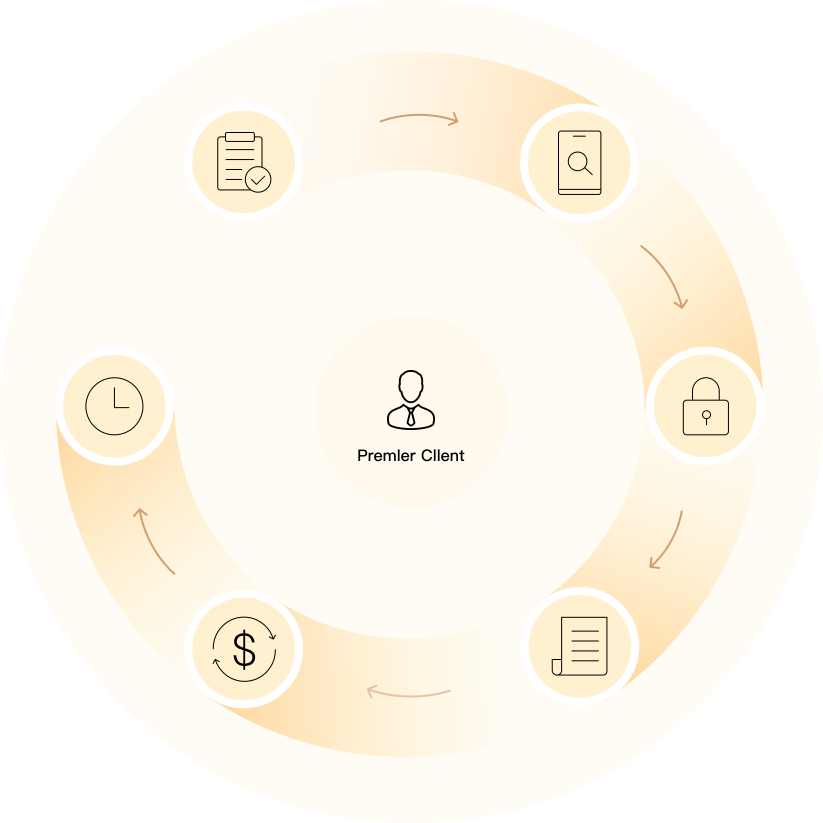

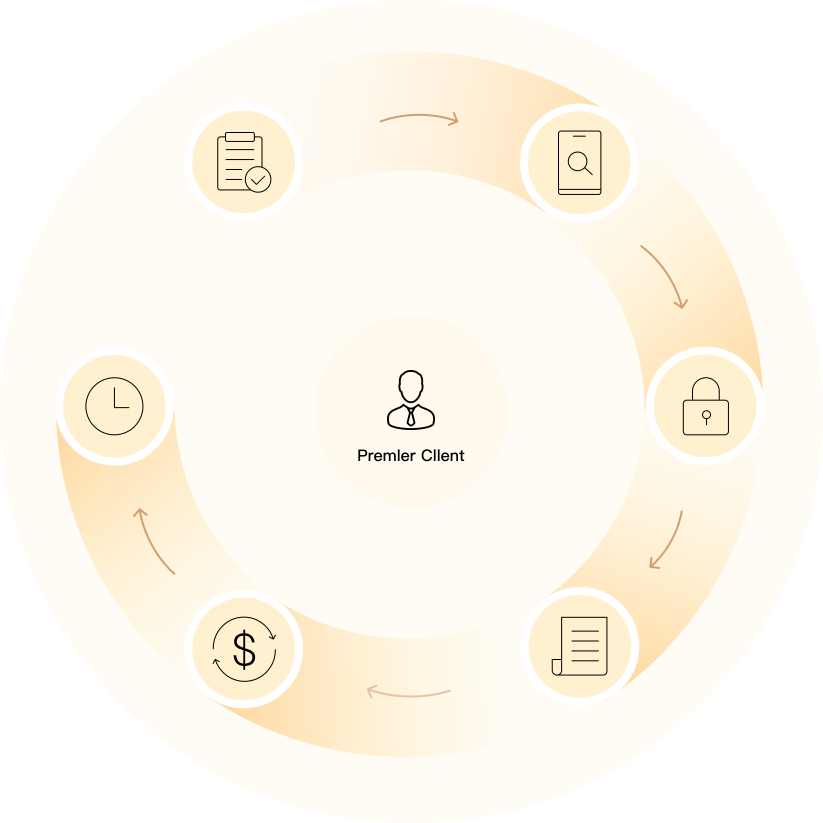

Personalized Investment ldeas

Sophisticated Solutions

Wealth Management

IPO Launch Priority

Dedicated Relationship Manager

A Holistic Wealth

Management For You

Get up to SGD 7,500 in rewards

AND Earn up to 4~% on daily interest on your cash balance in your uSMART trading account (USD/SGD)

T&Cs apply. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Sophisticated Solutions

Dedicated Relationship Manager

Invest through delegating the burden of making day-to-day investment decisions to a qualified professional Portfolio Manager.

Wealth Management

Protect and grow your wealth through our full suite of investment and insurance solutions tailored to your financial goals (savings, wealth protection, legacy and retirement planning)

IPO Launch Priority

Premier clients will have priority in share allocations.

Dedicated Relationship Manager

Single Point of Contact

Timely Market Updates

Periodic Portfolio Review

Portfolio Monitoring

Your Relationship Manager will reach out with you to complete a Client Investment Profile (CIP).

Alternatively, kindly leave your contact details in the form below and will be in touch with you soon.

Thank you!

Alternatively, kindly leave your contact details in the form below and will be in touch with you soon.

Thank you!

*terms and conditions

Singapore

Singapore Hongkong

Hongkong United States

United States Group

Group