On Monday, NVIDIA exceeded last week’s intraday high of $140.89, closing up 4.14% at $143.71, marking a new all-time closing high. The company's market cap now stands at $3.53 trillion, nearing Apple’s $3.6 trillion valuation.

NVIDIA's next test will come with Tesla’s earnings report, set to be released after the market closes this Wednesday. Following that, earnings reports from Microsoft, Amazon, Alphabet (Google's parent company), and Meta will also significantly impact NVIDIA’s stock performance.

Chinese stocks saw mixed results, with the Nasdaq Golden Dragon China Index falling about 0.80%. Baidu dropped more than 2%, while Vipshop, Alibaba, NetEase, NIO, and Futu Holdings declined over 1%. Tencent Music, Weibo, JD.com, iQiyi, and Full Truck Alliance experienced slight losses. On the positive side, XPeng Motors gained over 3%, while Bilibili, Pinduoduo, and Li Auto saw slight gains.

NVIDIA Hits Another Record High

On Monday, U.S. stocks closed with mixed results—Dow Jones fell 0.80%, Nasdaq gained 0.27%, and the S&P 500 dipped 0.18%. NVIDIA rose over 4%, reaching a new all-time high with a market cap surpassing $3.5 trillion, close to Apple’s valuation. Notably, NVIDIA's stock has surged over 180% year-to-date.

Bank of America analysts recently predicted that NVIDIA’s stock will continue to rise, raising their price target from $165 to $190. This suggests the stock could climb an additional 38% from its Friday closing price of $138.

Despite the stock’s remarkable gains, Bank of America still considers NVIDIA's valuation attractive. The bank's optimism stems from three key drivers:

- Recent industry events (TSMC’s earnings, AMD AI developments, conferences with companies like Broadcom and Micron, the speed of large language model rollouts, comments on capital expenditures by major hyperscale companies, and NVIDIA managing "insane Blackwell demand").

- Underestimated corporate partnerships (with Accenture, ServiceNow, Oracle) and software products (like NIM services).

- NVIDIA’s potential to generate $200 billion in free cash flow (FCF) over the next two years.

Bank of America expects NVIDIA's earnings per share (EPS) to grow by 13%-20% during the 2025-2026 fiscal years, and it raised its price target to $190. By 2027, NVIDIA’s EPS is projected to exceed five times its current level, reaching $5.67, with its price-to-earnings (P/E) ratio dropping to a more moderate 24x.

Narrowing Margin for Error in the Market

According to consulting firm International Business Strategies, which tracks industry data, the AI chip market is expected to grow by 99% in 2024 and another 74% in 2025.

However, any minor slowdown in NVIDIA’s growth could lead to a stock decline, as seen after the previous earnings report, when investors were underwhelmed by its performance.

On Monday, Susquehanna analyst Christopher Rolland maintained a "positive" rating on NVIDIA, predicting steady demand in AI. Rolland expects some correction in capital expenditures by hyperscale companies but notes that the bar for AI stocks has risen. He added that NVIDIA may need to raise its guidance to support further stock gains.

According to Bloomberg’s tracking data, Wall Street analysts expect NVIDIA’s third-quarter earnings per share to reach $0.74, representing an 84% year-over-year increase. Revenue is expected to grow 83% to $33.1 billion.

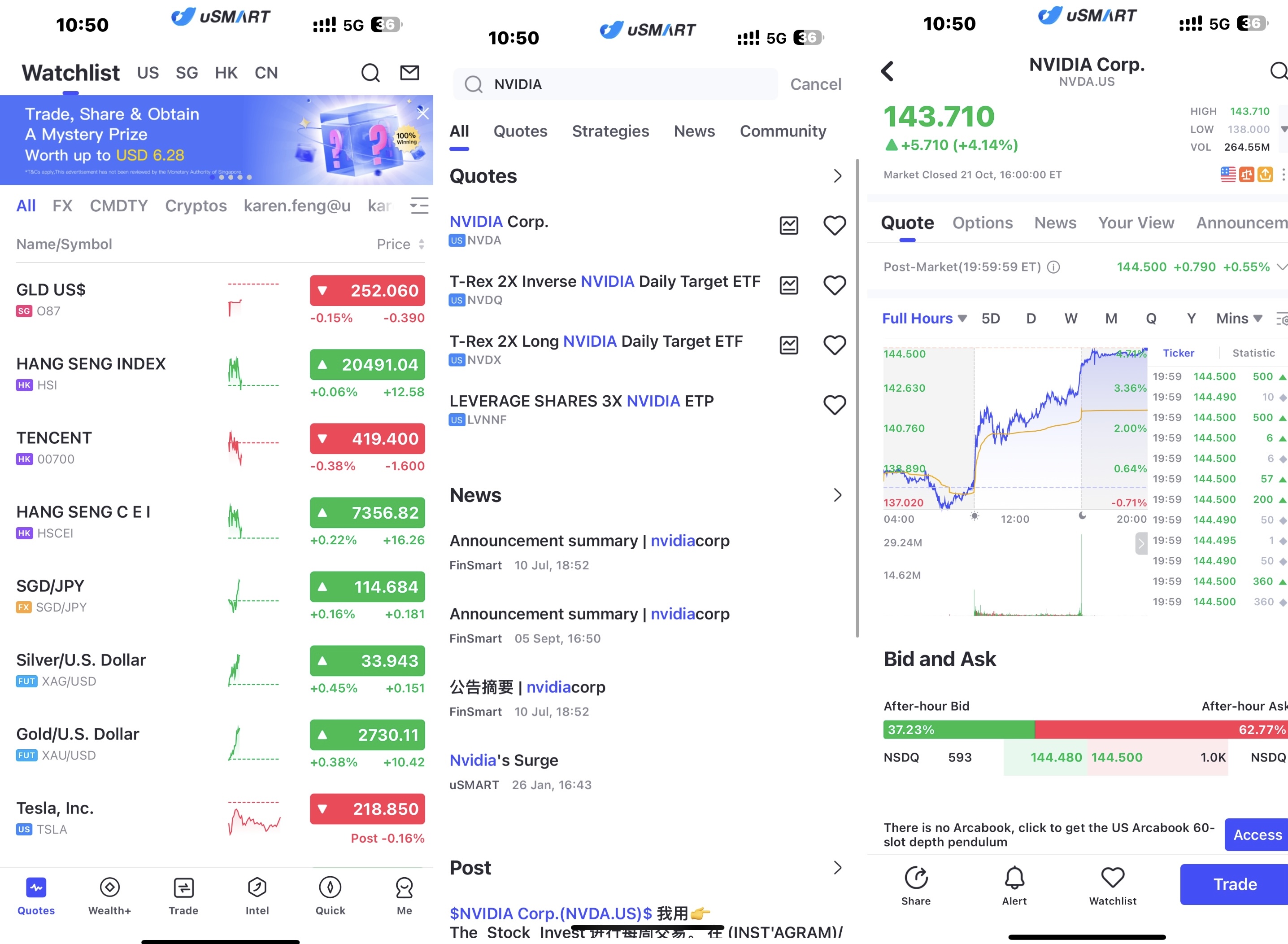

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "TSM", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global