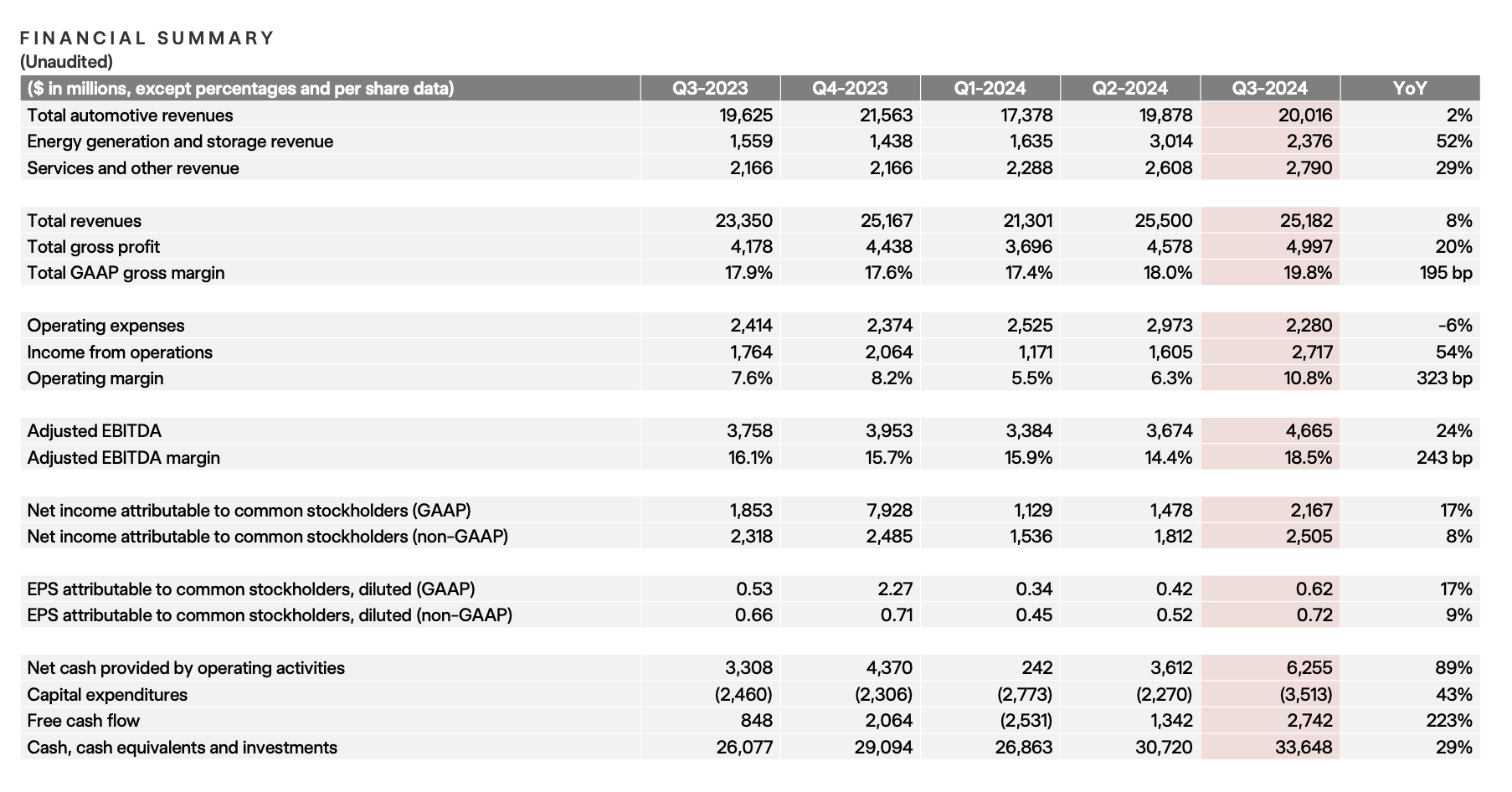

Following a strong earnings report, Tesla shares jumped over 12% in after-hours trading. Tesla's Q3 revenue reached $25.18 billion, an 8% year-on-year increase but slightly below market expectations of $25.37 billion. Net profit grew by 17% to approximately $2.17 billion, or $0.62 per share, exceeding analysts' forecasts. Operating margin was 10.8%, up from 7.6% the previous year.

Tesla's automotive revenue hit $20.016 billion, a 2% increase from the previous year, while its energy generation and storage revenue surged 52% to $2.376 billion. Service and other revenue rose by 29% to $2.79 billion. Tesla’s profit increase is primarily attributed to the rise in vehicle deliveries and revenue from selling carbon credits, earning $739 million in pure profit from these credits in Q3 alone.

Following a strong Q3 delivery, Tesla anticipates robust deliveries in the current quarter, with full-year deliveries projected to increase. Despite ongoing macroeconomic challenges, Tesla expects moderate growth in vehicle deliveries in 2024. Given the slower growth in the first half of the year, achieving or exceeding last year's figures will require a significant boost in Q4.

In its earnings release, Tesla also noted that its electric pickup, the Cybertruck, achieved positive gross margins for the first time. According to Kelley Blue Book, Tesla sold over 16,000 Cybertrucks in Q3, and Musk predicts a 20-30% sales growth for next year.

Meanwhile, BYD recently released its Q3 financial report, showing a revenue of RMB 162.15 billion, up 38.49% year-on-year, with a net profit of RMB 10.41 billion, marking an impressive 82.2% growth. This was BYD's first quarter with a net profit exceeding RMB 10 billion, translating to approximately RMB 113 million in daily earnings. The company sold 824,000 vehicles, including 431,600 pure electric passenger cars—a 23% quarterly increase, comprising 52.4% of total sales.

With these positive indicators, BYD's Q3 revenue of RMB 162.15 billion (equivalent to approximately $22 billion) has nearly caught up to Tesla’s Q3 revenue. BYD’s gross profit margin for automotive sales rose to 22.2% in Q3, up from 20.7% in Q1 and 21.6% in Q2. This efficiency in generating profit per vehicle rivals that of Tesla, even as Tesla’s automotive gross margin declined from 19.3% in Q1 to 17.9% in Q3 due to price cuts earlier in the year.

BYD’s advantage is bolstered by its hybrid segment, where its DM-i platform continues to gain market recognition. As a result, BYD’s overall profit margins have steadily improved, while Tesla, facing margin pressure from its aggressive pricing strategy, has seen a gradual decline in gross margins this year.

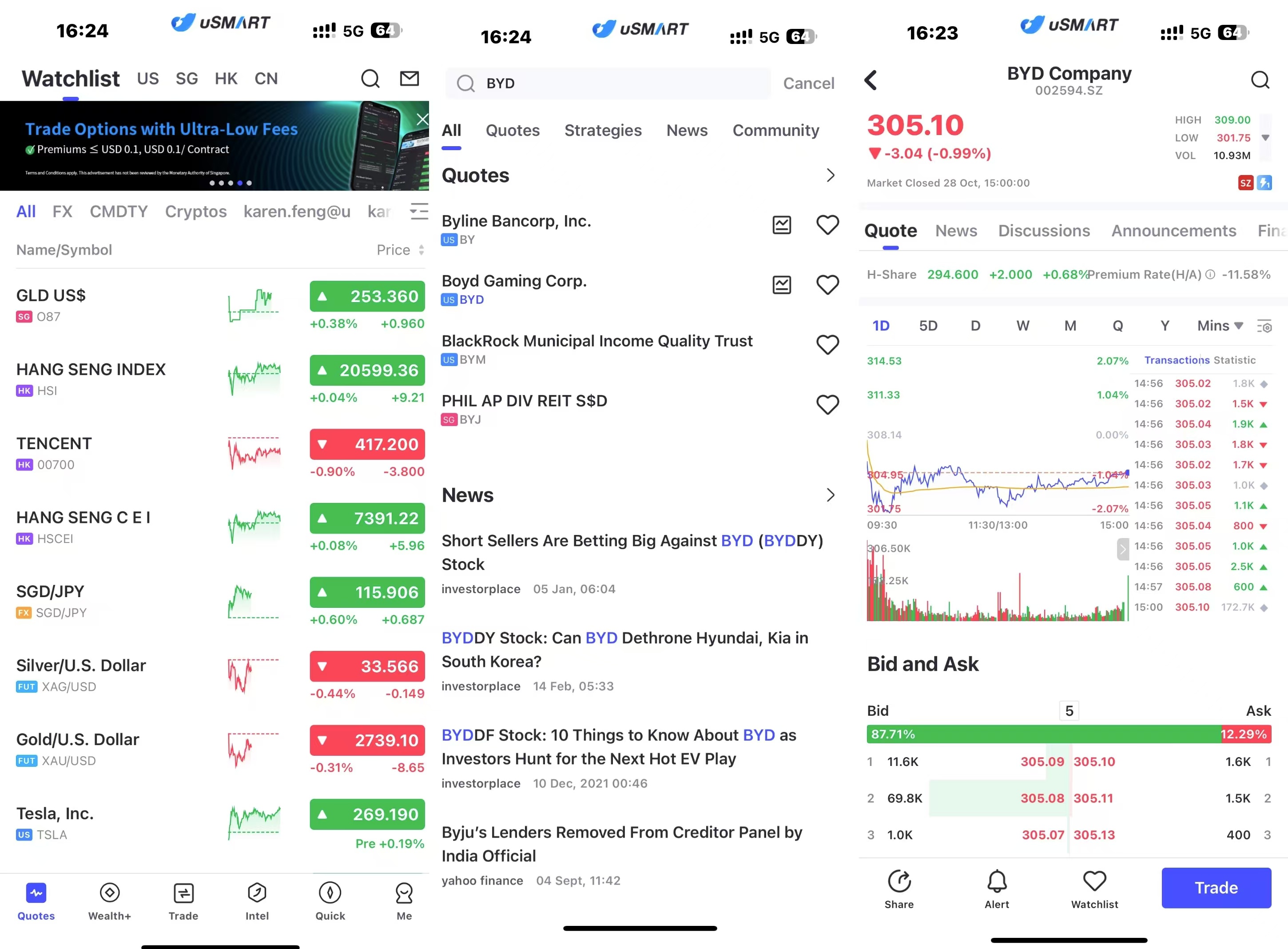

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "BYD", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global