Goldman Sachs' Prime Brokerage (PB) business saw a collective surge in Chinese stocks, recording the largest single-day net purchases since March 2021 and the second largest in the past decade, almost entirely driven by long positions. Hedge fund legend David Tepper remarked, “I buy everything; I will buy ETFs, futures—everything.”

This week, Chinese assets performed impressively, with the renminbi significantly appreciating, briefly surpassing 6.98 against the dollar, reaching its highest point since May 2023. A-shares, Hong Kong stocks, and U.S.-listed Chinese stocks all surged, with the FTSE China A50 index futures rising over 20% in a week.

Widespread Rally in Chinese Assets

This week, Chinese assets rebounded significantly. The Shanghai Composite Index, Shenzhen Component Index, and ChiNext Index posted cumulative increases of 12.81%, 17.83%, and 22.71%, respectively. All industry sectors rose, with food and beverage, beauty and personal care, and non-banking financial sectors leading the way, up 26.06%, 24.37%, and 23.00%. Notably, the stock Yinzhijie surged over 122%, while Dongfang Caifu and Tonghuashun both rose over 56% in a week.

In the Hong Kong market, the Hang Seng Index, Hang Seng China Enterprises Index, and Hang Seng Technology Index increased by 13.00%, 14.39%, and 20.23%, respectively.

- Top 10 Index Funds: Two Liquor Funds Lead, Eight Securities Funds Follow

Data shows a peculiar trend among the top 10 index funds in the past week: the top two were liquor funds, followed by eight securities industry index funds. Liquor indices approached daily limits on two occasions, and funds primarily investing in liquor made significant recoveries. The CSI Liquor Index fund, well-known in the market, was the biggest beneficiary. Penghua Fund’s Penghua Liquor C also saw considerable gains.

Brokerages serve as bull market flagbearers, and when the stock market rallies, outside capital often first flows into the brokerage sector, which was the case this time. Among the top 10 index funds, eight were securities index funds with gains over 24%, such as Bosera Securities Index A at 25.09%, Huaxia CSI Securities Index at 24.77%, and Harvest CSI Securities Index at 24.65%. This aligns almost perfectly with the 23.89% rise of the A-share securities index that week.

- Top 10 Equity Funds: Real Estate Industry Chain Funds Lead, Consumer Sector Follows

This week’s stock market surge saw the real estate development-related industry chains—including development, construction, building materials, renovation, home sales—take the lead, followed closely by consumer stocks, particularly food and beverage, with liquor stocks continuously climbing.

Among the top 10 equity funds, most heavily invested in these sectors include ICBC Industry Upgrade A, which focuses on real estate, and China Europe Core Consumer A, which heavily invests in liquor stocks. Other funds like Jianxin Food and Beverage Industry Fund focus on liquor and pig farming stocks, while Yinhua Food and Beverage Quantitative Fund is invested in liquor, beer, and dairy, with Inner Mongolia Yili as its largest holding.

- Top 10 Mixed Funds: A-shares Similar to Equity Funds, But Many Heavily Invest in Hong Kong Stocks

Compared to index and equity funds, the top 10 mixed funds have a more complex portfolio. The leading fund, Huatai-PB Hong Kong Stock Connect Era Opportunities Mixed A, rose 27.44% and heavily invested in Hong Kong stocks, including several brokerage H-shares. This year, Hong Kong stocks have performed stronger than A-shares, with the Hang Seng Index increasing 13% this week.

In fourth place, ICBC Core Opportunities Mixed A rose 24.01%, with top holdings also heavily focused on the real estate industry chain, including three Hong Kong stocks: China Overseas Development, China Resources Land, and China Jinmao.

- Top 10 Bond Funds: Balanced Fixed Income +, With Seven Convertible Bonds and Three Yield-Enhancing Funds

Typically, a soaring stock market signals declining bond indices. However, some bond funds performed well last week. Among the top 10 bond funds with net value growth exceeding 10%, seven were primarily invested in convertible bonds, while three were yield-enhancing bond funds that included some stock investments, providing a balanced approach.

For example, the fund with the highest net growth, Minsheng Enhanced Yield Bond C, had a 29.47% proportion in convertible bonds among its top five holdings by the end of June, with stocks accounting for 13.93%, including the recently surging Dongfang Caifu, which constituted 2.12%.

- Top 10 QDII Funds: Heavily Invested in Hong Kong Internet Leaders, With U.S.-listed Chinese Stocks in Some Portfolios

While A-shares soared, overseas markets, especially Hong Kong-listed Chinese stocks and the Nasdaq Golden Dragon China Index, also saw substantial increases, benefiting QDII funds with heavy holdings in these stocks.

The leading fund, E Fund Quality Select Mixed Fund, rose 19.86% and is managed by well-known fund manager Zhang Kun. By the end of June, half of its top 10 holdings included domestic liquor leaders such as Moutai, Wuliangye, and Luzhou Laojiao, while the other half consisted of diverse Hong Kong stocks, including tech giants Tencent and Alibaba, as well as CNOOC and Huazhu Group.

Ranking third, the China Europe Hong Kong Stock Digital Economy Mixed (QDII) A rose 17.36%, featuring five major Hong Kong internet companies: Tencent, Xiaomi, Meituan, Kuaishou, and Netease, along with three education stocks including New Oriental and electric vehicle leaders like BYD and Trip.com.

The fourth-ranked fund, Harvest Global Internet Stocks RMB, also included major Hong Kong stocks such as Tencent, Meituan, and Alibaba, along with six U.S.-listed Chinese stocks, including Pinduoduo, Alibaba, iQIYI, JD Cloud Warehouse, TAL, and Gaotu, as well as tech giants from the U.S. stock market.

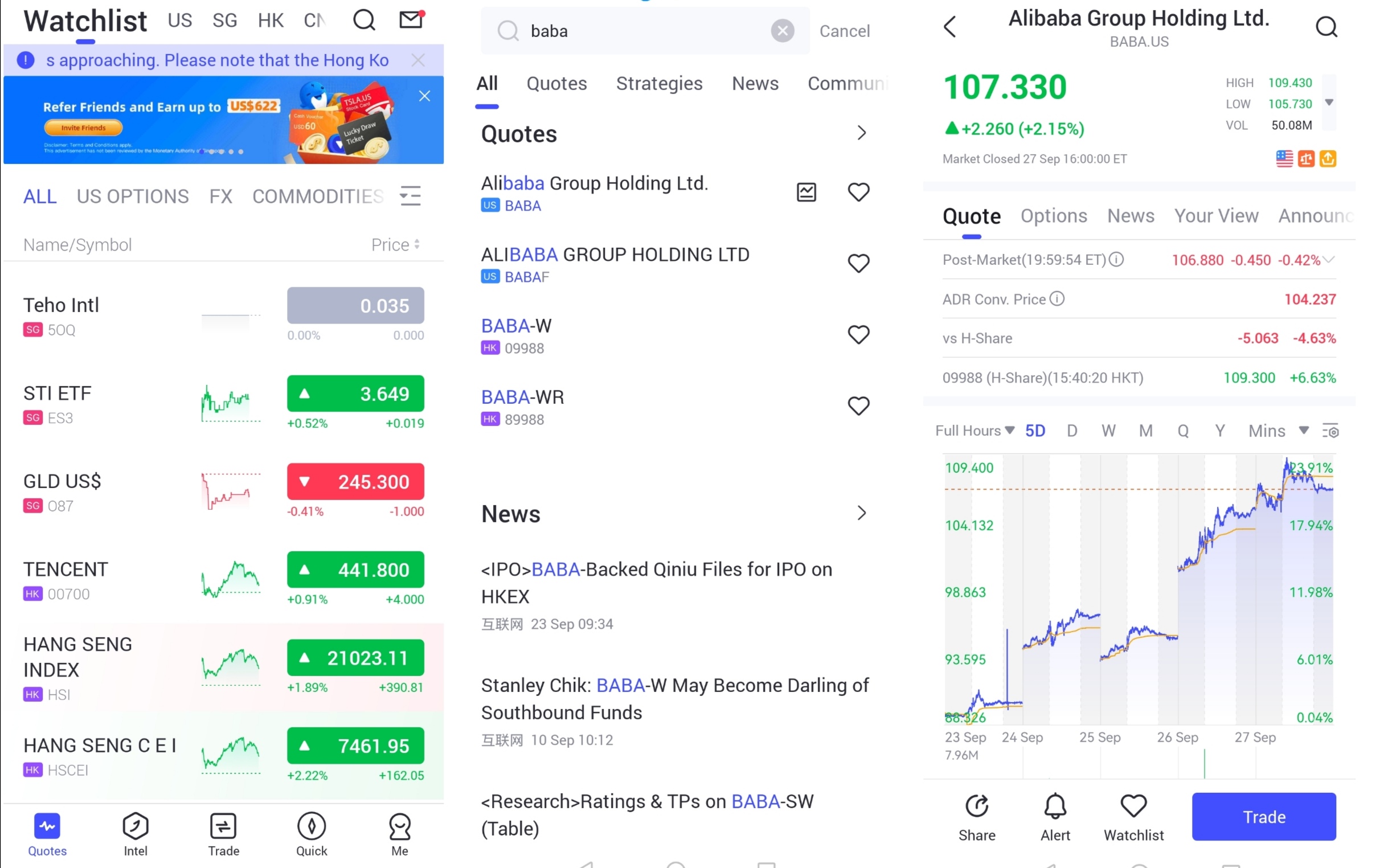

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "BABA", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global