Early Monday, results from Japan’s recent election indicated that the ruling Liberal Democratic Party (LDP) won only 191 seats, while its coalition partner Komeito secured 32 seats, totaling just 223 seats—short of the 233 needed for a parliamentary majority.

This outcome leaves the LDP with two options: it can bring other parties into the coalition to secure a majority, or, if other parties form a coalition, the LDP may lose its ruling status for the first time in 15 years. Such a shift could make Shigeru Ishiba one of Japan's shortest-serving prime ministers.

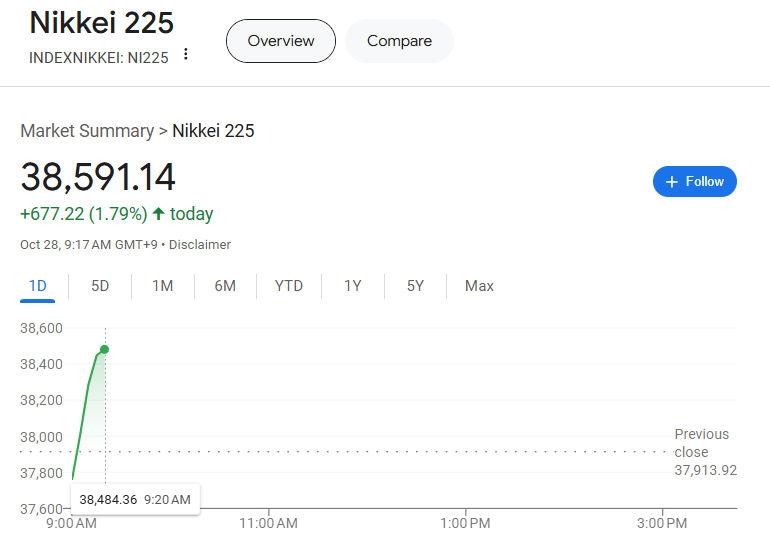

The LDP’s crisis poses potential shocks to the Japanese market, with analysts previously anticipating declines in both the yen and Japanese stocks on Monday. Goldman Sachs, for instance, had predicted a 2% drop in the Nikkei and a downtrend through the week. However, Japanese stocks quickly rebounded, with the Nikkei 225 rising 1.66% and the TOPIX index up 1.29%. Meanwhile, the yen weakened to a three-month low, with USD/JPY gaining 0.83%, now trading at 153.54.

Market Reactions and Analysts’ Perspectives

Analysts believe that the market had largely priced in a defeat for the LDP, anticipating it by around 60-80%. Nonetheless, with this event only partially priced, both the yen and Japanese equities could face short-term pressure. Goldman Sachs noted that the Nikkei may fall by about 2% on Monday, and, as investors realize the difficulty the LDP will face in gaining support from Japan Innovation Party or the Democratic Party, declines may persist for about a week.

Resilience of Japanese Stocks Amid Political Turmoil

According to Daiwa Securities’ senior strategist Shuji Hosoi, the Monday rally in Japanese stocks surprised the market, possibly due to earlier pricing-in of the election outcome or investor belief that, while political risks may be rising, Ishiba's government isn’t immediately viewed as a “lame duck.”

Nicholas Smith, Japan strategist at CLSA, was more optimistic, stating, “Don’t forget, Ishiba initially stated he intended to raise taxes. The weaker the LDP becomes, the harder it will be for him to do so, which is actually favorable for Japanese stocks.” Neil Newman, head of strategy at Astris Advisory Japan, commented, “Regardless of whether the LDP weathers this or if we soon have a new prime minister, Japan will undoubtedly continue to navigate its unique macroeconomic environment. Even if we face a weak or ineffective government, the underlying impact of Abenomics—corporate governance reforms, higher labor participation, and strong corporate earnings—will remain, which is positive for Japanese equities.”

Beyond short-term political uncertainty, analysts remain optimistic about the longer-term outlook for Japanese stocks. Warren Buffett, for example, recently shifted his focus from U.S. stocks to Japanese equities, a significant endorsement of the latter’s potential. He recently raised substantial funds in yen bonds to increase his investments in Japanese stocks.

According to UBS Japan equity strategist Moriyama, “Overall, we continue to view inflation adjustments and corporate governance reforms as vital structural themes for Japan’s transformation.” On inflation, Moriyama explained that with a structural labor shortage, Japanese companies are likely to increase wages next year and in subsequent years, indicating a shift from deflation to persistent inflation. “We believe this is a key top-down driver for Japanese stocks,” he added. Regarding corporate governance reforms, he stated that these will extend beyond shareholder returns, with Japan’s corporate governance evolving similarly to Germany’s transformation in the 1990s. As cross-shareholdings diminish and excess capital is optimized, companies may continue to expand shareholder returns. “We are highly optimistic about this trend, expecting Japan’s return on equity (ROE) to peak from 9% to above 12%,” Moriyama said.

He also noted that AI-related investments will continue to drive significant change for Japanese-listed companies. “Expectations around AI are a global focus, not just in Japan. Initially, the interest centered on semiconductor-related stocks, but now it’s expanding to other industries and companies expected to benefit across the value chain.” For instance, he said, AI-driven growth in semiconductor demand, especially for advanced chips and miniaturization technology, will continue driving demand for semiconductor chemicals, presenting significant opportunities for Japan’s specialty chemical companies.

The election loss signifies that the ruling coalition has lost its influence in the Diet, putting Ishiba’s ability to maintain power in question. On October 1, Ishiba was sworn in as Japan’s new prime minister, and Sunday marked the 27th day of his tenure. Should he resign following this setback, he could become Japan's shortest-serving post-WWII prime minister.

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "TSM", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global