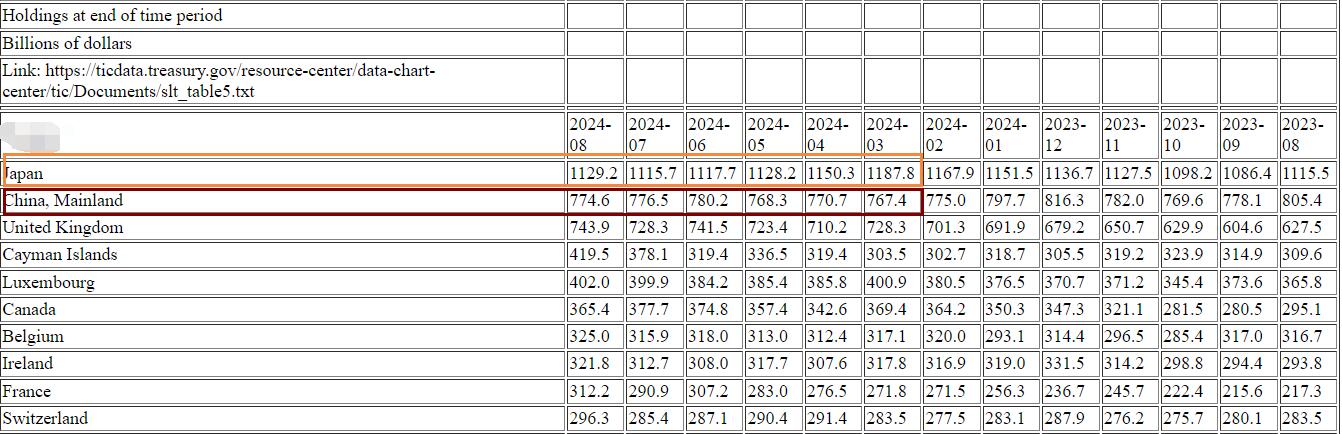

In August 2024, the Federal Reserve Chair Jerome Powell signaled a dovish shift at the Jackson Hole Symposium, raising expectations of interest rate cuts, which further boosted U.S. Treasury prices. On October 17, local time, the U.S. Department of the Treasury released data showing a divergence in the holdings of U.S. Treasury bonds among its top three foreign creditors: Japan, China, and the United Kingdom. While China reduced its holdings, Japan and the UK increased theirs.

According to the U.S. Treasury’s August 2024 International Capital Flow Report (TIC), Japan increased its U.S. Treasury holdings by $13.5 billion in August, bringing its total to $1.1292 trillion, maintaining its position as the largest holder of U.S. debt.

China, on the other hand, reduced its U.S. Treasury holdings by $1.9 billion, lowering its total to $774.6 billion. This marks the second consecutive month of reductions following its increase in June.

As the second-largest foreign holder of U.S. debt, China’s holdings have been below $1 trillion since April 2022 and have generally been on a downward trend. In January 2024, China reduced its U.S. Treasury holdings by $18.6 billion, starting a three-month streak of sell-offs. This was followed by reductions of $22.7 billion in February and $7.6 billion in March. However, in April, China made its first purchase of the year, increasing its holdings by $3.3 billion. In May, it once again reduced its holdings by $2.4 billion, only to increase by $11.9 billion in June, the largest purchase of the year. In July, China reduced its holdings by $3.7 billion.

The UK increased its U.S. Treasury holdings by $15.6 billion in August, reaching a total of $743.9 billion, making it the third-largest holder of U.S. debt.

The U.S. Treasury report showed a net inflow of $79.2 billion into U.S. securities, both long-term and short-term, as well as banking flows in August. Of this, $79.7 billion came from private foreign investments, while official foreign entities saw a net outflow of $600 million.

Additionally, foreign investors made net purchases of $129.8 billion in U.S. long-term securities in August, following net purchases of $134.7 billion in July. Of this, private foreign investors bought $158.1 billion, while official foreign institutions sold $28.3 billion. Adjusting for certain factors, including foreign portfolio purchases of U.S. stocks through swaps, the overall net purchases of U.S. long-term securities by foreign investors in August totaled $111.4 billion, down from $135.4 billion in July.

The TIC report also revealed that, among the top ten foreign holders of U.S. debt, only China and Canada reduced their holdings in August. Canada, ranked sixth, reduced its holdings by $12.3 billion. The Cayman Islands, a haven for hedge funds, increased its U.S. Treasury holdings by $41.4 billion, the largest increase for the second consecutive month, moving from fourth to fifth place. France, ranked ninth, increased its holdings by $21.3 billion, while the UK’s increase of $15.6 billion slightly outpaced Japan's.

As of August 2024, the top nine foreign holders of U.S. debt, according to data from the U.S. Treasury, were:

- Japan ($1.1292 trillion)

- China ($774.6 billion)

- United Kingdom ($743.9 billion)

- Cayman Islands ($419.5 billion)

- Luxembourg ($402.0 billion)

- Canada ($365.4 billion)

- Belgium ($325.0 billion)

- Ireland ($321.8 billion)

- France ($312.2 billion)

- Switzerland ($296.3 billion)

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group