According to a report by The Wall Street Journal on the 20th, insiders revealed that U.S. chip company Qualcomm is in discussions with American chip manufacturer Intel regarding a potential acquisition. Several financial media outlets have reported that if Qualcomm successfully acquires Intel, it would become one of the largest acquisition deals in tech history, potentially leading to significant changes in the global semiconductor industry.

Qualcomm has been internally discussing the acquisition for several months and had indicated on September 5 that it was interested in acquiring Intel's chip design business, excluding chip manufacturing. At that time, Intel firmly stated that it was "committed to its personal computer (PC) business," as PC processors have been its core since the 1980s and have generated the most revenue and profits for the company. Qualcomm had not yet contacted Intel about the potential acquisition.

Currently, Qualcomm's core business primarily revolves around smartphone chips, where it holds a strong market share in high-end mobile chips. In the second quarter of 2024, Qualcomm's chip shipment market share was 31%, but in recent years, it has increasingly targeted the PC market. Analysts believe Qualcomm's rise could mark a significant shift in the PC chip landscape, particularly with innovations focused on AI PCs.

In contrast, Intel stands at a critical crossroads. Once the largest chip manufacturer in the world, Intel has faced declining performance in recent years. Its second-quarter 2024 results were poor, with revenue dropping back to 2010 levels and a guidance for the third quarter indicating a potential decline of up to 11%. Additionally, the company announced it would lay off 15,000 employees, over 15% of its workforce, and would suspend dividends for the first time since 1992 starting in the fourth quarter. The CEO has also announced plans to divest its foundry business. Amid this downturn, Intel is actively seeking rescue strategies, with acquisitions being one of them.

Analysts point out that if Qualcomm's acquisition of Intel succeeds, it would be one of the largest tech mergers in history (the previous largest being Microsoft's $69 billion acquisition of Activision Blizzard). Intel's total market capitalization stands at approximately $93.388 billion, which could lead to a significant change in the competitive landscape of the global PC chip market.

Qualcomm and Intel have a strong competitive relationship; both companies are vying for Apple’s orders and have been at odds in the mobile baseband chip business. Currently, under the trend of AI PCs, Qualcomm has launched the Snapdragon X platform, designed for AI PCs, to capture Intel's orders in this area.

The news of a potential acquisition between former rivals raises questions about the reasons behind it. One is the world's largest high-end smartphone chip design company, while the other is one of the few IDM manufacturers capable of both designing and manufacturing CPU chips. If Qualcomm's acquisition of Intel is confirmed, it would undoubtedly change the competitive landscape of the global semiconductor industry.

In the fiercely competitive semiconductor industry, mergers and acquisitions are often seen as a shortcut for companies to grow stronger. For example, Intel previously acquired FPGA manufacturer Altera for $16.7 billion to enhance its advantages in the data center business; Qualcomm attempted to acquire automotive chipmaker NXP Semiconductors for approximately $47 billion to strengthen its position in automotive chips, although that deal ultimately failed.

In the second quarter of 2024, Intel reported revenues of $12.8 billion, a year-on-year decline of 1%, and a net loss of $1.654 billion. Coupled with a $437 million loss in the first quarter of 2024, Intel’s losses for the first half of the year totaled $2.091 billion. To address the current crisis, Intel plans to intensify cost-cutting measures, announcing a 15% workforce reduction and a suspension of shareholder dividends starting in the fourth fiscal quarter.

Regarding the losses and the business outlook for the second half of the year, Intel CEO Pat Gelsinger revealed in a letter to employees that costs are too high and profit margins too low, and the company has not fully benefited from strong trends like AI. The financial performance and outlook for the second half of 2024 are expected to be more challenging than previously anticipated.

Qualcomm’s acquisition of Intel may face antitrust investigations

According to key regulations in U.S. antitrust policy—the "Merger Guidelines" and "Horizontal Merger Guidelines"—Qualcomm's acquisition of Intel could be scrutinized for antitrust concerns.

Similar acquisitions have faced obstacles in the past. For instance, in 2017, Broadcom made an offer of over $100 billion to acquire Qualcomm, but the deal was blocked by the Trump administration on national security grounds due to Broadcom being headquartered in Singapore. In 2021, the U.S. Federal Trade Commission (FTC) filed a lawsuit to block NVIDIA's acquisition of Arm on antitrust grounds. Under further pressure from regulatory bodies in Europe and Asia, this deal was canceled in 2022.

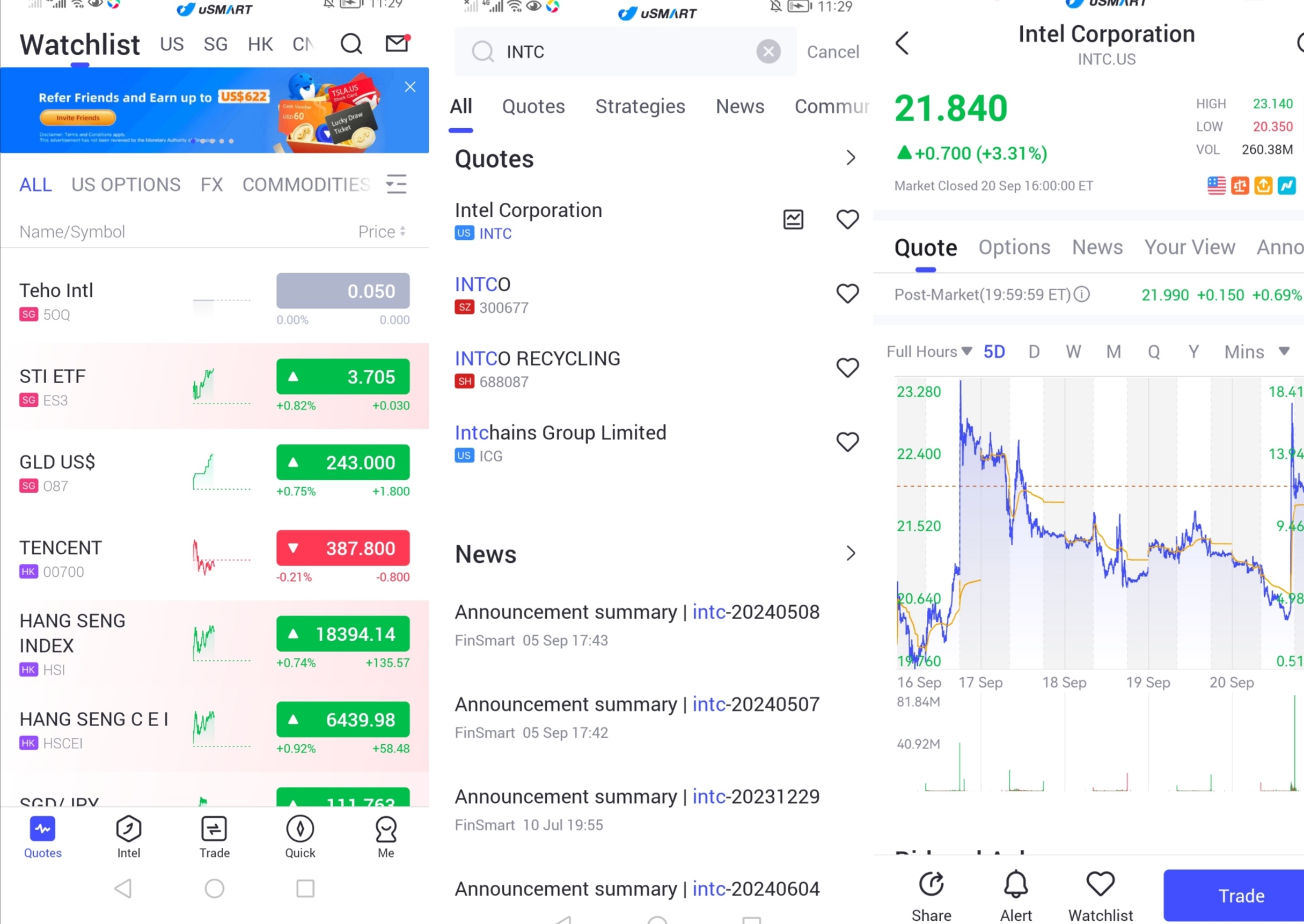

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "INTC", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group