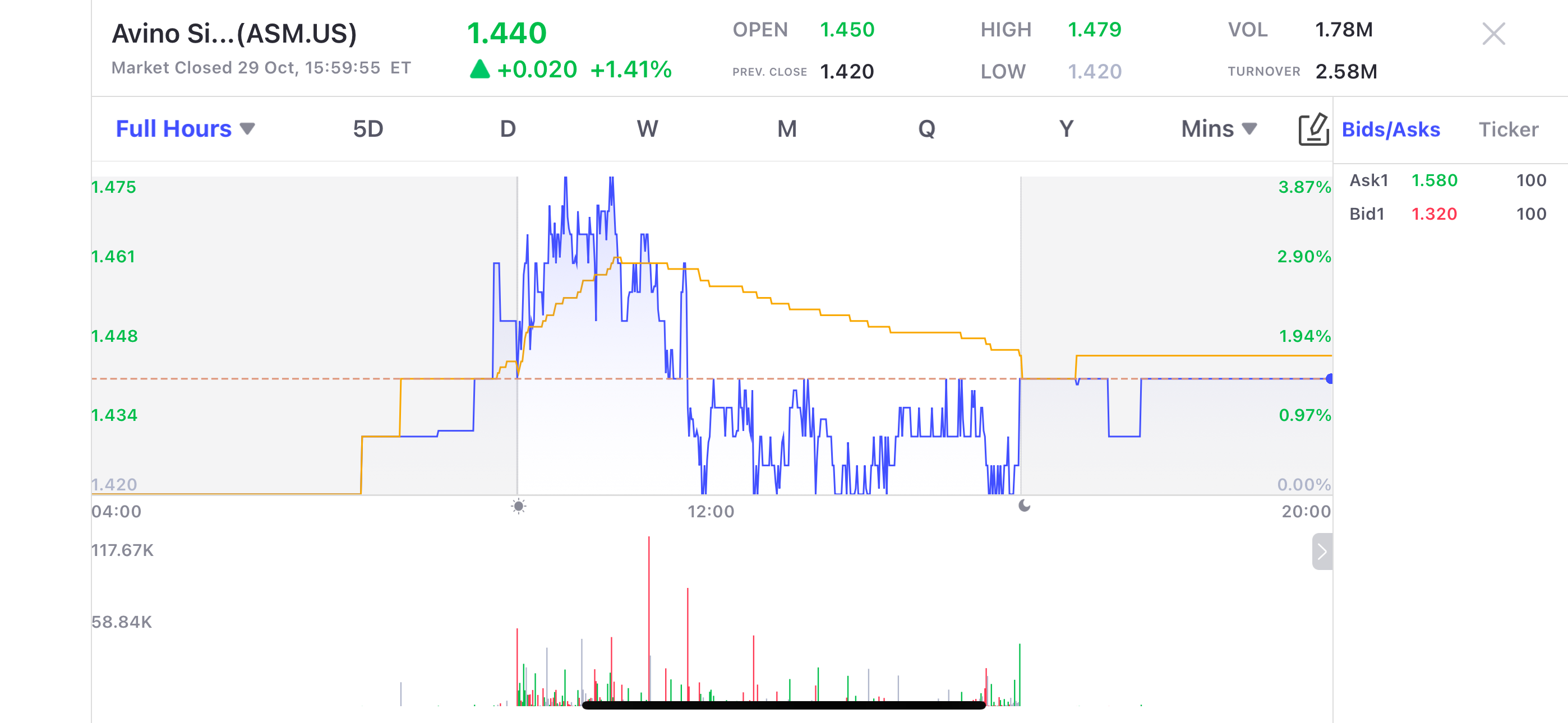

The rapid rise of artificial intelligence is fueling demand for advanced chip manufacturing equipment, benefiting ASM International NV (ASM), which achieved double-digit year-on-year growth in orders and revenue in Q3, setting a quarterly revenue record. ASM’s stock rose over 7% at one point.

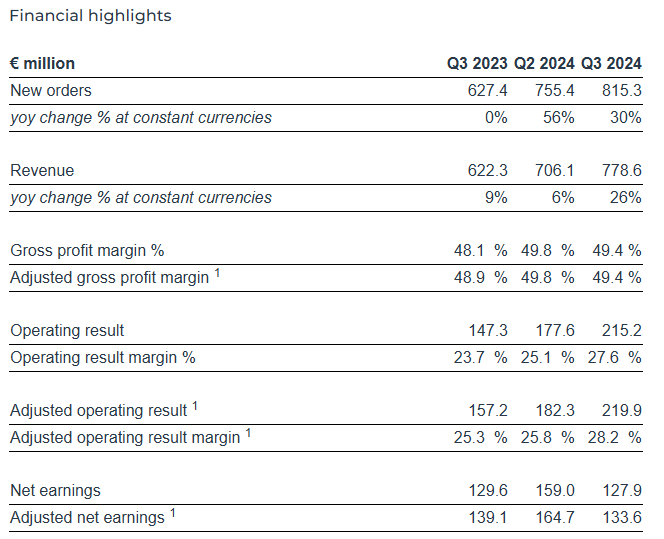

ASM International Q3 2024 Financial Highlights

New Orders and Backlog: In Q3, ASM received €815.3 million in new orders, marking a 30% year-on-year increase and surpassing analysts' expectations of €768.2 million. This growth was primarily due to strong demand for Gate-All-Around (GAA) and high-bandwidth memory (HBM) technology. The order backlog stood at €1.56 billion, slightly below the expected €1.59 billion.

Revenue: Revenue in Q3, at fixed exchange rates, reached €778.6 million, a quarterly record and a 26% year-on-year increase, hitting the upper end of the company’s guidance range of €740 million to €780 million.

Gross Margin: Q3 gross margin was 49.4%, surpassing the market forecast of 48.5%.

Operating Margin: Operating margin in Q3 reached 27.6%, above the expected 25.7%. Adjusted operating margin rose to 28.2% from 25.3% in the previous year, supported by a one-time gain of €7 million from the sale of a building.

Following the earnings release, ASM ADR shares rose as much as 7.4% intraday, eventually closing up 6.16%.

source:uSMARTSG

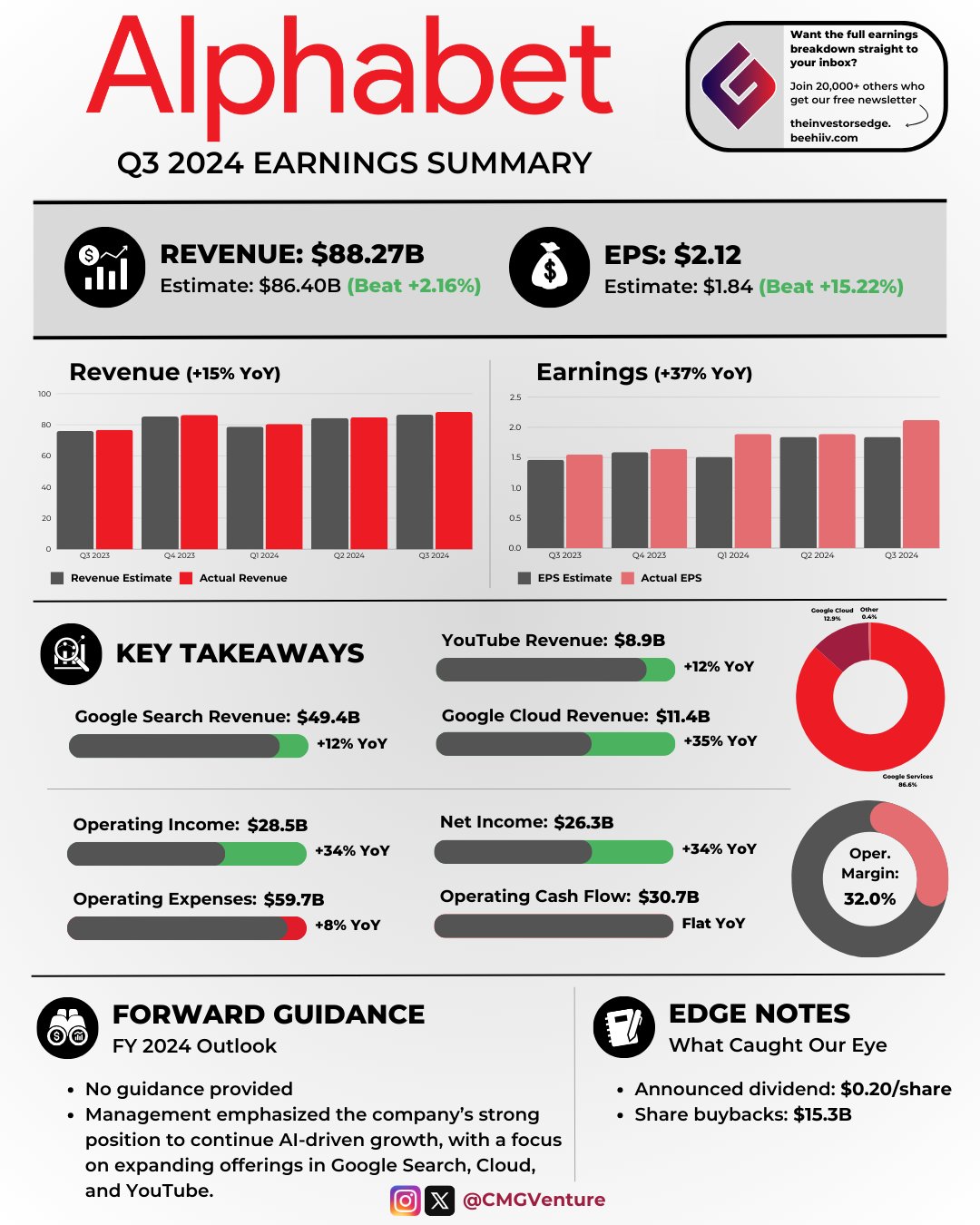

Q3 Results for Google Parent Alphabet

Alphabet, Google’s parent company, reported a 15% increase in Q3 revenue, with earnings per share (EPS) up nearly 37%, exceeding expectations. Among its businesses, the cloud segment performed exceptionally well, with operating profit up more than sixfold, marking a new quarterly record.

Key Financial Data:

Revenue: Alphabet reported Q3 revenue of approximately $88.27 billion, a 15.1% year-on-year increase, above the forecasted $86.45 billion.

EPS: Diluted EPS reached $2.12, a 36.8% year-on-year increase, above the expected $1.84.

Operating Profit: Operating profit in Q3 was $28.52 billion, a 33.6% year-on-year increase, above analysts’ forecasts of $26.67 billion, with an operating margin of 32%, a 4-point year-on-year increase.

Net Income: Net income in Q3 reached $26.3 billion, a 33.6% year-on-year increase.

Capital Expenditure: Capital expenditure for Q3 stood at $13.06 billion, slightly above expectations of $12.88 billion.

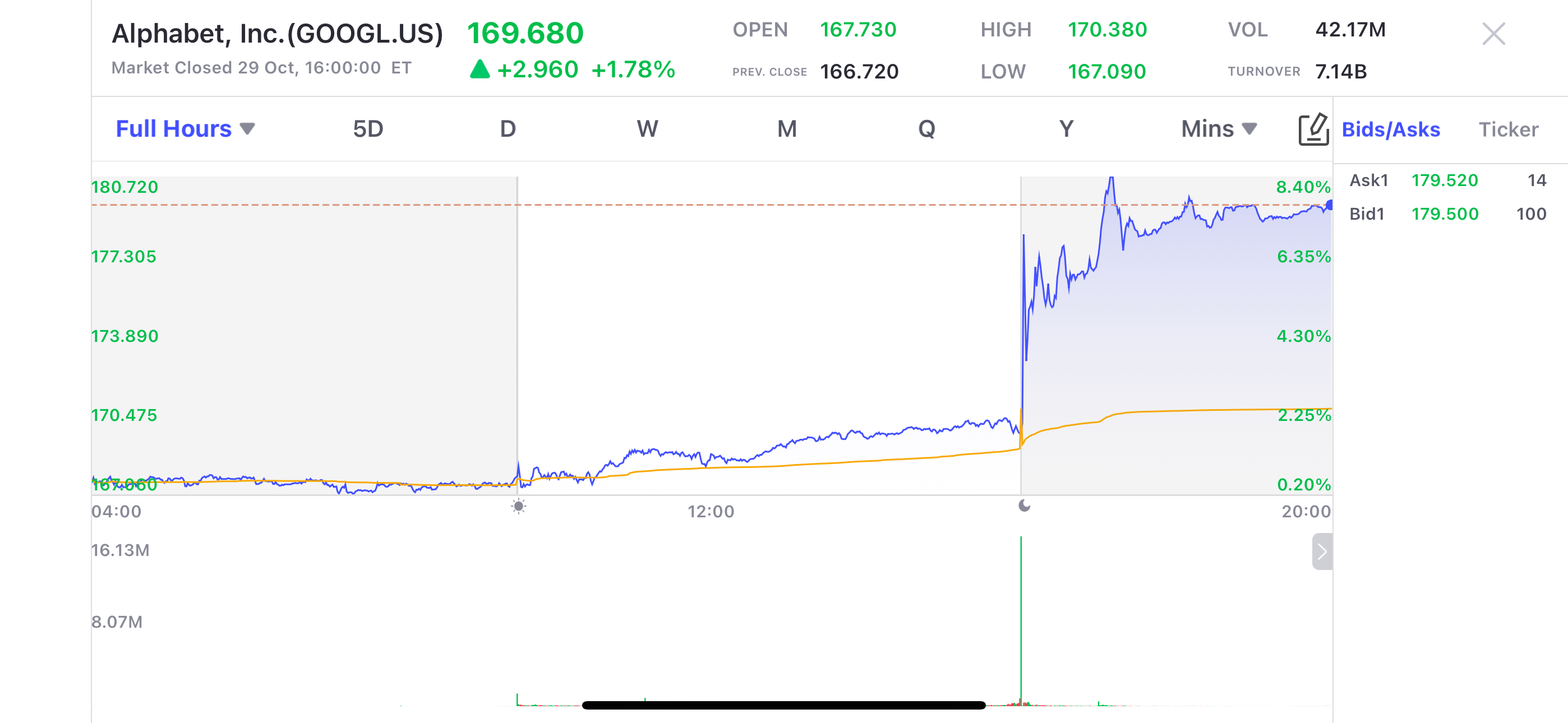

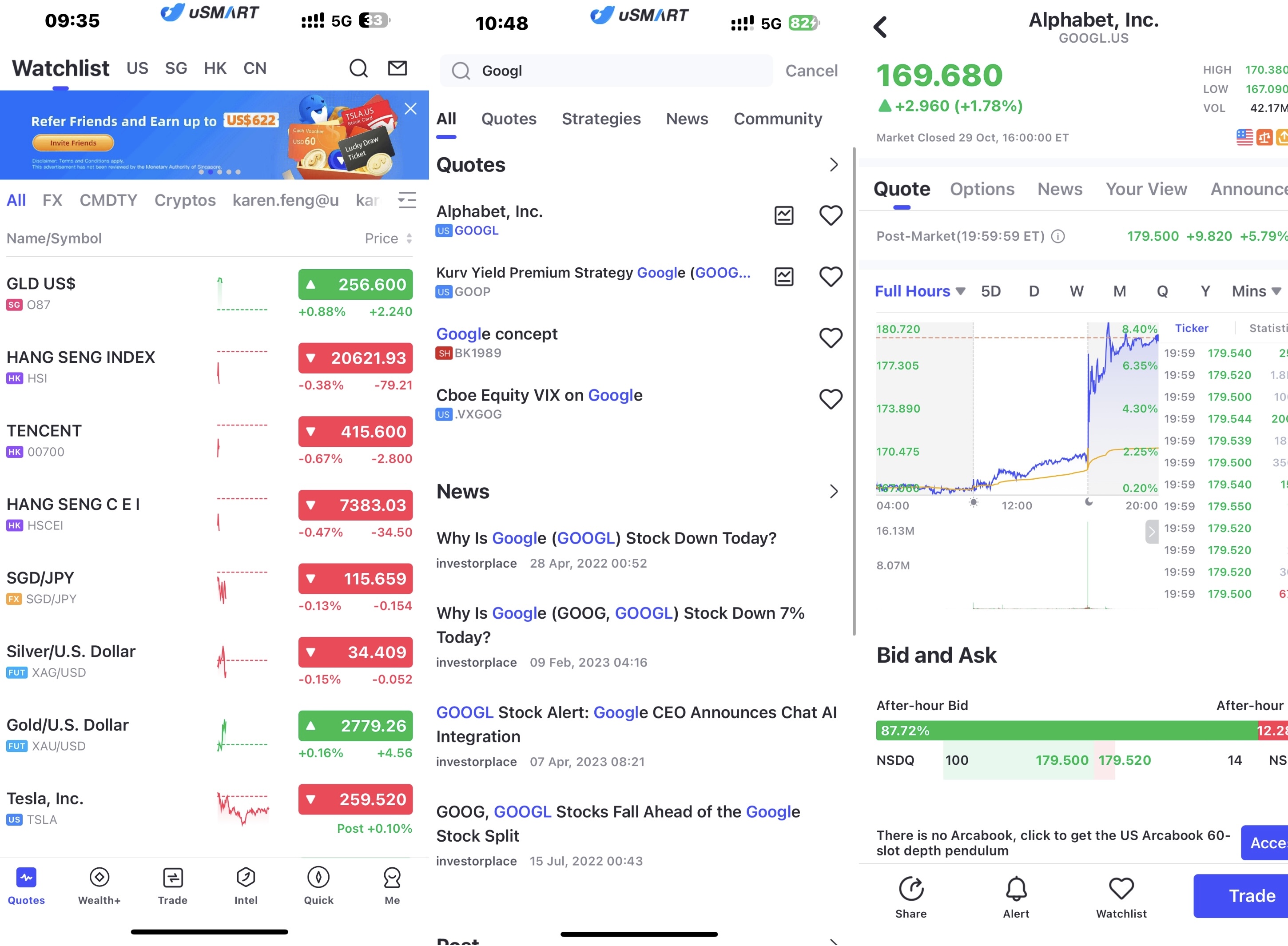

Following the earnings report, Alphabet’s stock rose by over 6% in after-hours trading.

source:uSMART SG

AI Boom Drives Demand for Advanced Manufacturing Equipment

Demand for advanced manufacturing equipment has surged due to the growing need for AI, benefiting companies like ASM, especially for high-performance products like GAA technology. ASM CEO Hichem M'Saad anticipates a significant sales increase next year. AI remains a major driving force in the semiconductor terminal market, particularly in the logic/foundry and high-bandwidth memory fields, aligning with ASM’s core strengths.

Deutsche Bank noted that major tech companies currently benefit primarily from generative AI in their cloud businesses, with AI-driven revenue beyond the cloud being more qualitative and less quantifiable in the short term. Alphabet CEO Sundar Pichai stated that the company will continue its long-term focus on AI investment, leveraging AI tools to benefit both consumers and partners.

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "GOOL", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global