U.S. stocks closed higher on Wednesday, with the Dow Jones Industrial Average hitting a record closing high. The Dow gained 337.28 points, or 0.79%; the Nasdaq rose by 51.49 points, or 0.28%; and the S&P 500 increased by 27.21 points, or 0.47%.

The market benefited from Morgan Stanley’s strong earnings report, and investors were also focused on the potential impact of the U.S. presidential election on the stock market. Goldman Sachs significantly raised its year-end 2024 target for the S&P 500.

Today, three major "cutting-edge technology" sectors showed strong performance: space satellites, quantum computing, and U.S. nuclear power stocks, which collectively surged by 40%.

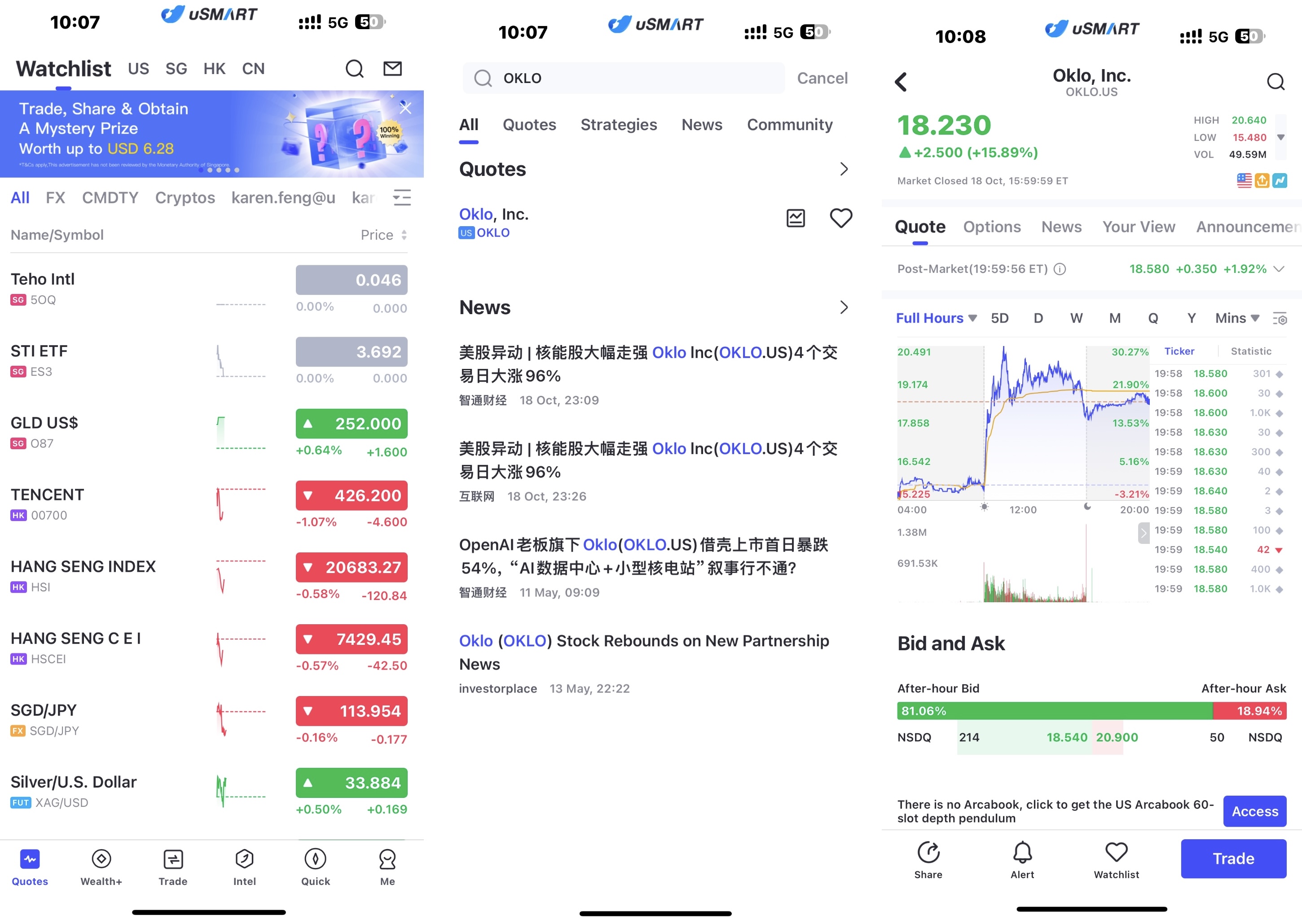

Data Source: uSMART SG

- Oklo Inc. (OKLO) +41.97%

- NANO Nuclear Energy Inc. (NNE) +37.85%

- NuScale Power Corporation (SMR) +40%

- Centrus Energy Corp. (LEU) +26.2%

In an effort to develop large data centers to meet the growing demand for artificial intelligence and cloud computing, U.S. tech giants are increasingly turning to clean nuclear energy for electricity. According to the 2023 AI Index Report by Stanford’s AI Research Institute, a single training session of OpenAI's GPT-3 consumes 1,287 MWh, equivalent to the electricity used by 3,000 Tesla Model Y vehicles driving 200,000 miles.

On Wednesday, October 16, Amazon announced that it had signed an agreement with Dominion Energy (ticker: D) in Virginia. The utility company will explore developing small modular reactors (SMRs) near Dominion's existing North Anna nuclear power plant. These nuclear reactors do not produce carbon emissions.

SMRs are advanced nuclear reactors with a smaller footprint, which can be built closer to power grids. Compared to traditional reactors, they have shorter construction times, allowing for quicker deployment.

Proponents of SMRs believe that they are smaller, safer, and more efficient than large nuclear reactors. However, until recently, investors have been cautious about SMRs, expressing concerns over whether these projects could be completed on time and within budget. High interest rates and a lack of customers have also slowed progress in the industry.

Last year, private SMR developer X-Energy was forced to abandon an $1.8 billion public listing plan through a special purpose acquisition company due to "challenging market conditions." Shortly afterward, NuScale canceled plans to build the first small reactor in the U.S.

Edwin Lyman, the Director of Nuclear Power Safety at the Union of Concerned Scientists, commented that SMRs from X-Energy and Kairos are "untested designs" and that their deployment could be delayed far beyond the 2030 target date. Any experimental nuclear technology aiming for safe, reliable commercial operation faces hurdles, and it's nearly impossible to estimate the final cost of electricity today.

Matthew Garman, CEO of AWS, said, "We foresee that gigawatt-level power will be needed in the coming years, and wind and solar projects will not be enough to meet that demand, making nuclear power a great opportunity." He added that SMR technology continues to advance and could become a safer, easier-to-manufacture, and more compact solution.

Virginia is home to nearly half of the data centers in the U.S., with Northern Virginia housing a region known as "Data Center Alley." Most of the data centers are located in Loudoun County. It is estimated that 70% of global internet traffic passes through "Data Center Alley" daily.

Dominion Energy provides approximately 3,500 MW of power to 452 data centers within its service area in Virginia, with about 70% of this power concentrated in Data Center Alley. According to Dominion Energy, a single data center typically requires about 30 MW or more of power. The company's President and CEO, Bob Blue, said on a recent quarterly earnings call that they are now receiving individual requests for as much as 60 MW to 90 MW or more. Dominion expects power demand to grow by 85% over the next 15 years. AWS anticipates that the new SMR could provide at least 300 MW of power to the Virginia region.

Recently, Google also acquired electricity from nuclear startup Kairos Power, which is building 6-7 small modular reactors (SMRs) with a total capacity of 500 MWh to support its data centers and AI energy needs.

Last month, Microsoft signed a 20-year power purchase agreement with Constellation Energy (ticker: CEG) to restart the Three Mile Island nuclear plant, which was shut down in 2019, with all generated power sold to Microsoft.

Similarly, in September, Oracle Chairman Larry Ellison announced during an earnings call that the company is designing a data center that will require over 1 GW of power, which will be supplied by three small nuclear reactors.

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "OKLO", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group