According to a Reuters report today, TSMC (Taiwan Semiconductor Manufacturing Company) is set to release its third-quarter financial report on Thursday, with profits expected to surge by 40%. This significant profit increase is primarily driven by the soaring demand for AI chips. TSMC, the world's largest contract chipmaker, announced that its quarterly earnings exceeded expectations, thanks to the strong demand for advanced processing node technology used in artificial intelligence applications. TSMC supplies chips to most global companies, including Nvidia and Apple.

As the world's largest contract chipmaker, TSMC has been riding the AI wave, which shows no signs of slowing down and continues to sweep the globe. Major chip giants such as Nvidia and Broadcom, TSMC’s clients, have benefited from the surge in demand for AI chips—the core infrastructure for AI. This growing demand has led to a sharp increase in TSMC’s contract manufacturing volumes for these companies, driving TSMC's performance beyond expectations and contributing to the record highs in its stock price on both Taiwan's stock market and the U.S. ADR market since last year.

Li Fang-kuo, Chairman of Uni-President Investment Trust, said: “Most of TSMC’s customers, such as Apple, Nvidia, AMD, Qualcomm, and MediaTek, are launching new products that heavily rely on TSMC’s advanced process technology.”

Last week, TSMC announced that its third-quarter revenue (calculated in New Taiwan dollars) grew significantly, far exceeding market expectations. The company also provided revenue guidance in U.S. dollars during its earnings call.

TSMC, headquartered in Hsinchu, Taiwan, reported consolidated operating revenue of NT$759.69 billion (US$23.5 billion) for the third quarter, representing a 39% year-over-year increase. Sequentially, revenue grew by 12.8%. In U.S. dollar terms, revenue rose 36% year-over-year and 12.9% quarter-over-quarter. The revenue figure exceeded the consensus estimate of NT$748 billion and surpassed the company’s guidance range of US$22.4 billion to US$23.2 billion.

The AI boom has driven sharp increases in the stock prices of tech-related companies, and TSMC is no exception. The company’s ADRs, listed on the New York Stock Exchange, have risen more than 82% year-to-date. According to Benzinga Pro data, TSMC’s shares closed at $187.48 on Wednesday, a 0.19% increase.

According to SmartEstimate data from the London Stock Exchange, which aggregates estimates from 22 analysts, TSMC is expected to report a quarterly net profit of NT$298.2 billion (approximately RMB 65.54 billion) for the period ending September 30.

TSMC will hold its quarterly earnings call on Thursday, during which it will update its outlook for the current quarter and the full year, including capital expenditures for expanding production.

TSMC is reportedly investing billions of dollars in building new overseas factories, including a US$65 billion investment to construct three factories in Arizona, USA. However, TSMC has stated that the majority of its manufacturing operations will remain in Taiwan.

During its earnings call in July, TSMC raised its full-year revenue forecast and adjusted its capital expenditure plan for the year to US$30 billion to US$32 billion, up from the previous forecast of US$28 billion to US$32 billion.

In addition, the AI boom has also propelled TSMC’s stock price higher. Year-to-date, TSMC’s stock, listed on the Taipei Stock Exchange, has surged 77%, outpacing the broader market’s 28% increase.

Following the earnings release, the share price decline of Japanese chipmakers like Lasertec narrowed, though their trading session was hours away from starting. TSMC’s stock has soared more than 70% this year, outperforming many large tech companies in Asia, reflecting strong market expectations for its AI business.

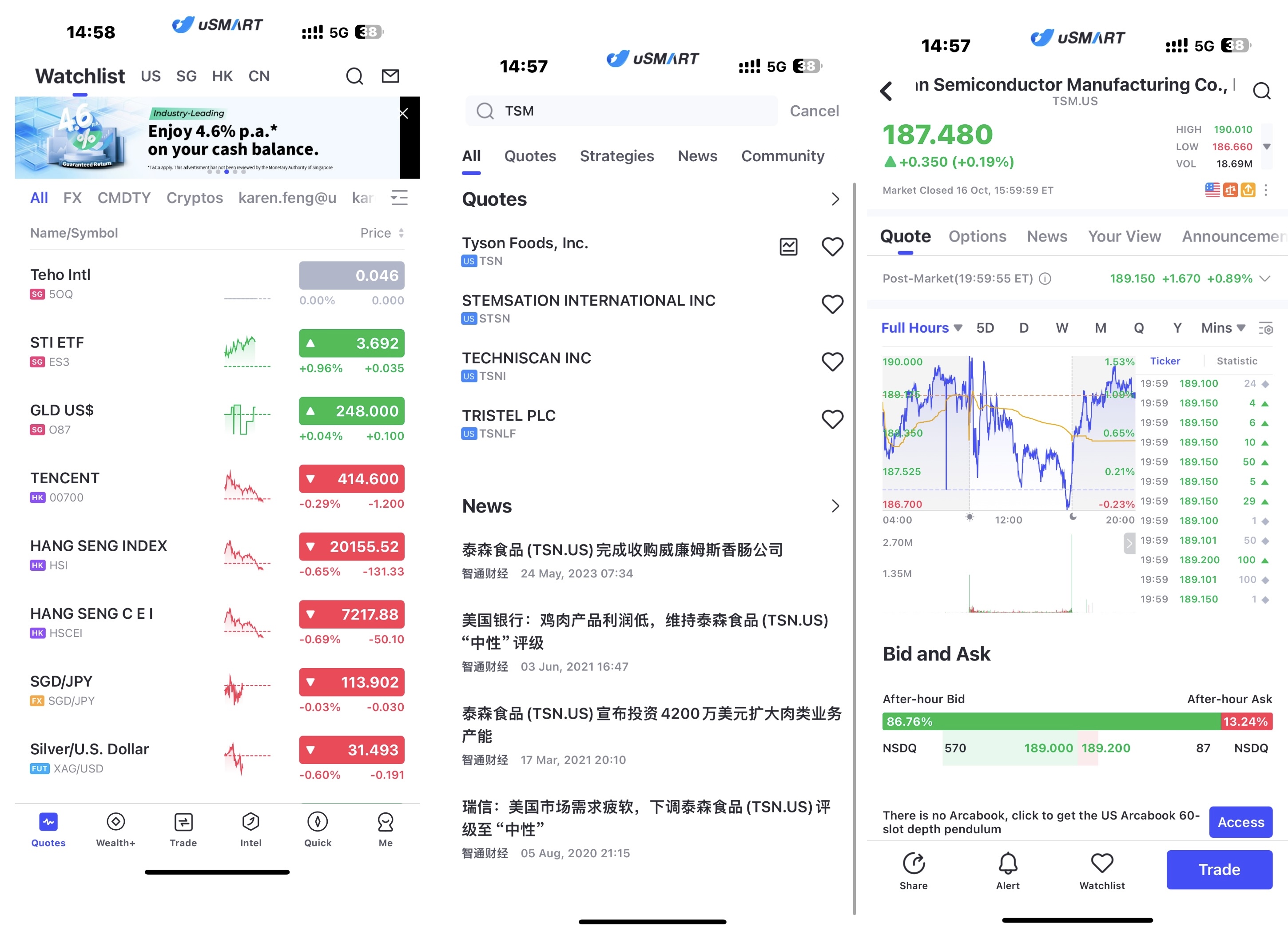

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "TSM", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global