A thorough analysis of the relationship between the US dollar and US Treasuries reveals their profound impact on the international financial landscape. As the primary global reserve currency, fluctuations in the value of the US dollar significantly influence international capital flows, global trade, and investment decisions. Key factors affecting the value of the US dollar include the strength of the US economy, the accommodative or contractionary nature of monetary policy, and global investor demand for US assets.

US Treasuries, representing the public debt of the United States government, are debt instruments issued by the government to raise funds, typically secured by future tax revenues. As the world's largest bond market, Treasury yields serve as benchmarks for evaluating the costs of debt across different maturities. Changes in US Treasury yields not only affect borrowing costs domestically but also have significant implications for global financial markets.

The complexity of the relationship between the US dollar and US

The complexity of the relationship between the US dollar and US Treasuries can be analyzed from two main economic perspectives: supply and demand dynamics and interest rate relationships.

- Supply and Demand Dynamics:

The supply and demand of the US dollar and US Treasuries interact with each other. When investors purchase US Treasuries, they need to use US dollars for transactions, increasing the demand for the dollar and potentially driving up its value. Conversely, when investors sell bonds, the dollars they receive flow back into the market, increasing the supply of dollars and potentially causing the dollar's value to decrease. This dynamic equilibrium between supply and demand establishes a relationship between the dollar and bonds.

For instance, in 2023, the US Treasury issued a substantial amount of bonds to support its fiscal expenditures, attracting a significant influx of US dollar funds into the US market, further boosting the demand for the dollar. This supply-demand relationship led to an increase in the value of the dollar, subsequently affecting its exchange rates against other currencies.

- Interest Rate Relationships:

The level of US Treasury yields directly impacts the exchange rate of the US dollar. Bonds with higher interest rates typically attract more investors, increasing the demand for the dollar and potentially raising its exchange rate. Conversely, when bond yields decrease, investor demand may diminish, leading to an increase in the supply of dollars and a decrease in the exchange rate. Therefore, changes in Treasury yields can be considered important indicators of fluctuations in the US dollar exchange rate.

- Safe-Haven Properties:

During periods of global economic instability or financial market turmoil, investors tend to purchase US Treasuries as a hedge against risk. This is because the United States, as the world's largest economy, offers relatively high political and economic stability, and US Treasuries, as direct obligations of the US government, are widely recognized for their safety. The existence of this safe-haven attribute results in a positive correlation between the US dollar and bonds during market volatility.

For example, during the global financial crisis, when economies and financial markets in other countries were in turmoil, investors often chose to buy US Treasuries as a safe-haven asset. This preference stemmed from the relatively higher political and economic stability of the United States and the widely acknowledged safety of US Treasuries as direct obligations of the US government.

While there is a direct link between the US dollar and US Treasuries, their relationship is not always linear or unidirectional. Global economic events, political uncertainty, and changes in market expectations can all distort this relationship. Additionally, the independence of the Federal Reserve means that its decisions may not always align with government fiscal policy, which can also influence the relationship between the two.

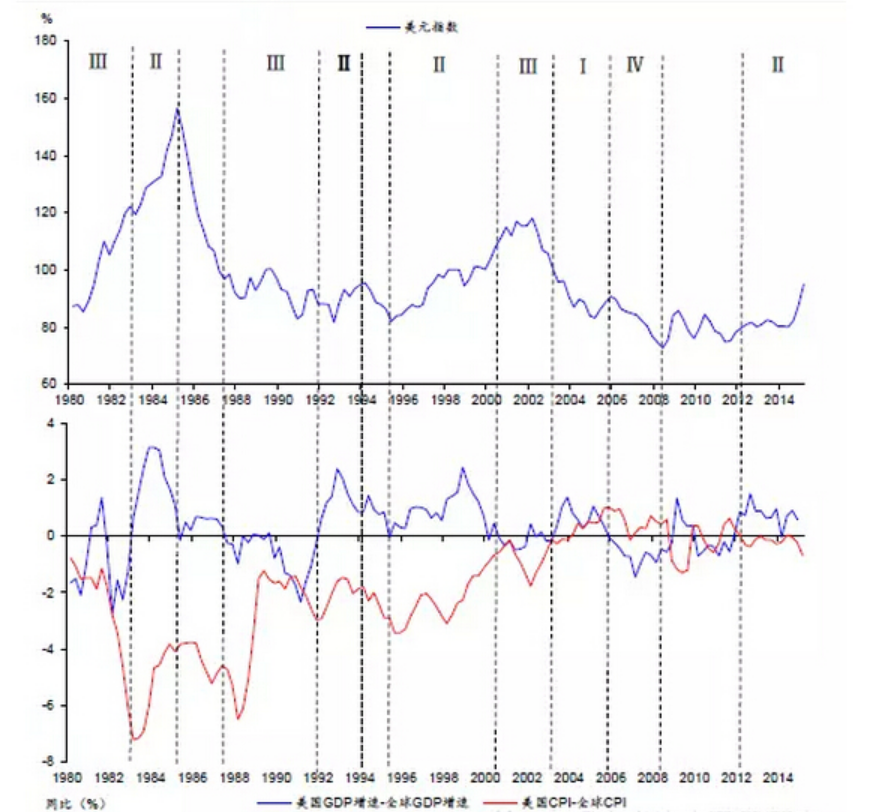

Correlation Analysis between the US Dollar and US Treasury Yields

source:Bloomberg

source:Bloomberg

Data as of: December 31, 2014

The correlation between the US dollar and US Treasury yields is not static but is determined by the dynamic interaction of multiple macroeconomic factors. Here are several scenarios that illustrate possible correlations:

- Positive Correlation Scenario: If the US economy experiences robust growth and inflation remains below global levels, while the nominal GDP growth rates of developed economies increase, the US dollar may appreciate, and US Treasury yields may rise, exhibiting a positive correlation between the two.

- Negative Correlation Scenario: If the US economy is relatively weak and inflation exceeds global levels, while the nominal GDP growth rates of developed economies decline, the US dollar may depreciate, and US Treasury yields may fall, showing a negative correlation between the two.

|

period |

US Dollar |

US Treasury Yield |

Details |

|

Early 1980s |

Appreciation |

Increase |

The US raised interest rates to curb inflation, leading to a stronger dollar and attracting international capital inflows. Market confidence in the US economy pushed up bond yields. |

|

2004-2006 |

Depreciation |

Increase |

Despite economic growth, concerns about twin deficits led to a depreciation of the dollar. Meanwhile, the Fed raised interest rates to combat inflation, causing bond yields to rise. |

|

2008 Global Financial Crisis |

Appreciation |

Decrease |

Heightened risk aversion led investors to seek safe-haven assets, increasing demand for US Treasuries and lowering yields. Simultaneously, the dollar, as a safe-haven currency, saw increased demand, driving its appreciation. |

|

2011 Eurozone Crisis |

Fluctuation |

Decrease |

During the 2011 Eurozone debt crisis, market uncertainty increased, prompting funds to seek refuge. Demand for US Treasuries rose, causing yields to fall. The dollar fluctuated due to market risk aversion, but uncertainties about the US economy and fiscal conditions limited its potential for appreciation. |

|

2020 COVID-19 Impact |

Appreciation followed by Depreciation |

Decrease |

Initially, market panic drove investors to buy US Treasuries, causing yields to decline and the dollar to appreciate. However, the Fed's quantitative easing provided liquidity, and market assessments of the long-term impact of the pandemic led to dollar depreciation, while Treasury yields remained low |

The impact of the US dollar and US Treasuries on the global economy

As the primary reserve and trading currency globally, fluctuations in the value of the US dollar affect global trade and capital flows. Dollar appreciation attracts capital inflows into the United States but may reduce the competitiveness of exports from other countries. The issuance of US Treasuries and changes in yields influence global investors' risk preferences and asset allocation, with high yields potentially diverting funds from risky assets to Treasuries, thereby increasing market uncertainty.

Adjustments in US monetary policy affect global capital flows and currency values. Tightening policies elevate the US dollar, while accommodative policies may bolster exports from other countries but also carry the risk of inflation and asset bubbles. Loss of confidence in the US dollar and Treasuries may trigger global financial market turmoil and a crisis of trust, posing a threat to global economic stability. Therefore, the dynamic changes in the US dollar and US Treasuries have significant implications for the global economy.

The relationship between the US dollar and US Treasuries is multidimensional and dynamic. Understanding this relationship is crucial for predicting the direction of global financial markets. While the monetary policy of the Federal Reserve and the economic fundamentals of the United States are two primary factors influencing this relationship, global events and market sentiment also play critical roles. Investors and decision-makers must closely monitor these factors to make informed investment and policy decisions.

US Dollar and US Treasury-related Products on uSMART Platform:

|

ETF Name |

Ticker |

Underlying Currency Pairs Ticker |

|

iShares US Treasury ETF |

GOVT |

GBP/USD |

|

Pacer Trendpilot US Bond ETF |

PTBD |

EUR/USD |

|

Vident US Bond Strategy ETF |

VBND |

AUD/USD |

|

T.Rowe Price QM US Bond Active ETF |

TAGG |

USD/JPY |

|

Franklin US Treasury Active ETF |

FLGV |

USD/CAD |

source:uSMART

How to place a trade on uSMART mobile application:

After logging into the uSMART SG app, click on "Search" at the top right corner of the page.Enter the name or code of the relevant US Treasury-related ETF in the search bar.Click to view the details of the ETF.Then, click on the "Trade" button at the bottom right corner.Choose the "Buy/Sell" function.Finally, select the price, quantity, and trading conditions, then submit your order.Image instructions are as follows:

This diagram is provided for illustrative purposes exclusively

Follow us

Find us on Twitter, Instagram, YouTube, and TikTok for frequent updates on all things investing.

Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app !

Important Notice and Disclaimer:

We have based this article on our internal research and information available to the public from sources we believe to be reliable. While we have taken all reasonable care in preparing this article, we do not represent the information contained in this article is accurate or complete and we accept no responsibility for errors of fact or for any opinion expressed in this article. Opinions, projections and estimates reflect our assessments as of the article date and are subject to change. We have no obligation to notify you or anyone of any such change. You must make your own independent judgment with respect to any matter contained in this article. Neither we or our respective directors, officers or employees will be responsible for any losses or damages which any person may suffer or incur as a result of relying upon anything stated or omitted from this article.

This document should not be construed in any jurisdiction as constituting an offer, solicitation, recommendation, inducement, endorsement, opinion, or guarantee to purchase, sell, or trade any securities, financial products, or instruments or to engage in any investment or any transaction of any kind, nor is there any intention to solicit or invite the purchase or sale of any securities.

The value of these securities and the income from them may fall or rise. Your investment is subject to investment risk, including loss of income and capital invested. Past performance figures as well as any projection or forecast used in this article is not indicative of its future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore

Singapore

Singapore Hongkong

Hongkong United States

United States Group

Group Global

Global