On Thursday, Micron Technology's stock soared over 16% in pre-market trading. For the fourth quarter of fiscal year 2024, Micron reported revenue of $7.75 billion, exceeding market expectations of $7.67 billion and up from $4.01 billion in the same period last year. The net profit was $888 million, below the expected $950 million, compared to a net loss of $1.43 billion last year. Earnings per share (EPS) were $0.79, slightly below the anticipated $0.81, while the previous year saw a loss per share of $1.31. Micron predicts that the HBM market will grow from $4 billion in 2023 to over $25 billion by 2025, with plans to ramp up production of HBM3E 12H products in early 2025.

After the market closed on September 25, Micron announced its financial results for the fourth quarter of fiscal year 2024, ending August 29, 2024, and provided guidance for the first quarter of fiscal year 2025.

Key Financial Data:

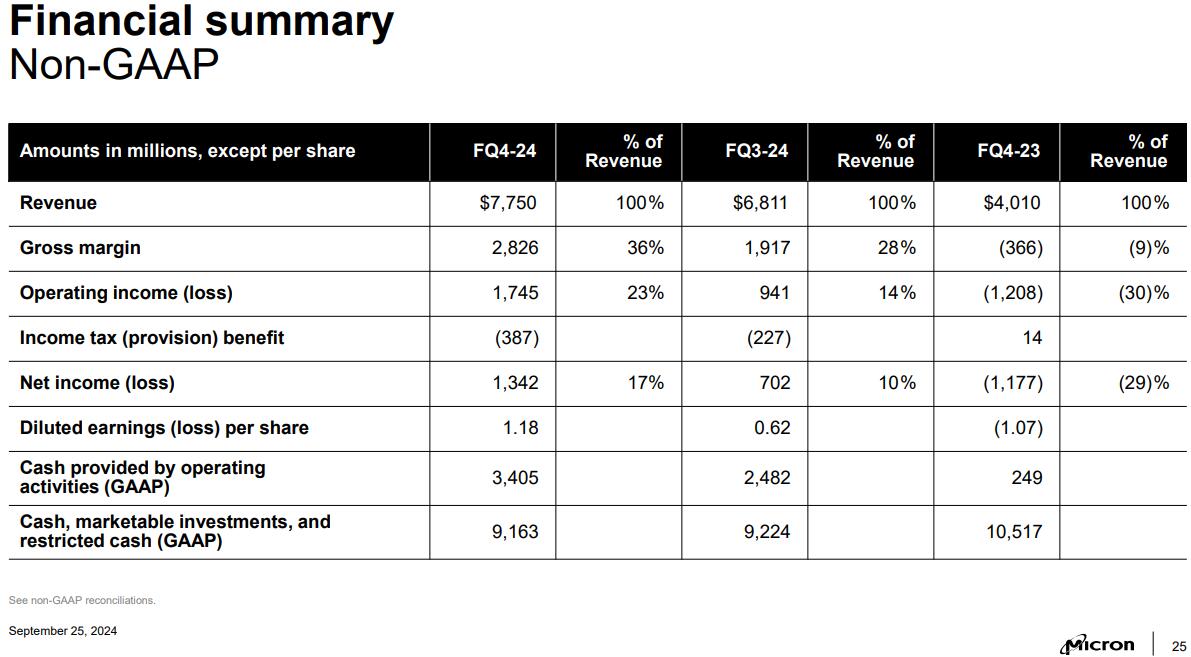

- Revenue: Fourth-quarter revenue reached $7.75 billion, a year-over-year increase of 93.3%. Analysts had expected $7.66 billion, while the company's guidance was between $7.4 billion and $7.8 billion. The previous quarter saw an 81.6% year-over-year growth.

- EPS: The adjusted diluted EPS under non-GAAP for the fourth quarter was $1.18, up from a loss of $1.07 a year earlier. Analysts expected $1.12, with the company's guidance set between $1.00 and $1.16; the previous quarter had turned a profit of $0.62.

- Operating Profit: The adjusted operating profit for the fourth quarter was $1.745 billion, compared to a loss of $1.208 billion the previous year. Analysts had anticipated $1.58 billion, while the prior quarter saw a profit of $941 million.

- Gross Margin: The adjusted gross margin for the fourth quarter was 36.5%, up from -9.1% a year ago. Analysts expected 34.7%, with guidance of 33.5% to 35.5%, while the previous quarter was 28.1%.

Data Source: Micron

Performance Guidance

Micron's last quarter performance exceeded expectations, but the guidance for the current quarter fell short of Wall Street's high expectations, leading to a decline in stock prices due to limited HBM chip capacity. Recent market sentiment towards Micron has been less optimistic, with Citi noting that many investors anticipated lower performance guidance.

Micron's results have injected confidence into market investors. Following the earnings report, Micron's stock rose nearly 1.9% on Thursday and surged over 10% in after-hours trading.

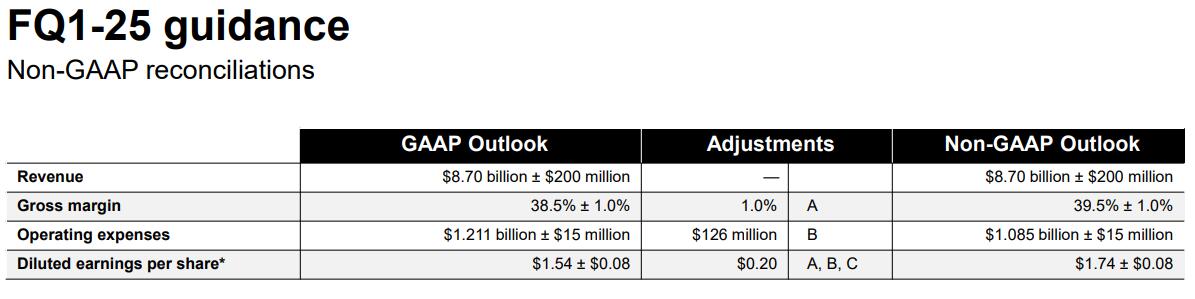

Micron forecasts first-quarter fiscal year 2025 revenue of about $8.7 billion, comfortably surpassing market expectations of $8.32 billion. The EPS, excluding certain items, is expected to be around $1.74, compared to the market expectation of $1.52.

Data Source: Micron

This optimistic outlook is the latest indication that Micron is benefiting from the surge in artificial intelligence spending. High Bandwidth Memory (HBM) orders are providing new revenue streams for the company and other chip manufacturers. This technology helps develop AI systems by enabling faster access to large amounts of data.

Demand has consistently outpaced supply, allowing Micron to raise prices and secure long-term contracts. The company stated that products for 2024 and 2025 are already sold out.

Micron's Executive Vice President Manish Bhatia noted that Micron is the first chip manufacturer to reliably deliver advanced memory at scale. He mentioned that as companies compete to enhance their AI software and hardware, using more memory in the process, Micron is in a favorable position.

The skyrocketing performance of Micron is expected to trigger a new wave of growth in the semiconductor industry. On one hand, HBM is a core component of NVIDIA’s AI GPUs, and Micron’s quarterly report indicates that AI demand remains very strong, alleviating market concerns. On the other hand, with the explosion of AI demand and a rebound in traditional demand, Micron is significantly increasing capital expenditures, which is a positive sign for semiconductor equipment!

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global