Data released by the US Bureau of Labor Statistics (BLS) on May 15th showed that the CPI in April increased by 3.4% year-on-year, in line with market expectations and slightly lower than the previous value of 3.5%. On a monthly basis, it grew by 0.3%, lower than both market expectations and the previous value of 0.4%. The core CPI fell to 3.6%, marking the smallest annual increase in three years, and recorded its first monthly decline in six months. The lower-than-expected increase in the US CPI in April indicates that inflation is returning to a downward trend in the early part of the second quarter, boosting market expectations of a Fed rate cut in September. In response, the US dollar weakened, and gold surged.

(Source:BLS,2024.05.15)

(Source:BLS,2024.05.15)

New York Copper Continues to Approach Historic Highs; Gold Surges Over 1% Following CPI, Silver Hits Eleven-Year High

As of May 16th, the price of COMEX gold has surpassed the $2400 per ounce mark, pushing for a three-day consecutive increase. Additionally, London copper revisited its recent high point during trading on the 15th, reaching $10400 per ton.

London base metal futures continued mostly upward on May 15th. Leading the gains, London nickel surged over 2%, rebounding to its highest level since late April. London copper also rebounded, rising slightly over 1%, closing above $10,200 for the first time in two years and hitting a new high since April 2022 after the previous high on May 13th. London aluminum closed up nearly 1.9%, approaching $2600, reaching a new high in three weeks, with London tin and lead both rising for three consecutive days. London lead hit new highs for the third consecutive day since November last year, while London tin hit new highs for three consecutive days since late April. However, London zinc fell from the high set during its four-day consecutive rise since March last year.

New York copper futures rose for the fifth consecutive day, with the COMEX July copper futures closing up 0.6% at $4.9245 per pound, hitting new closing highs for three consecutive days, continuing to approach the closing historical high set on March 4, 2022, reaching as high as $5.128 during trading, up nearly 4.8% intraday.

New York silver futures rose for the second consecutive day, with the COMEX July silver futures closing up about 3.6% at $29.73 per ounce, reaching a new closing high for the main contract since February 15, 2013. After closing, silver futures extended their gains, reaching as high as $29.98, up nearly 4.5% from the closing price on the 14th.

As shown in the figure below, spot gold hit a new high since late April during trading, returning to the level before the announcement of the March CPI in April.

(Source:The Wall Street Journal,2024.05.16)

(Source:The Wall Street Journal,2024.05.16)

Gold and Silver Market Boom: What Are the Advantages of Investing in Gold and Silver with uSMART?

From the end of 2022 until now, gold and silver prices have shown strong performance, and from 2024 to 2030, gold prices are expected to continue rising. In an optimistic scenario, prices could surpass $4,000, presenting an investment opportunity that should not be missed.

With uSMART SG, you can trade spot gold and silver, enjoying the following features:

1. Support for Both Long and Short Positions: You can choose to buy or sell based on market trends, and orders can be held long-term. For short positions in gold, you can earn overnight interest on your holdings, while long positions may incur overnight interest charges.

2. Up to 5x Leverage: We offer leverage of up to 5 times, helping you maximize capital efficiency.

3. Extremely Low Spreads: Our spreads are minimal, ensuring you get better prices while trading.

4. Commission-Free Trading: We do not charge any trading commissions, allowing you to trade with peace of mind without worrying about additional costs.

5. 23-Hour Trading: Our trading platform is available for trading 23 hours a day, allowing you to trade according to your own schedule. Gold trading hours are from 06:00 to 05:00 the following day.

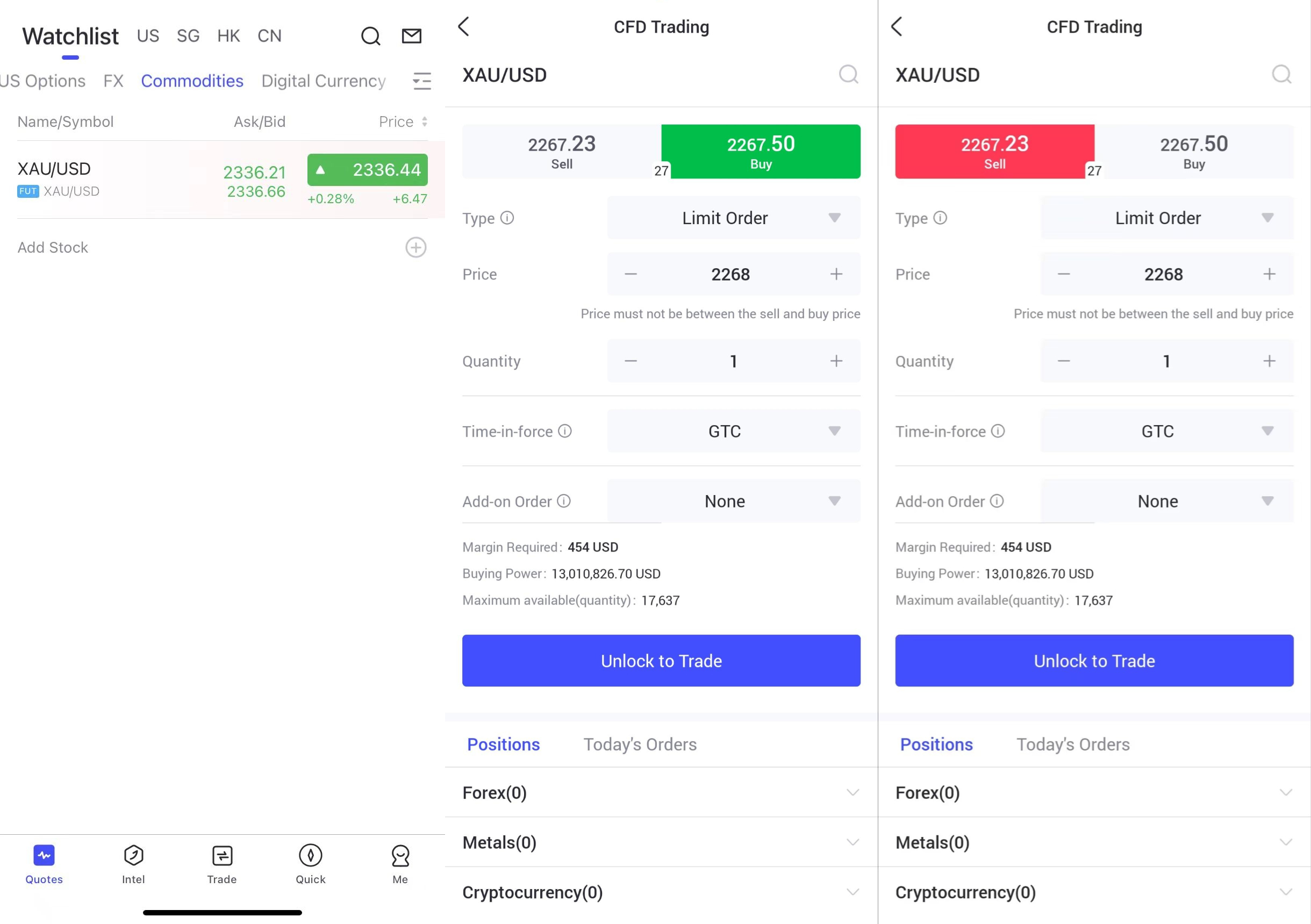

How to place a trade on uSMART mobile application:

Once logged into the uSMART SG app, go to the "Quotes" page, find "Commodities," select "XAU/USD," and you can unlock gold trading. Picture instructions are provided below:

This diagram is provided for illustrative purposes exclusively

This diagram is provided for illustrative purposes exclusively

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong Global

Global Group

Group