Global economists predict that US economic growth will slow down in the coming quarters, with some even anticipating a mild recession. As the global economy slows and interest rates remain high for an extended period, finding high-quality and reliable US growth stocks is becoming increasingly challenging. However, growth stocks in the US outperformed value stocks in 2023, and if the Federal Reserve eventually cuts rates in 2024, growth stocks may rise again. Here are five selected growth stocks.

Growth Stock 1: NVIDIA (NVDA)

Market Leadership: NVIDIA is a global leader in the graphics processing unit (GPU) market, with its GPUs widely used in gaming, data centers, and professional graphics processing. NVIDIA holds a significant share in both consumer and professional GPU markets, particularly impacting high-performance computing (HPC) and artificial intelligence (AI). The company has shown strong revenue and profit growth over the years, with ongoing increases in its gaming and data center revenues.

Financial Performance: The company typically demonstrates robust cash flow and high gross margins, providing ample funding for further investments and R&D. NVIDIA also usually maintains a strong balance sheet and good financial health, supporting its continued development in a competitive market environment.

source:NVIDIA

Long-Term Outlook: NVIDIA’s collaborations with major cloud service providers and tech companies like Microsoft and Amazon Web Services have bolstered its influence in data centers and cloud computing. With the growth of gaming, virtual reality (VR), augmented reality (AR), data analytics, and AI technologies, NVIDIA is well-positioned in rapidly expanding markets. NVIDIA continues to innovate in GPU technology and computing platforms, maintaining its technological edge.

Growth Stock 2: Tesla (TSLA)

Market Leadership: Tesla is a pioneer and leader in the global electric vehicle market, with its models like the Model S, Model 3, Model X, and Model Y gaining widespread recognition. Tesla leads with a 14.4% global market share and has a strong brand influence worldwide.

Technological Innovation: Tesla continues to enhance its Full Self-Driving (FSD) system, which is currently at Level 2 automation. Through ongoing software updates and the use of the Dojo supercomputer, Tesla has made progress and remains at the forefront of autonomous driving technology. Tesla has also made significant advancements in battery technology, particularly with the production of 4680 battery cells. In 2023, Tesla’s Gigafactory in Texas achieved a milestone by producing its 20 millionth 4680 cell, which is crucial for new models like the Cybertruck. The design of this battery cell aims to reduce battery costs by over 50%. Additionally, Tesla’s Gigacasting technology uses large die-casting machines to manufacture whole vehicle parts.

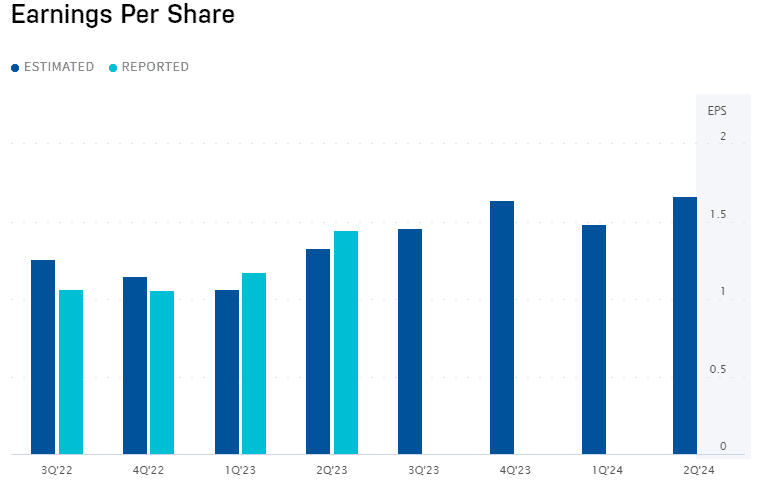

Financial Performance: Tesla has demonstrated strong revenue and profit growth in recent years. The company reported continuous quarterly profits and rapid revenue growth. In Q2 2024, Tesla achieved revenue of $25.5 billion, a 2% increase year-over-year. After deducting $600 million in restructuring and other expenses, Tesla’s operating profit for Q2 was $1.605 billion, with a net profit of $1.478 billion. Tesla’s strong cash flow supports further expansion and technological development.

source:Tesla

Production and Sales Network Expansion: Tesla has built several large manufacturing plants globally (e.g., Shanghai Gigafactory, Berlin Gigafactory, Texas Factory), significantly increasing production capacity and market coverage. The company is expanding its sales network across various countries and regions, improving market penetration. Tesla is also committed to driving global sustainability with its electric vehicles and energy products (e.g., solar panels and Powerwall), reducing carbon footprints. Tesla’s business and product lines aim to lower greenhouse gas emissions and energy consumption, aligning with global environmental trends, and enjoy high consumer recognition and loyalty. With the growing demand for electric vehicles and clean energy, Tesla is well-positioned to meet this demand and drive future growth with new models (e.g., Cybertruck and Roadster) and technologies (e.g., battery technology and energy products).

Growth Stock 3: Moderna (MRNA)

Technological Innovation: Moderna is a leader in mRNA (messenger RNA) technology, which is central to its development of the COVID-19 vaccine and serves as a foundation for future vaccines and therapies. Moderna’s COVID-19 vaccine (mRNA-1273) has shown high efficacy in clinical trials and has received emergency use authorizations and approvals worldwide. The high demand for COVID-19 vaccines has significantly boosted Moderna’s revenue and market share. Additionally, Moderna’s mRNA platform allows rapid development and production of vaccines and treatments for various infectious diseases and cancers, providing strong technological support for future growth.

Financial Performance: Moderna’s revenue saw substantial growth due to successful sales of its COVID-19 vaccine. The company reported strong profitability and cash flow. In the first quarter, revenue was $167 million, with a GAAP net loss of $1.2 billion and a GAAP diluted EPS of $3.07. Moderna’s revenue and earnings exceeded expectations, with revenue surpassing analyst estimates by 33% and EPS exceeding expectations by 14%. Looking ahead, the company expects a 20% annual revenue growth over the next three years, compared to an 18% projected growth rate for the US biotechnology industry.

source:moderna

Growth Stock 4: Block (formerly Square)

Innovation Driven: Block, founded by former Twitter CEO Jack Dorsey, is comprised of two main segments: the Square ecosystem for merchants and the Cash App digital wallet ecosystem for individuals. Block, Inc. continues to innovate in fintech and blockchain sectors, constantly launching new products and services such as payment processing solutions, cryptocurrency trading platforms, and financial management tools, which help maintain its market leadership.

Financial Performance: Bitcoin generated $65.5 million in revenue for Square in Q1 2019. Block has also been actively involved in Bitcoin investments, with an initial $50 million purchase in October 2020, followed by additional investments and a $170 million increase in Bitcoin holdings disclosed in its Q4 2020 earnings report. Block (SQ) reported Q2 results, with a cumulative revenue of $12.113 billion for the first half of 2024, up 15.08% from $10.525 billion in the same period last year. Net profit for the first half of 2024 was $661 million, compared to a net loss of $9.55 million in the previous year.

source:block

Market Expansion: Cash App, developed by Square, allows users to transfer funds via a mobile application and has supported Bitcoin transactions since 2018. Thus, the Cash App segment handles Block’s core Bitcoin-related business. Block, Inc. is expanding its business globally, especially in international markets, which helps diversify market risks. Over the past few years, Block has expanded into blockchain and buy-now-pay-later businesses, but its core business remains the Square ecosystem. We view Block as a market leader in point-of-sale management for small businesses. Like many fintech companies, Block aims to benefit from generative AI, having integrated features like “suggested actions” and “suggested replies” in its Square Messages product to simplify merchant-customer interactions. Block offers a range of products and services, including payment processing, cryptocurrency trading, and business financial services.

Growth Stock 5: Alphabet (GOOGL)

Financial Performance: Alphabet Inc., the parent company of Google and YouTube, has strong financial health and stable cash flow to support ongoing R&D and business expansion. Alphabet reported a 15% revenue growth in Q1, with Google Cloud growing by 28%. Despite the high growth rate, Alphabet’s valuation remains attractive, with significant opportunities in AI technology and substantial free cash flow potential.

source:Alphabet (GOOGL)

source:Alphabet (GOOGL)

How to trade investments on uSMART:

After logging into uSMART SG APP, click "Search" from the upper right corner of the page, enter the target code, such as "SMCI", and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

Source: uSMART SG

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Group

Group Global

Global