driving the market downward.

- The recent rally in the US stock market can be largely attributed to the exceptional performance of a few select companies. As a result, bulls are buying into smaller-cap and lower-weighted companies, with the belief that the bull market will spread to other companies and drive further gains in the stock market. However, bears believe that this recent market rally lacks market breadth and may be difficult to sustain at these high levels.

- I remain short-term bearish and anticipate another downturn, with the possibility of the S&P 500 index dropping to around 3600 in the worst-case scenario. Nevertheless, certain individual stocks may have already reached their bottom, so investors should not wait for the market to hit rock bottom before considering investing in quality stocks.

- If investors have missed investing opportunities for certain stocks, they could consider investing in ETFs like SPY, QQQ, and SUSA during market corrections to capture some market returns.

Follow us

Find us on Twitter, Instagram, YouTube , and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimer:

This article is intended for general circulation and educational purpose only and does not take into account of the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment products mentioned. In the event you choose not to seek advice from a financial adviser, you should consider whether the investment product in question is suitable for you.

Past performance figures as well as any projection or forecast used in this article, are not necessarily indicative of future performance of any investment products. Your investment is subject to investment risk, including loss of income and capital invested. The value of the investment products and the income from them may fall or rise. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this article. Overseas investments carry additional financial, regulatory and legal risks, you should do the necessary checks and research on the investment beforehand.

The information contained in this article has been obtained from public sources which the uSMART Securities (Singapore) Pte Ltd (“uSMART”) has no reason to believe are unreliable and any research, analysis, forecast, projections, expectations and opinion (collectively “Analysis”) contained in this article are based on such information and are expressions of belief only. uSMART has not verified this information and no representation or warranty, express or implied, is made that such information or Analysis is accurate, complete or verified or should be relied upon as such. Any such information or Analysis contained in this presentation is subject to change, and uSMART, its directors, officers or employees shall not have any responsibility for omission from this article and to maintain the information or Analysis made available or to supply any corrections, updates or releases in connection therewith. uSMART, its directors, officers or employees be liable for any or damages which you may suffer or incur as a result of relying upon anything stated or omitted from this article.

Views, opinions, and/or any strategies described in this article may not be suitable for all investors. Assessments, projections, estimates, opinions, views and strategies are subject to change without notice. This article may contain optimistic statements regarding future events or performance of the market and investment products. You should make your own independent assessment of the relevance, accuracy, and adequacy of the information contained in this article. Any reference to or discussion of investment products in this article is purely for illustrative purposes only, is not intended to constitute legal, tax, or investment advice of any investment products, and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products mentioned. This article does not create any legally binding obligations on uSMART. uSMART, its directors, connected persons, officers or employees may from time to time have an interest in the investment products mentioned in this article.

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global