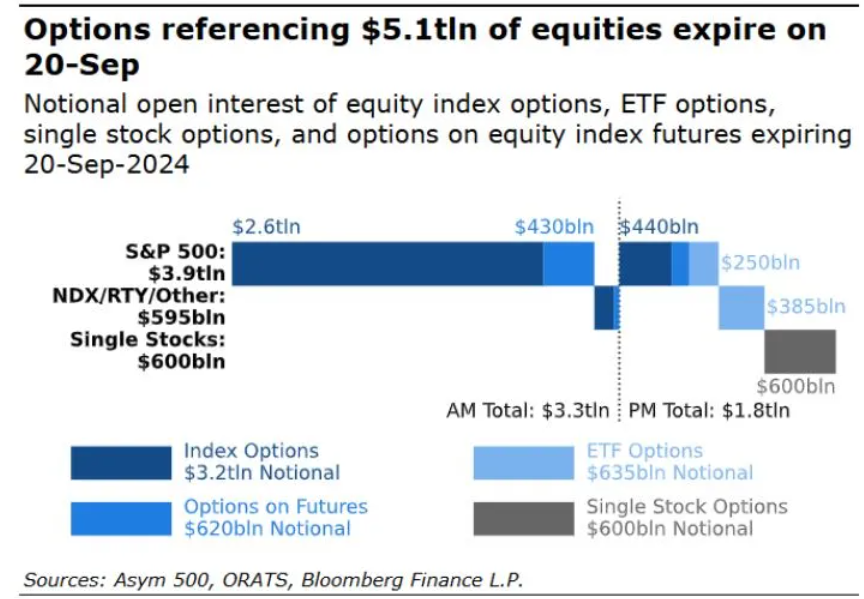

According to derivatives analysis firm Asym 500, approximately $5.1 trillion worth of options tied to individual stocks, indices, and exchange-traded funds (ETFs) are set to expire this quarter on "Triple Witching Day." While Wall Street often exaggerates this risk, options events are notorious for causing sudden price swings due to contract expirations, traders rolling over existing positions, or initiating new ones.

"Triple Witching Day" refers to the day when contracts for three types of financial derivatives—index options, stock options, and ETF options—expire simultaneously, occurring four times a year, typically on the third Friday of March, June, September, and December. As investors and traders need to adjust their positions before these contracts expire, the market often experiences significant volatility and increased trading volume around "Triple Witching Day."

This "Triple Witching Day" comes at a critical moment for market positioning. The Federal Reserve announced a 50 basis point interest rate cut on Wednesday, the first cut in over four years, exceeding the 25 basis point reduction anticipated by most economists. Meanwhile, the market is less than 1% away from its historical highs, and the volatility index (VIX), which measures expected volatility for the S&P 500, remains higher than levels seen before the market's plunge in late July and early August, indicating that investors are still somewhat cautious.

Tanvir Sandhu, Chief Global Derivatives Strategist at Bloomberg Intelligence, noted that most of the open contracts for put and call options are concentrated around the 5,500-point mark for the S&P 500. In recent weeks, the index has mostly remained within 200 points of that level, prompting speculation that the narrow trading range is a result of options activity, making the index a battleground between investors and market makers.

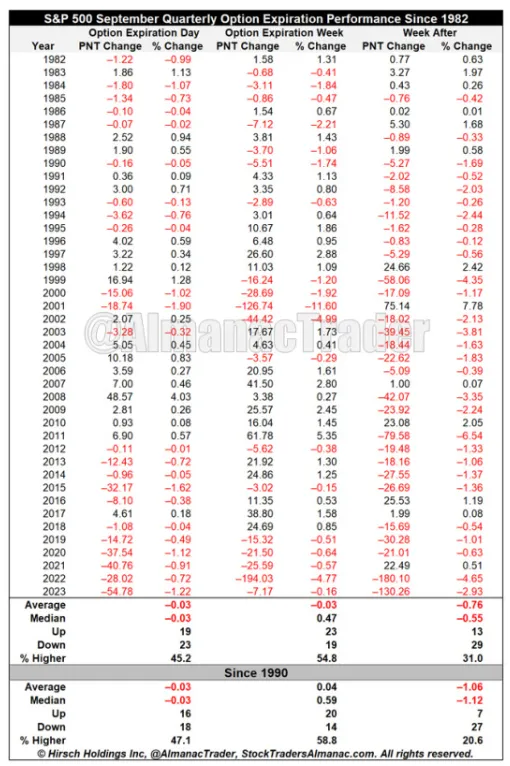

Seasonal factors are also noteworthy. The stock market typically faces significant declines in the week following September's "Triple Witching Day." According to Stock Trader's Almanac, since 1990, the S&P 500 has averaged a decline of 1.1% in the week after September's "Triple Witching Day." There have been only four exceptions during this period—in 1998, 2001, 2010, and 2016—when the S&P 500 managed to gain.

Matt Thompson, Co-Portfolio Manager at Little Harbor Advisors, commented, "Triple Witching Day may bring more volatility to the market; we just don’t know which direction it will take. Regardless of the market's view on the Fed's rate cut, the expiration of a large number of options on Friday will amplify this volatility."

Once again, the timing of option expirations coincides with the rebalancing of benchmark indices, including the S&P 500, meaning that a large number of investors will actively trade these positions, resulting in some of the highest single-day trading volumes of the year. Ahead of Monday's opening, Dell Technologies Inc., Erie Indemnity Co., and Palantir Technologies Inc. will replace Etsy Inc., Bio-Rad Laboratories Inc., and American Airlines Group Inc. in the S&P 500 index.

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global